Concept explainers

Glencoe Supply had the following

The balance in Glencoe’s allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off.

Required:

1. Determine bad debt expense.

2. Prepare the

3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense.

Answer to Problem 68E

The amount of bad debt expense is

Explanation of Solution

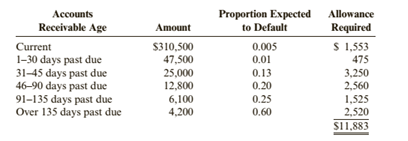

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

(b)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The necessary adjusting journal entry for recording the bad debt.

Answer to Problem 68E

The necessary journal adjusting entry has been recorded properly.

Explanation of Solution

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The adjusting journal entry for the Glencoe Supply is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Bad debt expense......... Allowance for Doubtful accounts.... (Record the adjusting entry for bad debt estimation) |

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense after changing in the written off amount.

Answer to Problem 68E

The amount of bad debt expense after the change in the written off amount is

Explanation of Solution

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning