Concept explainers

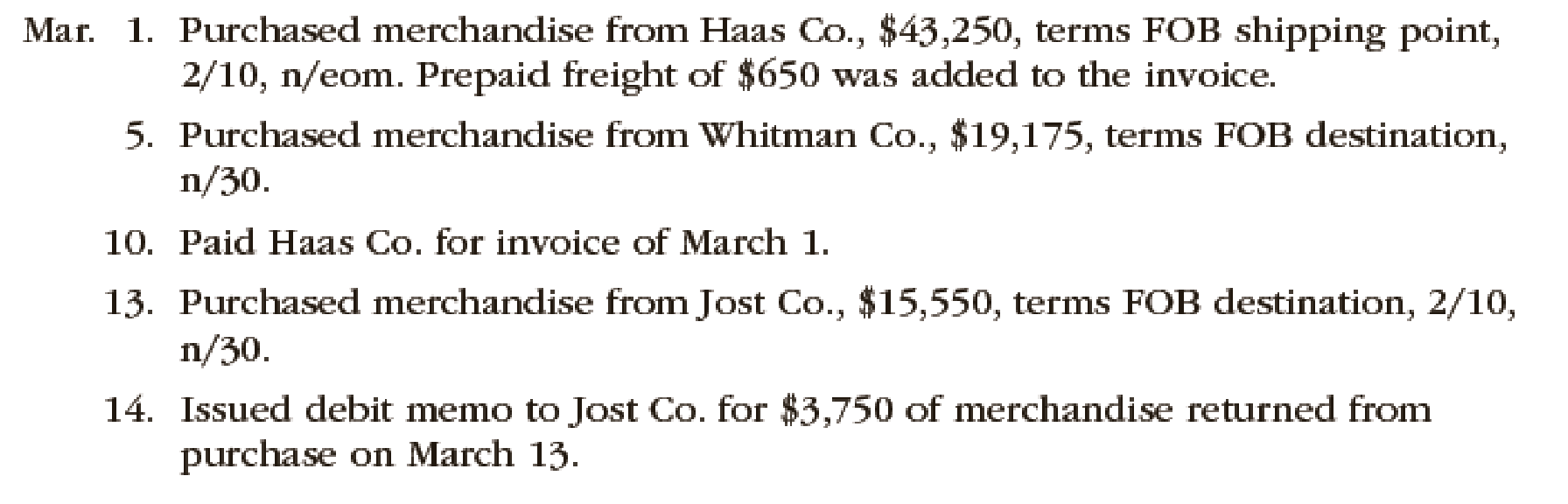

The following selected transactions were completed by Niles Co. during March of the current year:

Instructions

Prepare journal entries to record the transactions of Company N during the month of March using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System refers to the Merchandise Inventory system that maintains the detailed records of every Merchandise Inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-merchandise inventory at any point of time.

Journal entry: Journal is the book of original entry whereby all the financial transactions are recorded in chronological order. Under this method each transaction has two sides, debit side and credit side. Total amount of debit side must be equal to the total amount of credit side. In addition, it is the primary books of accounts for any entity to record the daily transactions and processed further till the presentation of the financial statements.

The following are the rules of debit and credit:

- 1. Increase in assets and expenses accounts are debited. Decrease in liabilities and stockholders’ equity accounts are debited.

- 2. Increase in liabilities, revenues, and stockholders’ equity accounts are credited. Decreases in all asset accounts are credited.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 1 | Merchandise Inventory | 43,035 | ||

| Accounts payable | 43,035 (1) | |||

| (To record purchase on account) |

Table (1)

- Merchandise Inventory is an asset and it is increased by $43,035. Therefore, debit Merchandise Inventory account with $43,035.

- Accounts payable is a liability and it is increased by $43,035. Therefore, credit accounts payable account with $43,035.

Working Note (1):

Calculate the amount of accounts payable.

Purchases = $43,250

Discount percentage = 2%

Freight charges = $650

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 5 | Merchandise Inventory | 19,175 | ||

| Accounts payable | 19,175 | |||

| (To record purchase on account) |

Table (2)

- Merchandise Inventory is an asset and it is increased by $19,175. Therefore, debit Merchandise Inventory account with $19,175.

- Accounts payable is a liability and it is increased by $19,175. Therefore, credit accounts payable account with $19,175.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 10 | Accounts payable | 43,035 | ||

| Cash | 43,035 | |||

| (To record the payment against accounts payable) |

Table (3)

- Accounts payable is a liability and it is decreased by $43,035. Therefore, debit accounts payable account with $43,035.

- Cash is an asset and it is decreased by $43,035. Therefore, credit cash account with $43,035.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 13 | Merchandise Inventory | 15,239 | ||

| Accounts payable | 15,239 (2) | |||

| (To record purchase on account) |

Table (4)

- Merchandise Inventory is an asset and it is increased by $15,239. Therefore, debit Merchandise Inventory account with $15,239.

- Accounts payable is a liability and it is increased by $15,239. Therefore, credit accounts payable account with $15,239.

Working Note (2):

Calculate the amount of accounts payable.

Purchases = $15,550

Discount percentage = 2%

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 14 | Accounts payable | 3,675 (3) | ||

| Merchandise Inventory | 3,675 | |||

| (To record purchase return) |

Table (5)

- Accounts payable is a liability and it is decreased by $3,675. Therefore, debit accounts payable account with $3,675.

- Merchandise Inventory is an asset and it is decreased by $3,675. Therefore, credit Merchandise Inventory account with $3,675.

Working Note (3):

Calculate the amount of accounts payable.

Purchases return = $3,750

Discount percentage = 2%

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

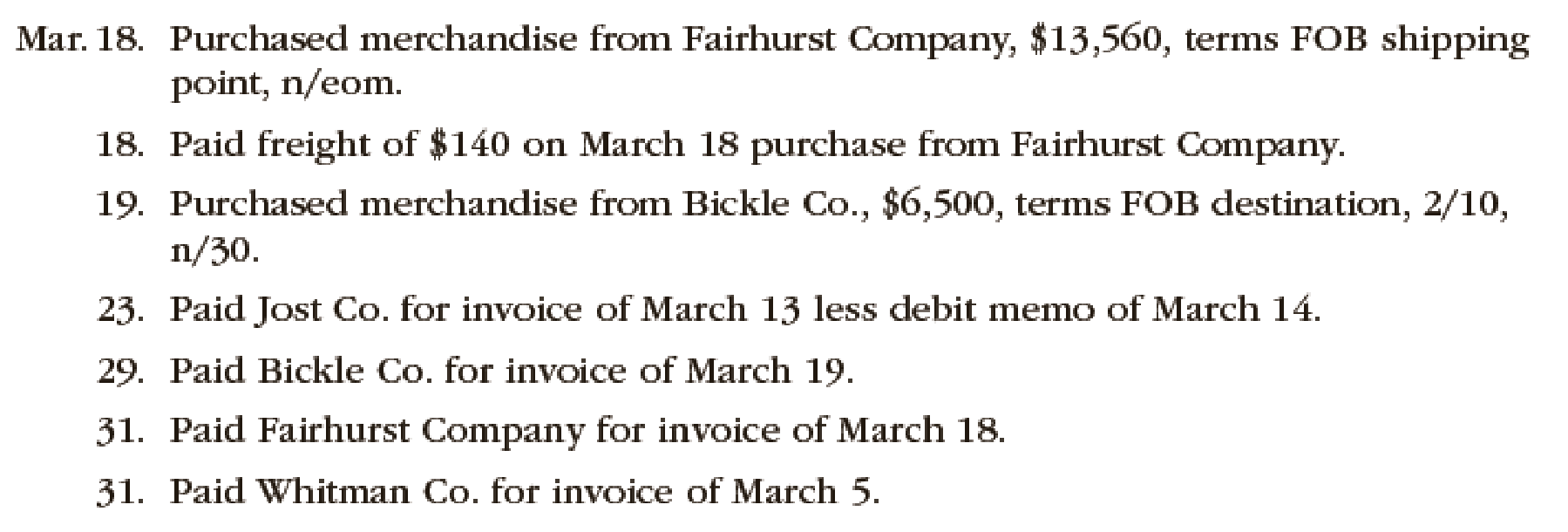

| March 18 | Merchandise Inventory | 13,560 | ||

| Accounts payable | 13,560 | |||

| (To record purchase on account) |

Table (6)

- Merchandise Inventory is an asset and it is increased by $13,560. Therefore, debit Merchandise Inventory account with $13,560.

- Accounts payable is a liability and it is increased by $13,560. Therefore, credit accounts payable account with $13,560.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Merchandise Inventory | 140 | ||

| Cash | 140 | |||

| (To record freight charges paid) |

Table (7)

- Merchandise Inventory is an asset and it is increased by $140. Therefore, debit Merchandise Inventory account with $140.

- Cash is an asset and it is decreased by $140. Therefore, credit cash account with $140.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Merchandise Inventory | 6,370 | ||

| Accounts payable | 6,370 (4) | |||

| (To record purchase on account) |

Table (8)

- Merchandise Inventory is an asset and it is increased by $6,370. Therefore, debit Merchandise Inventory account with $6,370.

- Accounts payable is a liability and it is increased by $6,370. Therefore, credit accounts payable account with $6,370.

Working Note (4):

Calculate the amount of accounts payable.

Purchases = $6,500

Discount percentage = 2%

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 23 | Accounts payable | 11,564 (5) | ||

| Cash | 11,564 | |||

| (To record payment made in full settlement less discounts) |

Table (9)

- Accounts payable is a liability and it is decreased by $11,564. Therefore, debit accounts payable account with $11,564.

- Cash is an asset and it is decreased by $11,564. Therefore, credit cash account with $11,564.

Working Note (5):

Calculate the amount of net accounts payable.

Merchandise Inventory = $15,239 (2)

Purchase returns = $3,675 (3)

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 29 | Accounts payable | 6,370 | ||

| Cash | 6,370 | |||

| (To record payment made in full settlement less discounts) |

Table (10)

- Accounts payable is a liability and it is decreased by $6,370. Therefore, debit accounts payable account with $6,370.

- Cash is an asset and it is decreased by $6,370. Therefore, credit cash account with $6,370.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 31 | Accounts payable | 13,560 | ||

| Cash | 13,560 | |||

| (To record payment made in full settlement less discounts) |

Table (11)

- Accounts payable is a liability and it is decreased by $13,560. Therefore, debit accounts payable account with $13,560.

- Cash is an asset and it is decreased by $13,560. Therefore, credit cash account with $13,560.

Record the journal entry of Company N.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 31 | Accounts payable | 19,175 | ||

| Cash | 19,175 | |||

| (To record payment made in full settlement less discounts) |

Table (12)

- Accounts payable is a liability and it is decreased by $19,175. Therefore, debit accounts payable account with $19,175.

- Cash is an asset and it is decreased by $19,175. Therefore, credit cash account with $19,175.

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/reeve/duchac's Financial Accounting, 15th

- Can you solve this financial accounting problem using accurate calculation methods?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardPlease provide the correct solution to this financial accounting question using valid principles.arrow_forward

- What is the pansion expense for 2024?arrow_forwardThe cost formula for the maintenance department of Redwood Manufacturing is $18,500 per month plus $7.25 per machine hour used by the production department. Required: Calculate the maintenance cost that would be budgeted for a month in which 5,400 machine hours are planned to be used.arrow_forwardSUBJECT FINANCIAL ACCOUNTINGarrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardOzzy Industries planned to use $75 of material per unit but actually used $78 of material per unit. The company planned to produce 2,400 units but actually produced 2,100 units. What is the sales-volume variance?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College