INTEREST RATE DETERMINATION Maria Juarez is a professional tennis player, and your firm manages her money. She has asked you to give her information about what determines the level of various interest rates.

Your boss has prepared some questions for you to consider.

- a. What are the four most fundamental factors that affect the cost of money, or the general level of interest rates, in the economy?

- b. What is the real risk-free rate of interest (r″) and the nominal risk-free rate (rRF)? How are these two rates measured?

- c. Define the terms inflation premium (IP), default risk premium (DRP), liquidity premium (LP), and maturity risk premium (MRP). Which of these premiums is included in determining the interest rate on (1) short-term U.S. Treasury securities, (2) long-term U.S. Treasury securities, (3) short-term corporate securities, and (4) long-term corporate securities? Explain how the premiums would vary over time and among the different securities listed.

- d. What is the term structure of interest rates? What is a yield curve?

- e. Suppose most investors expect the inflation rate to be 5% next year, 6% the following year, and 8% thereafter. The real risk-free rate is 3%. The maturity risk premium is zero for bonds that mature in 1 year or less and 0.1% for 2-year bonds; then the MRP increases by 0.1% per year thereafter for 20 years, after which it is stable. What is the interest rate on 1-, 10-, and 20-year Treasury bonds? Draw a yield curve with these data. What factors can explain why this constructed yield curve is upward sloping?

- f. At any given time, how would the yield curve facing a AAA-rated company compare with the yield curve for U.S. Treasury securities? At any given time, how would the yield curve facing a BB-rated company compare with the yield curve for U.S. Treasury securities? Draw a graph to illustrate your answer.

- g. What is the pure expectations theory? What does the pure expectations theory imply about the term structure of interest rates?

- h. Suppose you observe the following term structure for Treasury securities:

| Maturity | Yield |

| 1 year | 6.0% |

| 2 years | 6.2 |

| 3 years | 6.4 |

| 4 years | 6.5 |

| 5 years | 6.5 |

Assume that the pure expectations theory of the term structure is correct. (This implies that you can use the yield curve provided to “back out” the market’s expectations about future interest rates.) What does the market expect will be the interest rate on 1-year securities 1 year from now? What does the market expect will be the interest rate on 3-year securities 2 years from now? Calculate these yields using geometric averages.

- i. Describe how

macroeconomic factors affect the level of interest rates. How do these factors explain why interest rates have been lower in recent years?

a.

To identify: The factors which affect the cost of money or general level interest rate.

Interest Rate:

A rate at which a borrower is ready to pay and the depositor is ready to receive the money is known as the interest rate.

Answer to Problem 21IC

The factors that affects the general level of interest rate or the cost of money are as follows:

- Production opportunities

- Time preferences

- Risk

- Inflation

Explanation of Solution

- Production opportunities for a company are the main factor, which affects the cost of money as it leads to the higher production.

- The consumption of the product by the customer in the duration of a period, affect the cost of money.

- The concept of higher risk lead to higher return and lower risk leads to lower return mainly affects the interest rate. Hence, is also a factor which affects the interest rate.

- Inflation refers to the rise in price in the market. Due to increase in the price of products the money supply also increase which refers that the inflation is the main factor that affects the cost of money.

Hence, there are various factors such as production opportunities, time preferences, risk and inflation which affect the cost of money and interest rate.

b.

To explain: The real risk-free rate and nominal risk-free rate and their measurement.

Answer to Problem 21IC

Real Risk-Free Rate:

A rate of minimum return that is required by an investor is known as real risk-free return rate.

The measurement of real risk-free rate is difficult as it is measured withthe help of Treasury bond index.

Nominal Risk-Free Rate:

A combination of real risk-free rate and inflation premium is the nominal risk-free rate.

A formula is used for the measurement of nominal risk-free rate,

Where,

- r is the nominal risk-free rate.

- r* is the real risk-free rate.

- IP is inflation premium.

Explanation of Solution

- The real risk-free rate is the interest rate which is mainly attached to the short-term Treasury securities.

- The real risk-free rate is the rate which is lowest interest rate and is expected by the investors on their investments.

- The real risk-free rate and inflation premium combined are known as nominal risk-free rate. The inflation premium refers the compensation by the issuer for the inflation risk.

Hence, the real risk-free rate is the interest rate which is the at least interest expected by the investors and the nominal risk-free rate is the combination of real risk-free rate and the compensation of inflation risk.

c.

To explain: The inflation premium, default risk premium, liquidity premium and maturity risk premium.

Interest Rate:

A rate at which a borrower is ready to pay and the depositor is ready to receive the money is known as the interest rate.

