Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 6E

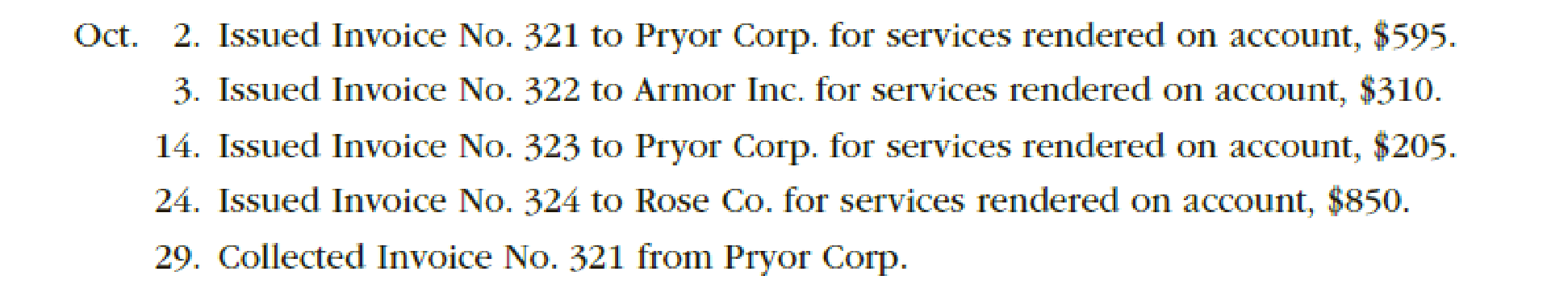

Horizon Consulting Company had the following transactions during the month of October:

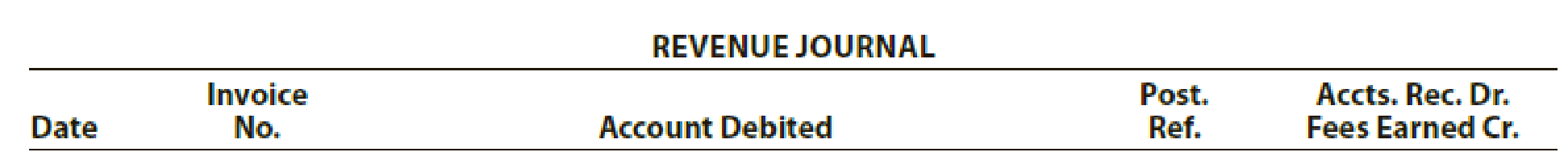

- a. Record the October revenue transactions for Horizon Consulting Company in the following revenue journal format:

- b. What is the total amount posted to the

accounts receivable and fees earned accounts from the revenue journal for October? - c. What is the October 31 balance of the Pryor Corp. customer account assuming a zero balance on October 1?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hi expert please given correct answer with accounting

Can you help me solve this general accounting question using the correct accounting procedures?

Can you solve this general accounting question with the appropriate accounting analysis techniques?

Chapter 5 Solutions

Financial Accounting

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - In recording 400 fees earned on account during a...Ch. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Assuming the use of a two-column general journal,...Ch. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - The following revenue transactions occurred during...Ch. 5 - Prob. 1PEBCh. 5 - The debits and credits from two transactions are...Ch. 5 - The debits and credits from two transactions are...Ch. 5 - The following purchase transactions occurred...Ch. 5 - The following purchase transactions occurred...Ch. 5 - The debits and credits from two transactions are...Ch. 5 - Prob. 4PEBCh. 5 - McHale Company does business in two customer...Ch. 5 - Prob. 5PEBCh. 5 - Using the following revenue journal for Bowman...Ch. 5 - Based on the data presented in Exercise 5-1,...Ch. 5 - Assuming the use of a two-column (all-purpose)...Ch. 5 - Assuming the use of a two-column (all-purpose)...Ch. 5 - The debits and credits from three related...Ch. 5 - Horizon Consulting Company had the following...Ch. 5 - The revenue journal for Sapling Consulting Inc....Ch. 5 - Prob. 8ECh. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Lasting Summer Inc. has 2,510 in the October 1...Ch. 5 - Using the following purchases journal, identify...Ch. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Guardian Services Inc. had the following...Ch. 5 - Prob. 15ECh. 5 - The cash payments and purchases journals for...Ch. 5 - Transactions related to purchases and cash...Ch. 5 - Happy Tails Inc. has a September 1, 20Y4, accounts...Ch. 5 - After Bunker Hill Assay Services Inc. had...Ch. 5 - Prob. 20ECh. 5 - Prob. 21ECh. 5 - Most computerized accounting systems use...Ch. 5 - Prob. 23ECh. 5 - For each of the following companies, determine...Ch. 5 - Prob. 25ECh. 5 - Prob. 26ECh. 5 - Prob. 27ECh. 5 - Sage Learning Centers was established on July 20...Ch. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Sterling Forest Landscaping designs and installs...Ch. 5 - Prob. 4PACh. 5 - The transactions completed by Revere Courier...Ch. 5 - Guardian Security Services was established on...Ch. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Plumb Line Surveyors provides survey work for...Ch. 5 - Prob. 4PBCh. 5 - The transactions completed by AM Express Company...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Prob. 3CPCh. 5 - The following conversation took place between...Ch. 5 - A subsidiary ledger is used for accounts...Ch. 5 - For the past few years, your client, Omni Care,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY