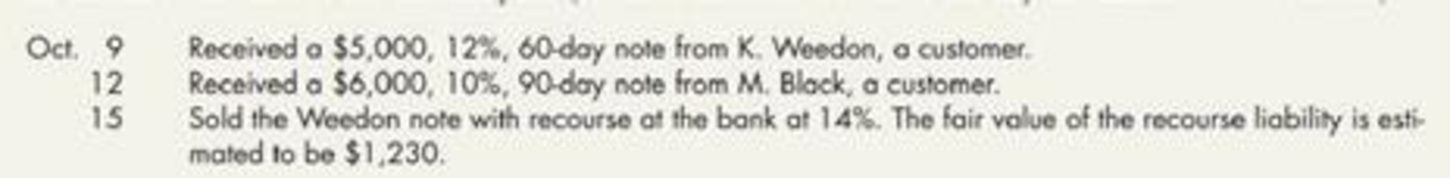

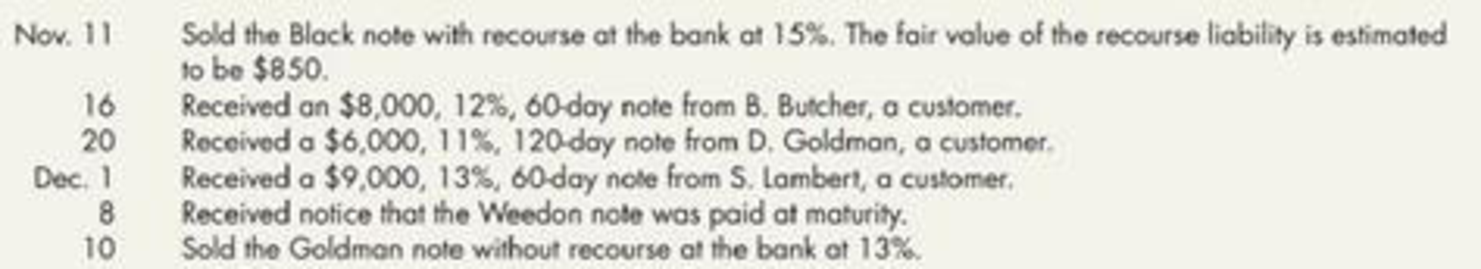

Notes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.)

Required:

- 1. Prepare the

journal entries to record the preceding note transactions and the necessaryadjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) - 2. Show how Harris’ notes receivable would be disclosed on the December 31

balance sheet . (Assume these are the only note transactions encountered by Harris during the year.)

1.

Record journal entries for previous note transactions and prepare the adjusting entries.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

| Date | Account Title and Explanation | Debit | Credit |

| December 1 | Notes receivable | $9,000 | |

| Accounts receivable | $9,000 | ||

| (To record the notes receivable) |

Table (1)

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $9,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $9,000.

| Date | Account Title and Explanation | Debit | Credit |

| December 8 | Recourse liability | $1,230 | |

| Gain from sale of notes | $1,230 | ||

| (To record the fair value of recourse liability) |

Table (2)

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,230.

- Gain from sale of notes is a component of stockholders’ equity and it is increased. Therefore, credit gain from sale of notes account by $1,230.

| Date | Account Title and Explanation | Debit | Credit |

| December 10 | Cash (1) | $5,995.39 | |

| Loss from sale of receivable (1) | $41.28 | ||

| Notes receivable | $6,000 | ||

| Interest income (5) | $36.67 | ||

| (To record note discounted on November 20 ) |

Table (3)

- Cash is an asset and it is increased. Therefore, debit cash account by $5,995.39

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $41.28

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $6,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $36.67.

| Date | Account Title and Explanation | Debit | Credit |

| December 31 | Interest receivable | $217.50 | |

| Interest income(6) | $217.50 | ||

| (To record the interest income of note) |

Table (4)

- Interest receivable is an asset and it is increased. Therefore, debit interest receivable account by $217.50.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $217.50.

Working note:

(1) Calculate the amount of loss from receivable:

| Particulars | Amount ($) |

| Face value of the note | 6,000 |

| Interest to maturity (2) | 220 |

| Maturity value of note | 6,220 |

| Less: Discount (3) | ($224.61) |

| Proceeds | 5,995.39 |

| Less: Book value of note (4) | (6,036.67) |

| Loss from sale of receivable | 41.28 |

Table (5)

(2) Calculate the interest to maturity:

(3) Calculate the amount of discount:

Note: 20 days is calculated from November 1 to November 20.

(4) Calculate the book value of note:

(5) Calculate accrued interest income:

Note: 20 days is calculated from November 1 to November 20.

(6) Calculate the interest income of note:

2.

State the manner in which the notes receivable of Company H will be disclosed on the balance sheet on December 31.

Explanation of Solution

Disclose the notes receivable in the balance sheet of Company H:

| Assets (Partial) | Amount |

| Notes Receivable | $17,000 |

| Interest Receivable | $217.50 |

| Liabilities (Partial) | |

| Recourse liability | $850 |

Table (6)

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Please solve this accounting problem not use ai and chatgptarrow_forwardFinancial Accountingarrow_forwardKhayyam Company, which sells tents, has provided the following information: Sales price per unit Variable cost per unit $40 19 $12,800 Fixed costs per month What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.) OA. 217 units B. 674 units OC. 610 units D. 320 unitsarrow_forward

- Please need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forwardDetermine the total fixed costs of these accounting questionarrow_forward

- Perreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forwardCalculate the day's sales in receivables for this accounting questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College