Answer to Problem 21IC

Inflation Premium:

Inflation refers a financial term which indicates the generally raised price level of goods and services in the market and currency’s decreased level of purchasing power and issued company compensates that risk of inflation through inflation premium.

Default Risk Premium:

A premium which is paid by the borrower to its lender in the form of compensation of lender’s money in the regards of default risk is known as default risk premium.

Liquidity Premium:

A premium which is paid by the borrower to its lender in the form of compensation of short-term or long-term liquidation of investment is known as maturity risk premium.

Maturity Risk Premium:

A premium which is paid by the borrower to its lender in the form of compensation of interest rate uncertainty in the regards of maturity risk is known as maturity risk premium.

The premium which is required for the calculation of interest rates on:

(1) Short-term U.S. Treasury Securities:

There is no as such risk in U.S. Treasury securities. The interest rate which is offered on the securities is real risk-free rate which is measured with the help of Treasury index.

(2) Long-term U.S. Treasury Securities:

The inflation risk is the main risk which is there on the long-term Treasury securities. The inflation premium is included with the interest rate of long-term Treasury securities.

(3)Short-term Corporate Securities:

The inflation premium, default risk premium and liquidity premiums are included in the interest rates of short-term corporate securities.

(4)Long-term Corporate Securities:

The inflation premium, default risk premium, liquidity premium and maturity risk premium is included in the interest rates of long-term corporate securities.

Explanation of Solution

- The inflation premium is an average inflation over a period of investment and it is connected with the interest rates of Long-term U.S. Treasury securities and both the type of corporate securities as the inflation risk is there with these securities.

- Default risk premium refers the expected default that can happen because of investment. The Treasury securities have no default risk. Hence, the default risk premium is connected with the interest rates of corporate securities.

- The liquidity premium is the premium which refers the conversion of investment into cash at a shorter period. The short-term and long-term corporate securities include the liquidity premium as there is a liquidity risk with it.

- The maturity risk premium was the consideration of price at the time of maturity of the securities. The long-term corporate securities have the maturity risk premium in their interest rates as the maturity payment risk or less payment risk is there.

Hence, the different securities have the different premium requirements according to their risk availability.

d.

To explain: The term structure of interest rate and the yield curve.

Yield:

Yield is the percentage of the securities at which the return is provided by the company to its investors. Yield can be used in the form of dividend and interest.

Answer to Problem 21IC

Term Structure of Interest Rate:

The term structure represents the connection between the interest rates at the different time period.

Yield Curve:

The graphical representation of expected which return, provided by the company to its investors during the years is known as the yield curve.

Explanation of Solution

- The term structure helps in the presentation of the volatility of the curve.

- To make the various investment-related decisions, the term structure of interest rate and yield curve helps.

Hence, the term structure of interest rate and yield curve are the representation of the relationship between the interest rates and term.

e.

To identify: The interest rate of securities: 1-year, 10-year, and 20-year Treasury bond and draw a curve to identify whether it is upward-sloping or not.

Explanation of Solution

The items required for the calculation of interest rates on Treasury bonds are risk-free rate, inflation premium, and market risk premium.

Compute the interest rate on 1-year:

Given,

The real risk-free rate is 3%.

The inflation premium is 5%.

The formula to calculate the interest rate,

- Wherer is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

Substitute 3% for r* 5% for IP.

The interest rate on 1-year Treasury security is 8%.

Compute the interest rate on 10-year:

Given,

The real risk-free rate is 3%.

The average inflation premium is 7.5%.

The maturity risk premium is 0.14%.

The formula to calculate the interest rate,

- Wherer is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

- MRP is maturity risk premium.

Substitute 3% for r*, 7.5% for IP and 0.14 for MRP.

The interest rate on 10-years Treasury security is 10.64%.

Compute the interest rate on 20-year:

Given,

The real risk-free rate is 3%.

The average inflation premium is 7.75%.

The maturity risk premium is 0.26%.

The formula to calculate the interest rate,

Where,

- r is the interest rate.

- r* is the real risk-free rate.

- IP is inflation premium.

- MRP is maturity risk premium.

Substitute 3% for r*, 7.75% for IP and 0.26 for MRP.

The interest rate on 20-years Treasury security is 11.01%.

Working note:

Computation of average inflation premium at 10-year Treasury securities,

The inflation premium is 7.5%.

Compute the maturity risk premium at 10-year Treasury securities.

| Year | Workings |

Maturity Risk Premium (%) |

| 1 | 0 | |

| 2 | 0.10 | |

| 3 |

| 0.11 |

| 4 |

| 0.121 |

| 5 |

| 0.1331 |

| 6 |

| 0.14641 |

| 7 |

| 0.161051 |

| 8 |

| 0.1772 |

| 9 |

| 0.195 |

| 10 |

| 0.2145 |

| Total | 1.358261 | |

| Average Maturity Risk Premium |

| 0.136 or 0.14 |

Table (1)

The average maturity risk premium is 0.14%.

Computation of average inflation premium at 20-year Treasury securities,

The inflation premium is 7.75%.

Compute the maturity risk premium at 20-year treasury securities.

| Year | Workings |

Maturity Risk Premium (%) |

| 1 | 0 | |

| 2 | 0.10 | |

| 3 |

| 0.11 |

| 4 |

| 0.121 |

| 5 |

| 0.1331 |

| 6 |

| 0.14641 |

| 7 |

| 0.161051 |

| 8 |

| 0.1772 |

| 9 |

| 0.195 |

| 10 |

| 0.2145 |

| 11 |

| 0.2359 |

| 12 |

| 0.2595 |

| 13 |

| 0.2855 |

| 14 |

| 0.3141 |

| 15 |

| 0.3456 |

| 16 |

| 0.3801 |

| 17 |

| 0.4182 |

| 18 |

| 0.4600 |

| 19 |

| 0.506 |

| 20 |

| 0.557 |

| Total | 5.120616 | |

| Average Maturity Risk Premium |

| 0.26 |

Table (2)

The average maturity risk premium is 0.26%.

Statement to show the interest rates:

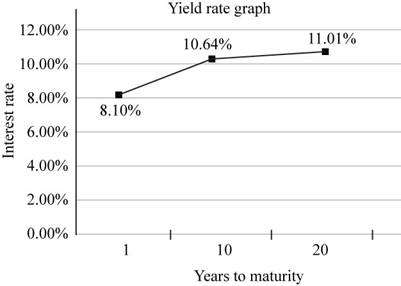

Fig 1

- Thex-axis represents the maturity years.

- They-axis represents the interest rate with the respective maturity years.

- The yield curve is upward sloping.

Hence, the interest rate at 1-year maturity is 8%, at 10-year maturity is 10.64% and at 20-year maturity, 11.01% and the curve which represent with the help of interest rates is upward sloping.

f.

To explain: The performance of U.S. Treasury securities, AAA-rated securities, and BB-rated securities.

Answer to Problem 21IC

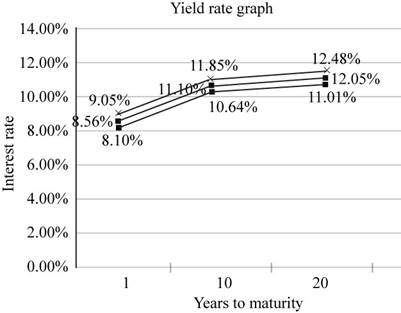

Statement to show the interest rates of the securities at a particular maturity,

| Years to Maturity |

U.S. Treasury Yield Rates (%) |

AAA-rated Yield Rates (%) |

BB-rated Yield Rates (%) |

| 1 | 8 | 8.56 | 9.05 |

| 10 | 10.64 | 11.10 | 11.85 |

| 20 | 11.01 | 12.05 | 12.48 |

Table (3)

Fig 2

- The lower curve shows the yields of U.S. Treasury securities, middle curve shows the yields of AAA-rated securities and higher curve shows the yields of SS-rated securities.

- The U.S. Treasury curve is the lowest as it doesn’t include the liquidity and default premium.

- AAA-rated securities include a lower rate of liquidity premium and default risk premium.

- BB-rated securities include the higher rate of liquidity premium than AAA-rated securities.

Explanation of Solution

- The interest rate of securities which includes the risk-free rate and inflation premium only is the treasury security bonds.

- The interest rates which includes the risk-free rate, inflation premium, liquidity premium, maturity risk premium and default risk premium has the higher interest rate and the curveis also higher than other securities.

Hence, the U.S. Treasury securities curve is lower, AAA-rated is medium and BB- rated curve is higher.

g.

To describe: The pure expectation theory and its implication in the regards of the term structure.

Answer to Problem 21IC

Expectation Theory: Expectation theory estimates the future interest without taking into consideration of maturity risk.

The maturity risk doesn’t consider in that case. The interest rate on long-term securities is calculated without considering the maturity risk.

Explanation of Solution

- According to the expectation theory, the yield curve of investment totally depends upon the future expectation of investors.

- The short-term securities have not defaulted risk premium and interest on long-term securities is the weighted average of securities.

Hence, the interest is calculated without taking into consideration default risk premium.

h.

To identify: The interest rate on 1-year securities after 1 year and interest rate on 3-year securities after 2 years from now with the use of the geometric average method.

Explanation of Solution

Compute the interest rate on 1-years securities after 1 year.

