Concept explainers

JOURNALIZE AND

REQUIRED

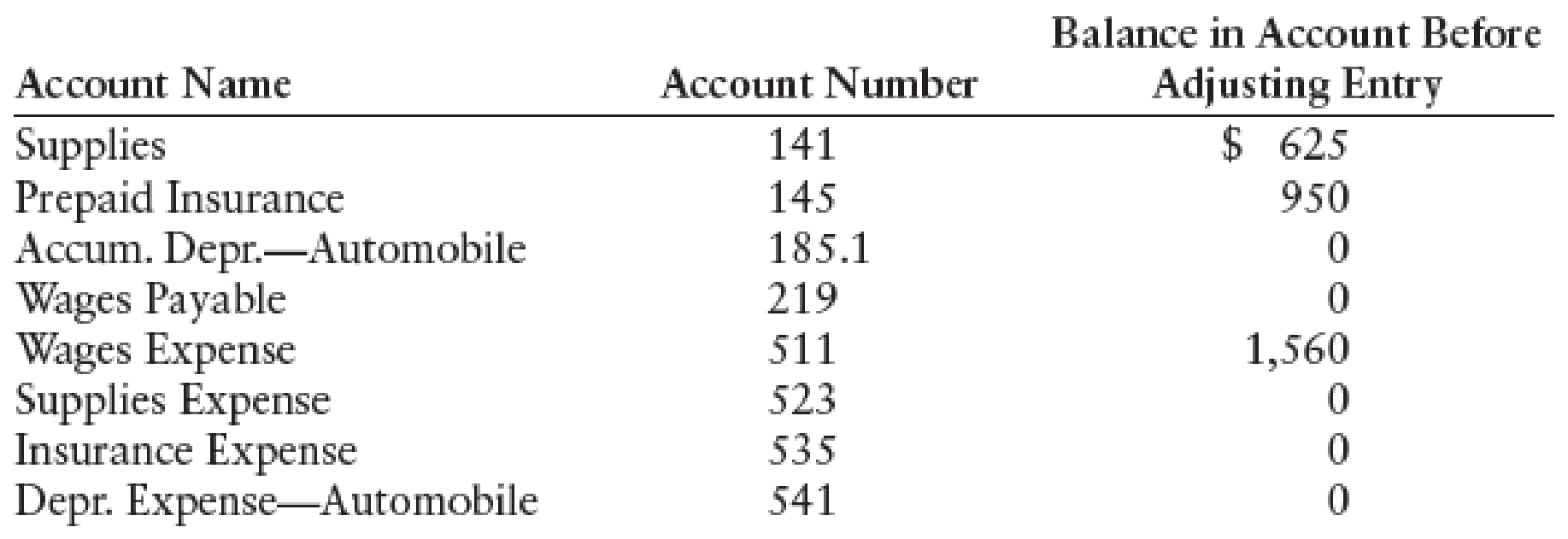

- 1. Journalize the adjusting entries on page 3 of the general journal.

- 2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany this text, enter the balances provided in this problem before posting the adjusting entries.)

1.

Prepare adjusting entries for the given transactions.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the ending inventory on supplies on October 31, $210.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Supplies expense | 523 | 415 | |

| Supplies | 141 | 415 | ||

| (To record the additional amount of supplies that must be used) |

Table (1)

- Supplies expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the supplies expense by $415.

- Supplies are an asset and there is decrease in the value of an asset. Hence, credit the supplies by 415.

Prepare adjusting entries for the unexpired insurance as of October 31, $800.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Insurance expense | 535 | 150 | |

| Prepaid insurance | 145 | 150 | ||

| (To record the insurance expense during the end of the year.) |

Table (2)

- Insurance expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the insurance expense by $150.

- Prepaid insurance is an asset and there is decrease in the value of an asset. Hence, credit the prepaid insurance by $150.

Prepare adjusting entries for the depreciation of automobile, $250.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Depreciation expense | 541 | 250 | |

| Accumulated depreciation | 185.1 | 250 | ||

| (To record the depreciation expense at the end accounting of the year.) |

Table (3)

- Depreciation expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the depreciation expense by $250.

- Accumulated depreciation is a contra asset and it has increased. Therefore, credit the accumulated depreciation by $250.

Prepare adjusting entries for the wages earned but not yet paid as of October 31, $175.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Wages expense | 511 | 175 | |

| Wages payable | 219 | 175 | ||

| (To record the wages earned but not yet paid to the employees at the end of the year.) |

Table (4)

- Wages expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the wages expense by $175.

- Wages payable is a liability and there is an increase in the value of the liability. Hence, credit the wages payable by $175.

2.

Post the adjusting entries to the general ledger.

Explanation of Solution

Post the adjusting entries to the general ledger.

| Supplies Account No: 141 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 625 | 625 | |||

| 31 | Adjusting | 415 | 210 | ||||

(Table 5)

| Prepaid insurance Account No: 145 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 950 | 950 | |||

| 31 | Adjusting | 150 | 800 | ||||

(Table 6)

| Accumulated Depreciation-Automobile Account No: 185.1 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 7)

| Wages Payable Account No: 219 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 175 | 175 | |||

(Table 8)

| Wages Expense Account No: 511 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 1,560 | ||||

| 31 | Adjusting | 175 | 1,735 | ||||

(Table 9)

| Supplies expense Account No: 523 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 415 | 415 | |||

(Table 10)

| Insurance Expense Account No: 535 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 150 | 150 | |||

(Table 11)

| Depreciation expense-Automobile Account No: 541 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 12)

Want to see more full solutions like this?

Chapter 5 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

- Please don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forwardQuick answerarrow_forward

- Financial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forwardPaterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub