Connect Access Card For Fundamental Accounting Principles

24th Edition

ISBN: 9781260158526

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 10QS

Perpetual: Assigning costs with FIFO

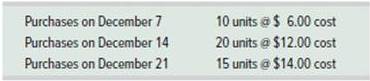

Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Also, on December 15, Monson sells 15 units for S20 each.

Required

Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory based on the FIFO method. (Round per unit costs and inventory amounts to cents.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting Question please answer do fast and step by step calculation

@ Account

Marketing Executive's Salary would be categorized as:

a. Product and direct material costs.

b. Product and direct labor costs.

c. Product and manufacturing overhead costs.

d. Period and selling/marketing costs.

Chapter 6 Solutions

Connect Access Card For Fundamental Accounting Principles

Ch. 6 - Prob. 1DQCh. 6 - Where is the amount of merchandise inventory...Ch. 6 - If costs are declining, will the LIFO or FIFO...Ch. 6 - Prob. 4DQCh. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - Prob. 12DQCh. 6 - Inventory ownership Homestead Crafts, a...Ch. 6 - QS 6-2 Inventory costs C2

A car dealer acquires a...Ch. 6 - Prob. 3QSCh. 6 - Perpetual: Inventory costing with FIFO P1 A...Ch. 6 - Perpetual: Inventory costing with LIFO Refer to...Ch. 6 - Perpetual Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with LIFO Refer to the...Ch. 6 - Periodic: Inventory costing with weighted average...Ch. 6 - Perpetual: Assigning costs with FIFO Trey Monson...Ch. 6 - QS6-11

Perpetual Inventory costing with LIFO

Refer...Ch. 6 - QS 6-12

Perpetual: Inventory costing with weighted...Ch. 6 - QS6.13

Perpetual Inventory costing with specific...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic Inventory costing with LIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with specific...Ch. 6 - QS 6-18 Contrasting inventory costing methods...Ch. 6 - Prob. 19QSCh. 6 - Inventory errors A2 In taking a physical inventory...Ch. 6 - Analyzing inventory A3 Endor Company begins the...Ch. 6 - Prob. 22QSCh. 6 - Inventory costs C2 A solar panel dealer acquires a...Ch. 6 - Exercise 6-1 Inventory ownership C1

1. At...Ch. 6 - Exercise 6-2

Inventory costs

C2

Walberg...Ch. 6 - Exercise 6-3 Perpetual Inventory costing methods...Ch. 6 - Exercise 6-4 Perpetual: Income effects of...Ch. 6 - Exercise 6-5A Periodic: Inventory costing P3 Refer...Ch. 6 - Exercise 6-6A Periodic: Income effects of...Ch. 6 - Exercise 6-7 Perpetual Inventory costing...Ch. 6 - Exercise 6.8 Specific identification Refer to the...Ch. 6 - Prob. 9ECh. 6 - Prob. 10ECh. 6 - Prob. 11ECh. 6 - Prob. 12ECh. 6 - Exercise 6-13 Inventory turnover and days' sales...Ch. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Exercise 6-1E Perpetual inventory costing P1 Tree...Ch. 6 - Exercise 6-19APeriodic inventory costing P3 I...Ch. 6 - Problem 6-1A

Perpetual: Alternative cost...Ch. 6 - Prob. 2APSACh. 6 - Prob. 3APSACh. 6 - Prob. 4APSACh. 6 - Problem 6-5A Lower of cost or market P2 A physical...Ch. 6 - Prob. 6APSACh. 6 - Prob. 7APSACh. 6 - Prob. 8APSACh. 6 - Prob. 9APSACh. 6 - Prob. 10APSACh. 6 - Prob. 1BPSBCh. 6 - Prob. 2BPSBCh. 6 - Prob. 3BPSBCh. 6 - Prob. 4BPSBCh. 6 - Prob. 5BPSBCh. 6 - Prob. 6BPSBCh. 6 - Prob. 7BPSBCh. 6 - Prob. 8BPSBCh. 6 - Prob. 9BPSBCh. 6 - Prob. 10BPSBCh. 6 - Prob. 6SPCh. 6 - AA 6-1 Use Apple's financial statements in...Ch. 6 - AA 6-2 Comparative figures for Apple and Google...Ch. 6 - Prob. 3AACh. 6 - BTN 6-3 Golf Challenge Corp. is a retail sports...Ch. 6 - Prob. 2BTNCh. 6 - Prob. 3BTNCh. 6 - Prob. 4BTNCh. 6 - Prob. 5BTNCh. 6 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Daya's Dogs has beginning net fixed assets of $520 and ending net fixed assets of $635. Assets valued at $310 were sold during the year. Depreciation was $60. What is the amount of capital spending? A. $10 B. $50 C. $90 D. $485 E. $390. Want Answerarrow_forwardPhoto Framing's cost formula for its supplies cost is $1,190 per month plus $19 per frame. For the month of November, the company planned for activity of 617 frames, but the actual level of activity was 609 frames. The actual supplies cost for the month was $12,500. The variance for supplies cost in November would bearrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License