Concept explainers

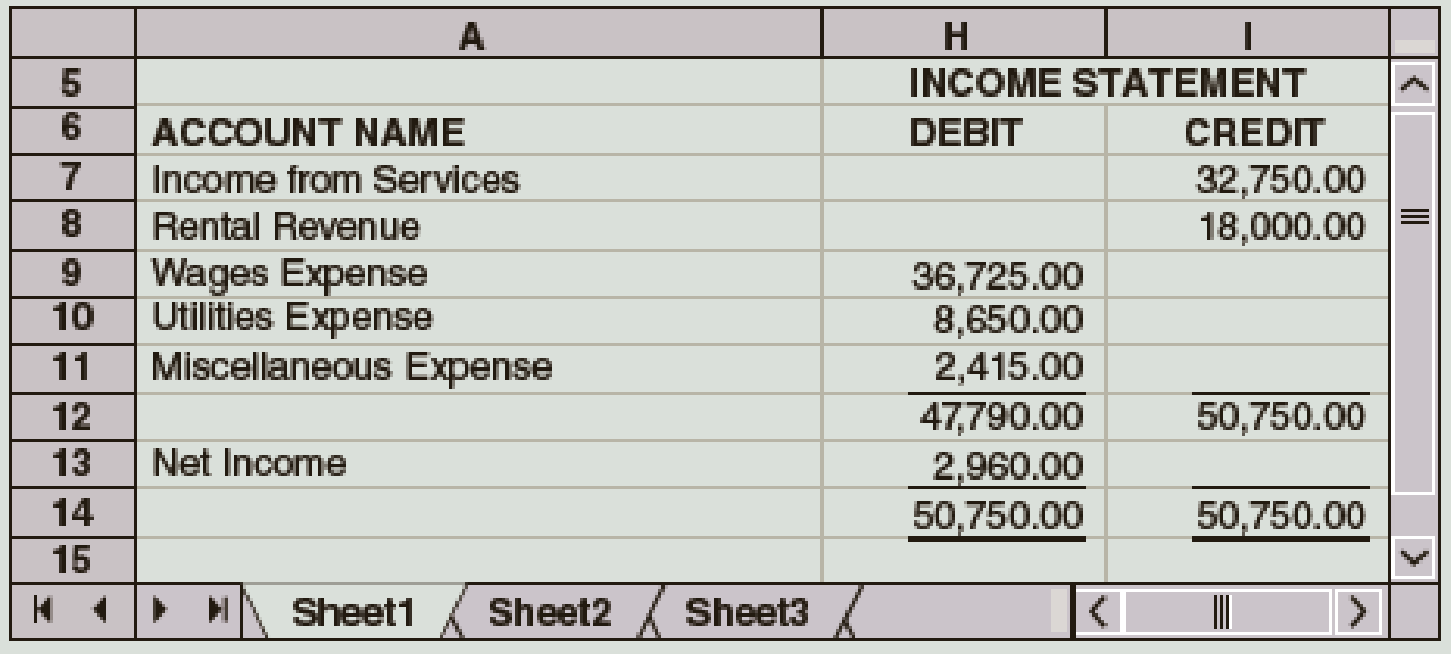

The Income Statement columns of the work sheet of Redfax Company for the fiscal year ended December 31 follow. During the year, D. Redfax withdrew $12,000. Journalize the closing entries.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning