1.

Prepare a single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

1.

Explanation of Solution

General Ledger: General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger: Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal: Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal: Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

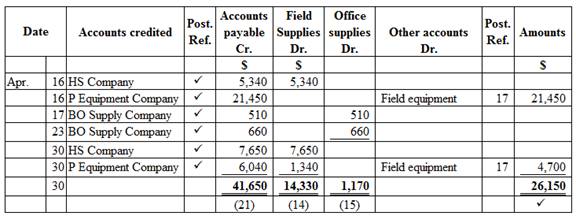

Purchase journal: Purchase journal of Company AF in the month of April is as follows:

Purchase journal

Figure (1)

Cash payment journal: Cash payment journal of Company AF in the month of April is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| Apr. | 16 | 1 | Rent expense | 71 | 3,500 | 3,500 | |

| 19 | 2 | Field supplies | 14 | 3,340 | 3,340 | ||

| Office supplies | 15 | 400 | 400 | ||||

| 23 | 3 | Land | 19 | 140,000 | 140,000 | ||

| 24 | 4 | HS Company | ✓ | 5,340 | 5,340 | ||

| 26 | 5 | P Equipment Company | ✓ | 21,450 | 21,450 | ||

| 30 | 6 | BO Supply Company | ✓ | 510 | 510 | ||

| 30 | 7 | Salary expense | 61 | 29,400 | 29,400 | ||

| 30 | 176,640 | 27,300 | 203,940 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: BO Supply Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 17 | P1 | 510 | 550 | ||

| 23 | P1 | 660 | 1,170 | |||

| 30 | CP1 | 510 | 660 | |||

Table (2)

| Name: HS Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 16 | P1 | 5,340 | 5,340 | ||

| 24 | CP1 | 5,340 | - | |||

| 30 | P1 | 7,650 | 7,650 | |||

Table (3)

| Name: P Equipment Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 16 | P1 | 21,450 | 21,450 | ||

| 26 | CP1 | 21,450 | - | |||

| 30 | P1 | 6,040 | 6,040 | |||

Table (4)

2. and 3.

2. and 3.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | CP1 | 203,940 | 203,940 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 19 | CP1 | 3,340 | 3,340 | |||

| 30 | P1 | 14,330 | 17,670 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 19 | CP1 | 400 | 400 | |||

| 30 | P1 | 1,170 | 1,570 | ||||

Table (7)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 16 | P1 | 21,450 | 21,450 | |||

| 30 | P1 | 4,700 | 26,150 | ||||

| 30 | J1 | 12,000 | 14,150 | ||||

Table (8)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 23 | CP1 | 140,000 | 140,000 | |||

| 30 | J1 | 12,000 | 152,000 | ||||

Table (9)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | P1 | 41,650 | 41,650 | |||

| 30 | CP1 | 27,300 | 14,350 | ||||

Table (10)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | CP1 | 29,400 | 29,400 | |||

Table (11)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 16 | CP1 | 3,500 | 3,500 | |||

Table (12)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| April | 30 | Land | 19 | 12,000 | |

| Field equipment | 17 | 12,000 | |||

| (To record the acquisition of land in exchange for field equipment) | |||||

Table (13)

4.

Prepare the accounts payable creditor balances.

4.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company AF | |

| Accounts payable creditor balances | |

| April 30 | |

| Amount ($) | |

| BO Supply Company | 660 |

| HS Company | 7,650 |

| P Equipment Company | 6,040 |

| Total | 14,350 |

Table (14)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company AF | |

| Accounts payable (Controlling account) | |

| April 30 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 41,650 |

| 41,650 | |

| Less: | |

| Total debits (from cash payment journal) | (27,300) |

| Total accounts payable | 14,350 |

Table (15)

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross check the creditor balance and accounts payable controlling account. From the above calculation, we can understand that the both balance of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

Discuss the reason for using subsidary ledger for the field equipment.

5.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is useful for safeguarding the equipment, and determining depreciation of equipment.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting

- Nonearrow_forwardA project will increase sales by $250,000 and cash expenses by $60,000. The project will cost $400,000 and be depreciated using the straight-line method to a zero book value over the 4-year life of the project. The company has a marginal tax rate of 35%. What is the yearly value of the depreciation tax shield? Answerarrow_forwardOn January 1, 2015, Paul Corp. paid $1,800,000 for 45,000 shares of Melrose Inc.'s voting common stock, representing a 30% ownership. No allocation to goodwill or other specific account was made. Significant influence over Melrose was achieved by this acquisition. During 2015, Melrose reported net income of $600,000 and declared a dividend of $2.50 per share. What was the balance in the Investment in Melrose Inc. account found in the financial records of Paul as of December 31, 2015? Right answerarrow_forward

- The average total asset amount isarrow_forwardWhat is the annual depreciation rate?arrow_forwardOn January 1, 2015, Paul Corp. paid $1,800,000 for 45,000 shares of Melrose Inc.'s voting common stock, representing a 30% ownership. No allocation to goodwill or other specific account was made. Significant influence over Melrose was achieved by this acquisition. During 2015, Melrose reported net income of $600,000 and declared a dividend of $2.50 per share. What was the balance in the Investment in Melrose Inc. account found in the financial records of Paul as of December 31, 2015? I want answerarrow_forward

- Thurman Industries expects to incur overhead costs of $18,000 per month and direct production costs of $155 per unit. The estimated production activity for the upcoming year is 1,800 units. If the company desires to earn a gross profit of $72 per unit, the sales price per unit would be which of the following amounts? A. $327 B. $240 C. $273 D. $347 provide helparrow_forwardOn January 1, 20X1, Pinnatek Inc., which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 12 years; Pinnatek expects the machine to have a residual value of $6,000. What is the annual depreciation rate? a. 9.7% b. 11.5% c. 12.5% d. 6.25% e. 7.64% helparrow_forwardJob H85arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage