Periodic: Income comparisons and cost flows

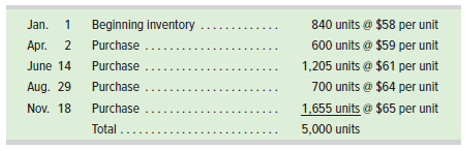

Shepard Company sold 4,000 units of its product at $100 per unit during the year and incurred operating expenses of $15 per unit in selling the units. It began the year with 840 units in inventory and made successive purchases of its product as follows.

Required

Prepare comparative income statements similar to Exhibit 5.8 for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is

Check (1) Net income: LIFO, $52,896; FIFO, $57,000;WA, $55,200

- How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing decreasing prices in its purchases of inventory?

- What advantages and disadvantages are offered by using (a) LIFO and(b) FIFO? Assume the continuing trend of increasing costs.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,