Given,

The yield for 2 years is 6.20%.

The yield for 1 year is 6%.

The formula to compute the rate,

Substitute 0.062 for yield for year 2, 0.060 for yield for year 1, 1 for a number of years and 1 for years from now.

The rate is 6.40%.

Compute the interest rate on 3-years securities after 2years.

Given,

The yield for 5 years is 6.50%.

The yield for 2years is 6.2%.

The formula to compute the rate,

Substitute 0.065 for yield for year 5, 0.062 for yield for year 2, 3 for a number of years and 2 for years from now.

Simplify the above equation,

The rate is 6.70%.

Hence, the interest rate on1-years securities after 1 year is 6.40% and at 3-years securities after 2 years is 6.70%.

i.

To explain: The effect of macroeconomic factors on interest rate and the reason of securities have the low-interestrate.

Answer to Problem 21IC

- The Federal Reserve policy mainly affects the interest rate on short-term and long-term securities. The federal trade the short-term securities which would result in the increment of the money supply.

- Federal budget deficits and surplus increase the interest rate to balance the budget, the government would issue the investment securities and increase the interest on that and interest rates would increase.

- The corporations require fund for their business and increase the demand for the product. The increase in demand of the product leads to increase in nominal interest rate.

Explanation of Solution

- The increase in money supply results to increase in inflation and high inflation is not good for the economy.

- To attract the outside borrowers it is necessary not to fix the less interest rate which increases the investments.

Hence, the international factors, businesses, Federal Reserve policies and federal budget deficits are the main factors of macroeconomics which directly affect the interest rate.

Want to see more full solutions like this?

Chapter 6 Solutions

EP APLIA FOR BRIGHAM/HOUSTON'S FUNDAMEN

- If your Uncle borrows $60,000 from the bank at 10 percent interest over the seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest? How much of his first payment will be applied to interest? To principal? How much of his second payment will be applied to each?arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forward

- Q1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardJerome Moore invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year; and $2.40 at the end of the third year. also, he believes that at the end of the third year he will be able to sell the stock for $33. what is the present value of all future benefits if a discount rate of 11 percent is applied?arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forward

- Q1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardTrue and False 1. There are no more than two separate phases to decision making and problem solving. 2. Every manager always has complete control over all inputs and factors. 3. Opportunity cost is only considered by accountants as a way to calculate profits 4. Standard error is always used to evaluate the overall strength of the regression model 5. The t-Stat is used in a similar way as the P-valued is used 6. The P-value is used as R-square is used. 7. R-square is used to evaluate the overall strength of the model. 8. Defining the problem is one of the last things that a manager considers Interpreting Regression Printouts (very brief answers) R² = .859 Intercept T N = 51 Coefficients 13.9 F= 306.5 Standard Error .139 SER=.1036 t Stat P value 99.8 0 .275 .0157 17.5 0 The above table examines the relationship between the nunber, of poor central city households in the U.S. and changes in the costs of college tuition from 1967 to 2019. 9. What is the direction of this relationship? 10.…arrow_forward

- CARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 A/C NAME TRIAL BALANCE DR CR cash 240,000 Accounts receivables 120,000 supplies 41,100 Lease hold improvement 200,000 Accumulated depreciation – Lease hold improvement 80,000 Furniture and fixtures 800,000 Accumulated depreciation - furniture and fixtures 380,000 Accounts payable 30,000 Salary payable Unearned service revenue 44,100 Cars, capital 649,000 Cars, withdrawal 165,100 Service revenue 450,000 Salary expense 48,400 Supplies expense Rent expense Depreciation expense – leasehold improvement Depreciation expense – furniture and fixtures Advertising expense 18,500 1,633,100 1,633,100 Data presented for the adjusting entries include the following: Rent expense of $160,000…arrow_forwardScenario: Jim played football for a famous club but, due to a long term injury and on medical advice, he retired from the game in January 2007. The club, grateful for Jim’s contribution to their success over the years, held a testimonial match in Jim’s honour. Jim received €150,000 from this testimonial match and he decided to open a shop selling sporting goods with the proceeds. On 1 May 2007, Jim opened a business bank account into which he paid the €150,000. In the first year of trading, he undertook the following transactions: 2 May 2007: Jim signed a five year lease on a shop in the town centre and paid €50,000 to cover the lease for the whole five years 3 May 2007: Jim paid shop fitters €10,000 for shelves and racking and for the electronic till in which to record sales. Jim expects these assets will also have a useful life of 5 years. He hired a part time assistant at a cost of €250 per month paid monthly by cheque from the business bank account. While his main business is to…arrow_forwardHelp with questions 7-24arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning