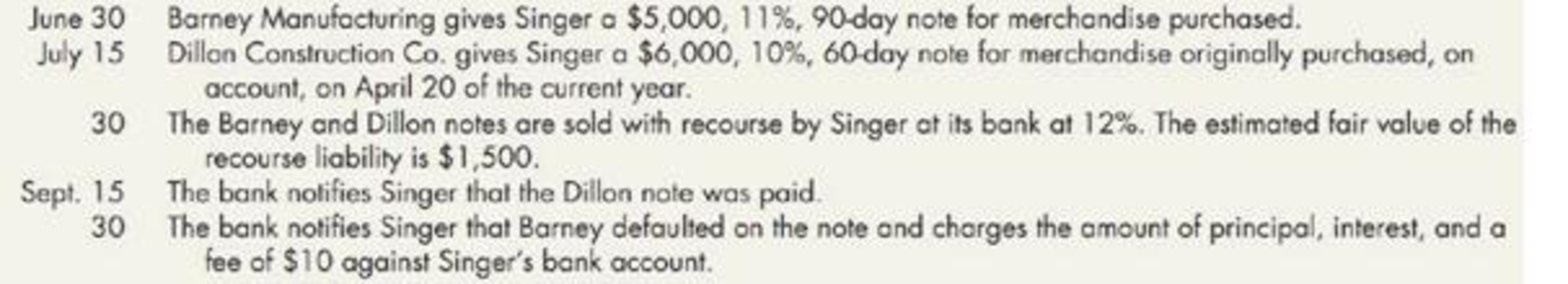

Recording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year:

Required:

Prepare the

Provide journal entries to record the previous information on Corporation S’ accounts.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Prepare journal entries:

| Date | Account titles and explanation | Debit ($) | Credit ($) |

| June 30 | Notes Receivable (Company B) | 5,000 | |

| Sales Revenue | 5,000 | ||

| (To record the receipt of the interest bearing note) | |||

| July 15 | Notes Receivable (Company D) | 6,000 | |

| Accounts Receivable | 6,000 | ||

| (To record the notes receivable) | |||

| June 30 | Cash | 11,043.25 | |

| Loss from Sale of Receivable | |||

| 1,527.58 | |||

| Recourse Liability | 1,500.00 | ||

| Notes Receivable (Company B and D) | 11,000.00 | ||

| Interest Income | 70.83 | ||

| (To record the note discounted on July 30) | |||

| September 30 | Recourse liability | 1,500 | |

| Notes receivable dishonored | 3,647.50 | ||

| Cash | 5,147.50 | ||

| (To record the notes dishonored) |

Table (1)

To record the receipt of the interest bearing note:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $5,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $5,000.

To record the notes receivable:

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $6,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $6,000.

To record the note discounted on July 30:

- Cash is an asset and it is increased. Therefore, debit cash account by $11,043.25

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $1,527.58

- Recourse liability is a liability and it is increased. Therefore, credit recourse liability by $1,500.

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $11,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $70.83.

To record the notes dishonored:

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,500.

- Notes dishonored are a component of stockholders’ equity and it is decreased. Therefore, debit notes dishonored account by $3,647.50.

- Cash is an asset and it is decreased. Therefore, credit cash account by $5,147.50.

Working note:

(1) Calculate the loss from sale of receivables:

| Particulars | Company B | Company D |

| Face value of note | $5,000 | $6,000 |

| Interest to maturity | (2)$137.50 | (6)$100 |

| Maturity value of note | $5,137.50 | $6,100 |

| Discount | (3)($102.75) | (7)($91.50) |

| Proceeds | $5,034.75 | $6,008.50 |

| Book value of note | (5)$5,045.83 | (9)$6,025 |

| Loss from sale of receivable | ($11.08) | ($16.50) |

Table (2)

(2) Calculate the interest to maturity of note for Company B:

(3) Calculate the discount amount for company B:

Note: 30 days is calculated from June 30 to July 30.

(4) Calculate the amount of accrued interest income for Company B:

Note: 30 days is calculated from June 30 to July 30.

(5) Calculate the amount of book value note for company B:

(6) Calculate the interest to maturity of note for Company D:

(7) Calculate the discount amount for company D:

Note: 15 days is calculated from June 30 to July 15.

(8) Calculate the amount of accrued interest income for company D:

Note: 15 days is calculated from June 30 to July 15.

(9) Calculate the amount of book value note company D:

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Khayyam Company, which sells tents, has provided the following information: Sales price per unit Variable cost per unit $40 19 $12,800 Fixed costs per month What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.) OA. 217 units B. 674 units OC. 610 units D. 320 unitsarrow_forwardPlease need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forward

- Determine the total fixed costs of these accounting questionarrow_forwardPerreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage