Concept explainers

Determining

At the beginning of the year, Tennyson Auto Parts had an

Required:

1. Determine the desired post adjustment balance in allowance for doubtful accounts.

2. Determine the balance in allowance for doubtful accounts before the bad debt expense

3. Compute bad debt expense.

4. Prepare the adjusting entry to record bad debt expense.

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

To calculate:

The post adjustment balance in allowance for doubtful accounts.

Answer to Problem 85APSA

The post adjustment balance in allowance for doubtful accounts is

Explanation of Solution

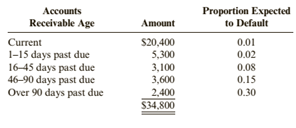

The Tennyson Auto Parts accounts receivables indicate a total of

| Amount |

Proportion expected | |

This is given in the question.

The post adjustment balance in allowance for doubtful accounts for the Tennyson Auto Parts is as follows:

| Amount |

Proportion expected | Allowance required |

|

| Total |

(b)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

To calculate:

The balance in allowance for doubtful accounts before the adjustment of bad debt.

Answer to Problem 85APSA

The balance in allowance for doubtful accounts before the adjustment of bad debt expense is

Explanation of Solution

The Tennyson Auto Parts has an opening balance in the allowance for doubtful account of

The computation of allowance for doubtful account for Tennyson Auto Parts is as follows:

| Allowance for Doubtful Account | |||

| Particulars | Amount |

Particulars | Amount |

| Write off | Opening Balance | ||

| Bad debts | |||

| Post adjustment balance | |||

So, the balance in the account before adjusting the bad debt expense is

(c)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense.

Answer to Problem 85APSA

The amount of bad debt expense is

Explanation of Solution

The Tennyson Auto Parts has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Tennyson Auto Parts is as follows:

| Allowance for Doubtful Account | |||

| Particulars | Amount |

Particulars | Amount |

| Write off | Opening Balance | ||

| Bad debts | |||

| Post adjustment balance | |||

(d)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The necessary adjusting journal entry for recording the bad debt.

Answer to Problem 85APSA

The necessary journal adjusting entry has been recorded properly.

Explanation of Solution

The Tennyson Auto Parts has an opening balance in the allowance for doubtful account of

The adjusting journal entry for the Tennyson Auto Parts is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Bad debt expense…………………………… Allowance for Doubtful accounts….……(Record the adjusting entry for bad debt estimation) |

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Calculate break-even sales in units given: Fixed Costs = $10,000; Selling Price per unit = $25; Variable Cost per unit = $15. need helparrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardA product costs $25 to make. The company wants a 20% profit margin. What should be the selling price?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning