Concept explainers

a

Calculate the cost per unit for each product.

a

Explanation of Solution

Calculation of

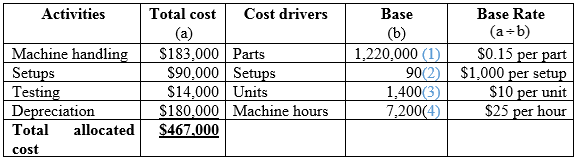

Table (1)

Hence, the total allocated cost is $467,000.

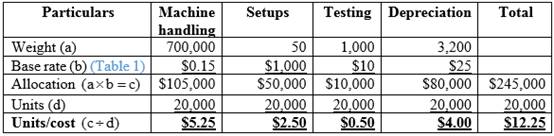

Calculation of total allocated cost and cost per unit for Model W:

Table (2)

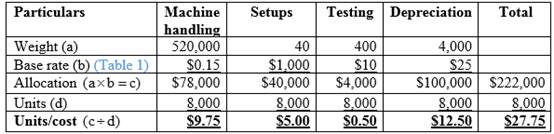

Calculation of total allocated cost and cost per unit for Model M:

Table (3)

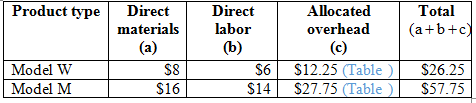

Calculation of cost per unit consumption:

Table (4)

Hence, the costs per unit of Model W and Model M are $26.25 and $57.75.

Working notes:

Calculation of base for material handling:

Hence, the base for material handling is 1,220,000 hours.

…… (1)

Calculation of base for machine setup:

Hence, the base for machine setups is 90 setups.

…… (2)

Calculation of base for product testing:

Hence, the base product level is 1,400 units.

…… (3)

Calculation of

Hence, the base of depreciation is 2,500 hours.

…… (4)

b)

Calculate whether Company S earns a profit or loss for the next year.

b)

Explanation of Solution

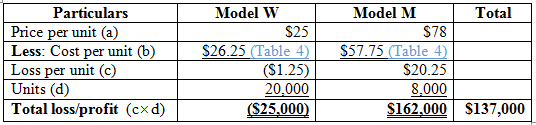

Calculation of profit or loss earned by the company previous month:

Table (5)

Hence, the company has a loss of -$25,000 on Model W and earns a profit of $162,000 on Model M.

c)

Calculate the target cost for each product and total target profit.

c)

Explanation of Solution

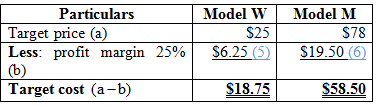

Calculation of target cost:

Table (6)

Hence, the target costs of Model W and Model M are $21 and $63.75.

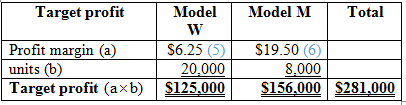

Calculation of total target profit:

Table (7)

Hence, the total target profit from both the models is $310,000.

Working notes:

Calculation of profit margin for the Model ZM:

Hence, the profit margin for Model W is $6.25.

…… (5)

Calculation of profit margin for the Model M:

Hence, the profit margin for Model M is $58.50.

…… (6)

d

Whether the new process allows Company S to attain its target cost

d

Explanation of Solution

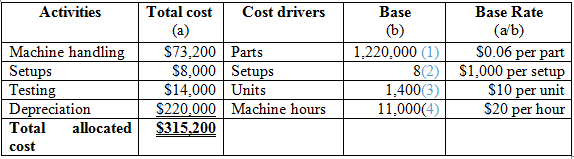

Calculation of overhead cost under ABC system using new process:

Table (8)

Hence, the total allocated cost is $315,200.

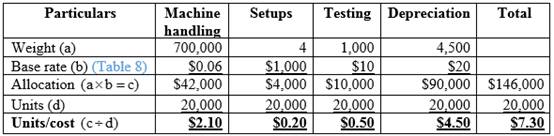

Calculation of total allocated cost and cost per unit for Model W:

Table (9)

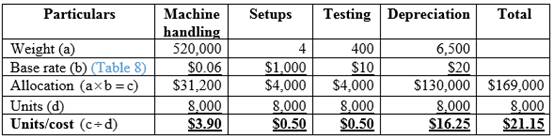

Calculation of total allocated cost and cost per unit for Model W:

Table (10)

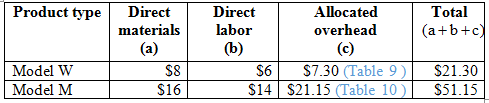

Calculation of cost per unit consumption:

Table (11)

Hence, the costs per unit of Model W and Model M are $21.30and $51.15.

Company S will not achieve its target with a new process because the cost per unit of Model W is above the target cost.

Working notes:

Calculation of machine handling cost for a new process:

Hence, the machine handling data for a new process is $73,200.

…… (7)

Calculation of setup cost for new process:

Hence, the setup cost for new process is $8,000.

Note:

The cost per setup is not affected.

…… (8)

Calculation of depreciation cost for new process:

Hence, the depreciation cost for new process is $220,000.

…… (9)

Calculation of base for setup for a new process:

Hence, the base for setup is 1,220,000 hours.

…… (10)

Calculation of base for machine hours for a new process:

Hence, the base for machine hours is 11,000 hours.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamental Managerial Accounting Concepts

- 82. What role does assurance boundary definition play in attestation? a) Standard limits work always b) Boundaries never matter c) All areas need equal coverage d) Engagement scope limits determine verification responsibilitiesarrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardGiven solution for General accounting question not use aiarrow_forward

- How many units were started and completed with respect to direct materials during the month?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education