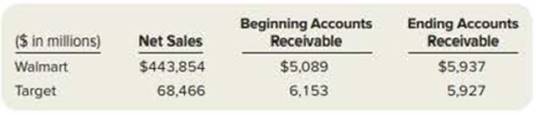

Assume selected financial data for Walmart and Target, two close competitors in the retail industry, are as follows:

Required:

1. Calculate the receivables turnover ratio and average collection period for Walmart and Target. Round your answers to one decimal place. Which company has better ratios? Compare your calculations with those for Tenet Healthcare and LifePoint Hospitals reported in the chapter text. Which industry maintains a higher receivables turnover?

2. Because most companies do not separately report cash sales and credit sales, the calculations used here and in the chapter text use companies’ reported amount of net sales, which is a combination of cash sales and credit sales. How would including cash sales affect the receivables turnover ratio? How does this help to explain your answer in Requirement 1 above?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Financial Accounting

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning