Concept explainers

Time-Driven Activity-Based Costing LO5—6

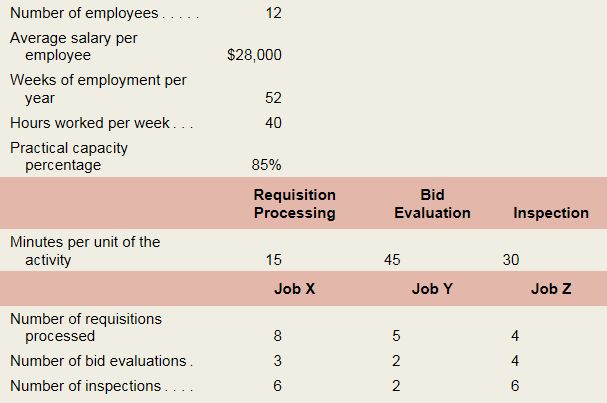

Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Required:

Calculate the cost per minute of the resource supplied in the Purchasing Department.

1.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

The cost per minute of the resource supplied.

Answer to Problem 5A.1E

The cost per minute of the resource supplied is 0.40.

Explanation of Solution

Determine the cost per minute of the resource supplied:

Thus, the cost per minute of the resource supplied is 0.40.

Working note 1:

Calculate the total cost of resources supplied:

Working note 2:

Calculate the capacity per employee:

Working note 3:

Calculate the practical capacity of resources supplied:

2.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

To Calculate: The time-driven activity rate for the given activities.

Answer to Problem 5A.1E

The time-driven activity rate is $6, $18 and $12 for requisition processing,bid evaluation, and inspection.

Explanation of Solution

Calculate the time-driven activity rate for the given activities:

| Particulars | Requisition Processing | Bid Evaluation | Inspection |

| Minutes per unit of the activity (a) | 15 | 45 | 30 |

| Cost per minute of the resource supplied (b) | $0.40 | $0.40 | $0.40 |

| Time-driven activity rate (a × b) | $6.00 | $18.00 | $12.00 |

Table: (1)

Thus, the time-driven activity rate is $6, $18, and $12 for requisition processing,bid evaluation, and inspection.

3.

Concept introduction:

Cost allocation:

Costallocation refers to the process where the common cost of the production and service rendered to the various departments of the business are distributed. It is used to calculate the actual cost attributed to a specific department.

The purchasing labor cost for Job X, Job Y, and Job Z.

Answer to Problem 5A.1E

The total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Explanation of Solution

Determine the purchasing labor cost for Job X, Job Y, and Job Z:

| Particulars | Job X | Job Y | Job Z |

| Requisition processing costs | $48 | $30 | $24 |

| Bid evaluation costs | $54 | $36 | $72 |

| Inspection costs | $72 | $24 | $72 |

| Total costs | $174 | $90 | $168 |

Table: (2)

Thus, the total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Working note 1:

Calculate the requisition processing costs:

| Particulars | Time-driven activity rate(a) | Number of requisitions processed(b) | Requisition processing costs(c = a × b) |

| Job X | $6.00 | 8 | $48.00 |

| Job Y | $6.00 | 5 | $30.00 |

| Job Z | $6.00 | 4 | $24.00 |

Table: (3)

Calculate the bid evaluation costs:

| Particulars | Time-driven activity rate(a) | Number of bid evaluations(b) | Bid evaluation costs(c = a × b) |

| Job X | $18.00 | 3 | $54.00 |

| Job Y | $18.00 | 2 | $36.00 |

| Job Z | $18.00 | 4 | $72.00 |

Table: (4)

Calculate the bid inspection costs:

| Particulars | Time-driven activity rate(a) | Number of inspections(b) | Inspection costs(c = a × b) |

| Job X | $12.00 | 6 | $72.00 |

| Job Y | $12.00 | 2 | $24.00 |

| Job Z | $12.00 | 6 | $72.00 |

Table: (5)

Want to see more full solutions like this?

Chapter 5A Solutions

Loose Leaf For Managerial Accounting for Managers

- Using the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forwardElectan Company produces two types of printers. The company uses ABC, and all activity drivers are duration drivers. Electan Company is considering using DBC and has gathered the following data to help with its decision. A. Activities with duration drivers: B. Activities with consumption ratios and costs: C. Products with cycle time and practical capacity: Required: 1. Using cycle time and practical capacity for each product, calculate the total time for all primary activities. Comment on the relationship to ABC. 2. Calculate the overhead rate that DBC uses to assign costs. Comment on the relationship to a unit-based plantwide overhead rate. 3. Use the overhead rate calculated in Requirement 2 to calculate (a) the overhead cost per unit for each product, and (b) the total overhead assigned to each product. How does this compare to the ABC assignments shown in Part B of the Information set? 4. What if the units actually produced were 10,000 for Printer A and 18,000 for Printer B. Using DBC, calculate the cost of unused capacity.arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forward

- it does yield good information about production-specific costs. REVIEW QUESTIONS Question one Destin products uses a job costing system with two direct cost categories (direct material and direct manufacturing labor) and one manufacturing overhead cost pool. Destin allocates manufacturing overhead costs using direct manufacturing labor costs. Destin provides the following information: Budgeted for 2007 1,500,000 1,000,000 1,750,000 Direct material costs Direct manufacturing labor costs Manufacturing overhead cost Required 1. Compute the actual and budgeted manufacturing overhead rates for 2007 2. During March, the job cost record for job 626 contained the following information: Direct materials used shs. 40,000 . Direct manufacturing labor costs shs. 30,000 Compute the cost of job 626 using (a) actual costing and (b) normal costing 3. At the end of 2007, compute the under or over allocated manufacturing overhead under normal costing. Why is there no under or over allocated overhead…arrow_forwardPlease help me with show all calculation thankuarrow_forwardProblem 2 Milky Corporation has provided the following data from its activity-based costing accounting system: Activity Cost Pools Designing products Setting up batches Assembling products Total Cost P1,372,448 P33,300 P126,160 Total Activity 7,798 product design hours 740 batch set-ups 6,640 assembly hours The activity rate for the "designing products" activity cost pool is answer must be in nearest peso A The activity rate for the "setting up batches" activity cost pool is answer should be in nearest peso A The activity rate for the "assembling products" activity cost pool is answer must be in nearest peso Aarrow_forward

- E4-14 Venus Creations sells window treatments (shades, blinds, and awnings) to both commercial and residential customers. The following information relates to its budgeted operations for the current year. $300,000 Direct materials costs Direct labor costs 150,000 Setup time 500,000 Supervision $ 30,000 100,000 Commercial Operating income (loss) $480,000 Overhead costs Revenues $85,000 85,000 Estimated Overhead 90,000 60,000 $85,000 The controller, Peggy Kingman, is concerned about the residential product line. She cannot understand why this line is not more profitable given that the installations of window coverings are less complex for residential customers. In addition, the residential client base resides in close proximity to the company office, so travel costs are not as expensive on a per client visit for residential customers. As a result, she has decided to take a closer look at the overhead costs assigned to the two product lines to determine whether a more accurate product…arrow_forwardDo not give answer in imagearrow_forwardWolseley’s dilemma of Traditional Costing versus Activity Based Costing Wolseley Manufacturing Corporation manufactures various electronics products and follows a traditional (job-order) costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs). The company has two products, C18R and G19R, about which it has provided the following data: C18R G19R Direct materials per unit $10.20 $50.50 Direct labour per unit $8.40 $25.20 Direct labour hours per unit 0.40 1.20 Annual production 30,000 10,000 The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labour-hours for the year is 24,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Activities…arrow_forward

- Saved Help Sav CH 07 i Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system cont following six activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Activity Rates $6 per direct labor-hour $ 4 per machine-hour $ 50 per setup $ 90 per order $ 14 per shipment $ 840 per product Production orders Shipments Product sustaining Activity data have been supplied for the following two products: Total Expected Activity K425 M67 Number of units produced per year Direct labor-hours 200 2,000 80 500 Machine-hours Machine setups Production orders 100 1,500 1 4 4 Shipments Product sustaining 1 10 1 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? DELL F3 prt sc home end F4 F5 F6arrow_forwardJay Give me correct answer with explanation..arrow_forwardi need the answer quicklyarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College