Allison and Paul are married and have no children. Paul is a lawyer who earns a salary of $80,000. In November 2018, Allison quit her job as a copy editor and began exploring the possibility of breeding and showing horses. She would run the business on their property. Allison expects to travel to nine or ten horse shows during the year. While researching the activity, she came across an article entitled: “IRS Cracking Down on Horse Breeding—Is It Really a Business or Is It a Hobby?” She is unsure of the tax ramifications discussed in the article and has come to you for advice on whether her activity will be considered a business or a hobby. Allison provides you with the following projections of the 2019 income and expense items for the horse breeding and showing activity:

Revenue:

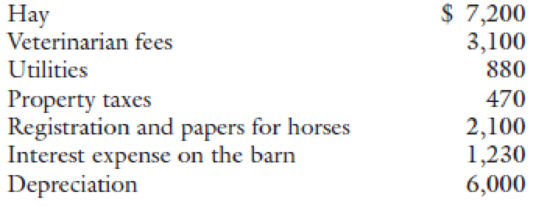

Expenses:

Paul and Allison expect to receive $6,000 in interest and dividend income, they will have an $8,000 net long-term

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

CONCEPTS IN FED.TAX.,2020-W/ACCESS