Concept explainers

a

The

a

Explanation of Solution

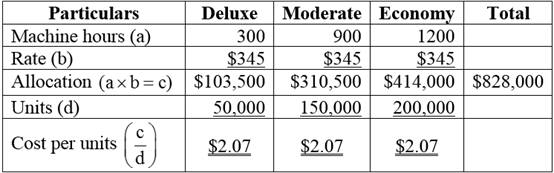

The calculation of overhead rate is as follows:

Hence, the overhead rate per hour is $345 per hour.

Table (1)

WORKING NOTE:

The calculation of total overhead cost is as follows:

Hence, the total overhead cost is $828,000.

…… (1)

b

The overhead cost for each book using activity-based costing.

b

Explanation of Solution

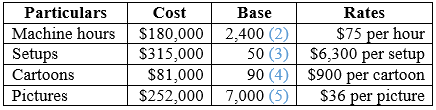

The calculation of per hour rate for each cost drivers:

Table (2)

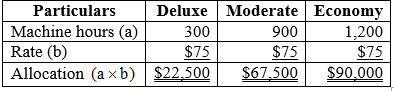

The calculation of allocation cost for machine hours is as follows:

Table (3)

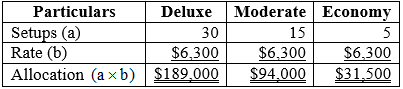

The calculation of allocation cost for setups is as follows:

Table (4)

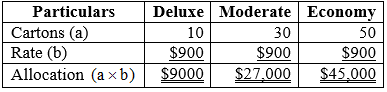

The calculation of allocation cost for cartons is as follows:

Table (5)

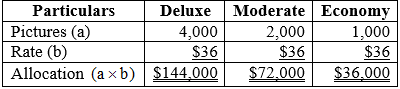

The calculation of allocation cost for pictures is as follows:

Table (6)

The calculation of cost/unit per deluxe is as follows:

Hence, the cost/unit per deluxe is $7.29.

The calculation of cost/unit per moderate is as follows:

Hence, the cost/unit per moderate is $1.74.

The calculation of cost/unit per economy is as follows:

Hence, the cost/unit per economy is $1.01.

Working notes:

The calculation of total number of machine hours is as follows:

Hence, the total number of machine hours is 2,400.

…… (2)

The calculation of total number of setups is as follows:

Hence, the total number of setups is 50.

…… (3)

The calculation of total number of cartons is as follows:

Hence, the total number of cartons is 90.

…… (4)

The calculation of total number of pictures is as follows:

Hence, the total number of pictures is 7,000.

…… (5)

The calculation of total allocation cost for deluxe is as follows:

Hence, the total allocation cost for deluxe is $364,000.

…… (6)

The calculation of total allocation cost for moderate is as follows:

Hence, the total allocation cost for moderate is $261,000.

…… (7)

The calculation of total allocation cost for economy is as follows:

Hence, the total allocation cost for economy is $200,500.

…… (8)

c

Explain the reason for different overhead costs per unit in requirement a and b.

c

Explanation of Solution

The reason for different overhead costs per unit in requirement a and b is as follows:

As it requires the equal amount of machine hours for printing each book, the assignment based on volume will allocate a same amount of overhead cost for every unit ($2.07). This gives an incorrect measure of units because consumption of overhead costs differs from product to product. For instance, the deluxe text needs better photo development than the economy text.

Activity-based costing (ABC) provides closer link between cost assignment and resource consumption. Therefore, ABC allocates more overheads costs for the products leads to the incurring of overhead costs. (That is $7.29 for deluxe, $1.74 for moderate, and $1.01 for economy).

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamental Managerial Accounting Concepts

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forward

- Cooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Helparrow_forwardCooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education