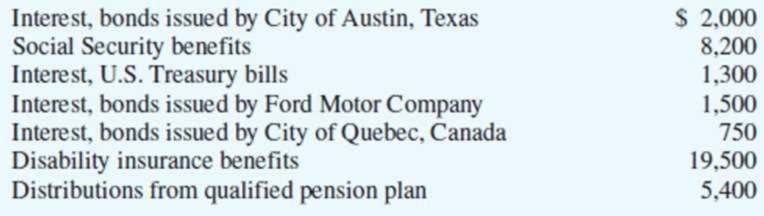

Irene is disabled and receives payments from a number of sources. The interest payments are from bonds that Irene purchased over past years and a disability insurance policy that Irene purchased herself. Calculate Irene’s cross income.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Connect Access Card for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting, Student Value Edition (5th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Please help me with the error in Q4arrow_forwardGeneral accounting questionarrow_forwardCariman Company is a manufacturer with two production departments (Machining and Assembly) as well as two support departments (Human Resources and Information Services).For the last quarter of 2020, Cariman’s cost records indicate the following:SUPPORT PRODUCTIONHuman Resources (HR)Information Services(IS)MachiningAssemblyTotalBudgeted overhead costs before any inter-department cost allocations$400,000$2,000,000$10,912,000$14,916,000$28,228,000Support work supplied by HR (Number of employees)025%40%35%100%Support work supplied by IS (Processing costs)10%030%60%100%Required:1. Allocate the two support departments’ costs to the two operating departments using the following methods:a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.2. Compare and explain differences in the support-department costs allocated to each production department. 3. What approaches might be used to decide the sequence in which to allocate…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT