Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

23rd Edition

ISBN: 9780357252352

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

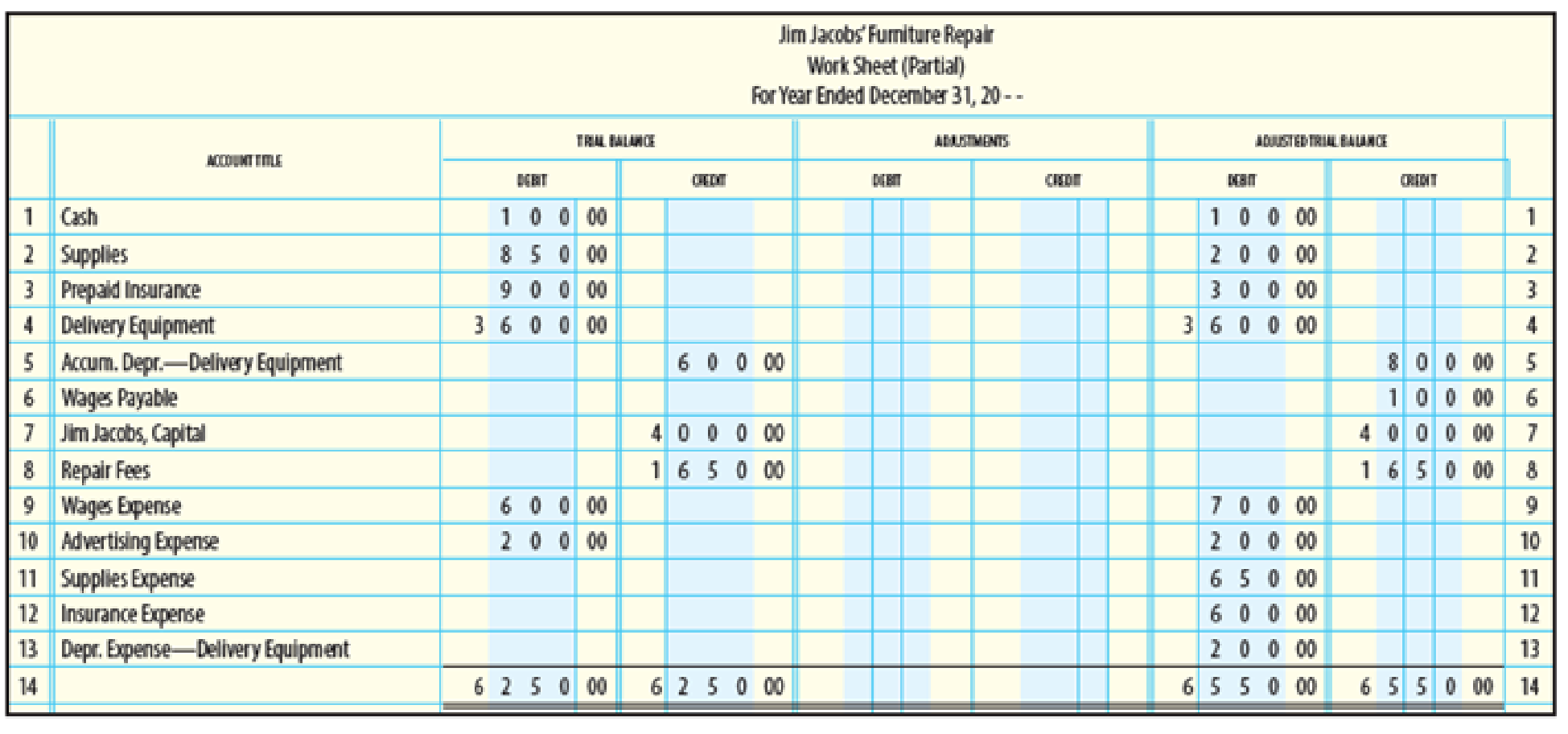

Chapter 5, Problem 9SEA

WORK SHEET AND

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

If you want to make a 15%profit from 250 shillings, what price do you place on your goods? Accounting

Current Attempt in Progress

In 2025, Sunland Corporation disposed of Amy Division, a major component of its business. Sunland realized a loss of $1493000, net

of taxes, on the sale of Amy's assets. Amy's operating income, net of taxes, was $466000 in 2025. How should these facts be reported

in Sunland's income statement for 2025?

Total Amount to be Included in

Income from

Results of

Continuing Operations

Discontinued Operations

1027000 loss

0

1493000 loss

466000 gain

0

1027000 loss

$466000 gain

$1493000 loss

Need help with this question solution general accounting

Chapter 5 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

Ch. 5 - The matching principle in accounting requires the...Ch. 5 - Prob. 2TFCh. 5 - LO1 As part of the adjustment of supplies, an...Ch. 5 - LO1 Depreciable cost is the difference between the...Ch. 5 - LO1 The purpose of depreciation is to record the...Ch. 5 - LO1 The purpose of depreciation is to (a) spread...Ch. 5 - Prob. 2MCCh. 5 - Prob. 3MCCh. 5 - Prob. 4MCCh. 5 - The first step in preparing a work sheet is to (a)...

Ch. 5 - On December 31, the trial balance indicates that...Ch. 5 - LO2 When posting adjusting entries to the general...Ch. 5 - Prob. 3CECh. 5 - Prob. 4CECh. 5 - LO5 Using the following partial work sheet...Ch. 5 - Prob. 6CECh. 5 - Prob. 1RQCh. 5 - Prob. 2RQCh. 5 - Prob. 3RQCh. 5 - Prob. 4RQCh. 5 - Prob. 5RQCh. 5 - Prob. 6RQCh. 5 - Prob. 7RQCh. 5 - Prob. 8RQCh. 5 - What is an assets depreciable cost?Ch. 5 - Prob. 10RQCh. 5 - Prob. 11RQCh. 5 - Identify the five major column headings on a work...Ch. 5 - List the five steps taken in preparing a work...Ch. 5 - Prob. 14RQCh. 5 - Explain when revenues are recorded under the cash...Ch. 5 - Prob. 16RQCh. 5 - ADJUSTMENT FOR SUPPLIES On December 31, the trial...Ch. 5 - Prob. 2SEACh. 5 - ADJUSTMENT FOR WAGES On December 31, the trial...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On December...Ch. 5 - CALCULATION OF BOOK VALUE On June 1, 20--, a...Ch. 5 - ANALYSIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - Prob. 7SEACh. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - Prob. 11SEACh. 5 - ANALYSIS OF NET INCOME OR NET LOSS ON THE WORK...Ch. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING NET INCOME The...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING A NET LOSS...Ch. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - Prob. 17SPACh. 5 - ADJUSTMENT FOR SUPPLIES On July 31, the trial...Ch. 5 - ADJUSTMENT FOR INSURANCE On July 1, a six-month...Ch. 5 - ADJUSTMENT FOR WAGES On July 31, the trial balance...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On July 1,...Ch. 5 - CALCULATION OF BOOK VALUE On January 1, 20--, a...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR INSURANCE Analyze...Ch. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - EXTENDING ADJUSTED BALANCES TO THE INCOME...Ch. 5 - Prob. 12SEBCh. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - Prob. 14SPBCh. 5 - Prob. 15SPBCh. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - CORRECTING WORK SHEET WITH ERRORS A beginning...Ch. 5 - Delia Alvarez, owner of Delias Lawn Service, wants...Ch. 5 - Prob. 1MPCh. 5 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- merchandise inventory lost in the floodarrow_forwardCarla Vista Company reported the following information for 2025: Sales revenue $2046000 Cost of goods sold 1397000 Operating expenses 219000 Unrealized holding gain on available-for-sale debt securities 121200 Cash dividends received on the securities 7800 For 2025, Carla Vista would report other comprehensive income (ignoring tax effects) of $121200. ○ $430000. $129000. ○ $437800.arrow_forwardWhat is the total number of equivalent units?arrow_forward

- Das Corp had originally expected to earn operating income of $150,000 in the coming year. Das's degree of operating leverage is 3.1. Recently, Das revised its plans and now expects to increase sales by 15% next year. What is the percent change in operating income expected by Das in the coming year?arrow_forwardGeneral Accountarrow_forwardcost 0f goods (COGS) for 2023?arrow_forward

- Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino.Assume 360 days in a year. March 29 Received a $57,600, 60-day, 8% note dated March 29 from Karie Platt on account.April 30. Received a $43,200, 60-day, 10% note dated April 30 from Jon Kelly on account.May 28. The note dated March 29 from Karie Platt is dishonored, and the customer's account is charged forthe note, including interest.June 29. The note dated April 30 from Jon Kelly is dishonored, and the customer's account is charged for thenote, including interest.August Cash is received for the amount due on the dishonored note dated March 29 plus interest for 90 days26. at 12% on the total amount debited to Karie Platt on May 28.October Wrote off against the allowance account the amount charged to Jon Kelly on June 29 for the22. dishonored note dated April 30. March 29th ____________ _____ _____ ____________ _____ _____ Apr 30 ____________ _____ _____ ____________…arrow_forwardI want to correct answer general accounting questionarrow_forwardBrightStar Retailers uses a periodic inventory system. For 2023, its beginning inventory was $85,500, purchases of inventory were $420,000, and inventory at the end of the period was $102,300. What was the amount of BrightStar's cost of goods sold (COGS) for 2023?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY