To calculate: The size of settlements, and if Person X is a plaintiff, what will be his choice on the interest rate.

Introduction:

The series of payments that are made at equal intervals is an

Answer to Problem 58QP

Solution:

The size of the settlement or the award is $527,202.72.

Explanation of Solution

Given information:

Person X serves on a jury. A plaintiff sues the city for the injuries that are continued after the accident of a sweeper in the street. In the trial, the doctors stated that it will be 5 years earlier the plaintiff would be able to return back to work. The decision made by the jury was in favor of the plaintiff. Person X is the foreperson of the jury. The jury proposes that the plaintiff will be provided an award that is as follows:

- a) The

present value of the 2 years back pay. The annual salary of the plaintiff for the last 2 years would have been $43,000 and $46,000. - b) The present value of the 5 years’ salary in future is assumed to be $49,000 for a year.

- c) The sum that has to be paid for the pain and suffering is $200,000.

- d) The amount of the court costs is $25,000.

It has to be assumed that the payment of the salary is made at the end of the month in equal amounts. The rate of interest is 7% at an effective annual rate.

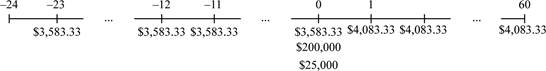

Time line of the cash flow:

Note: The cash flows here would have happened in the past and will also occur in the future. It is essential to find the present cash flows. Before computing the present value of the cash flow, it is essential to adjust the rate of interest and thus, the effective monthly interest rate can be found. Finding the annual percentage rate with compounding monthly and dividing it by twelve, it will provide the effective monthly rate. The annual percentage rate with the monthly compounding is calculated as follows:

Compute the annual percentage rate with the effective annual rate:

Hence, the annual percentage rate is 0.0678 or 6.78%.

To determine the today’s value of the back pay from 2 years ago, it is essential to find the

Formula to calculate the future value of an annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the future value annuity:

Hence, the future value of an annuity is $44,362.73.

Formula to compute the future value:

Note: C denotes the annual cash flow or an annuity payment, r represents the rate of interest, and t denotes the number of payments.

Compute the future value:

Hence, the future value is $47,468.12

Note: The future value of the annuity is determined by the effective monthly rate and the future value of the lump sum is determined by the effective annual rate. The other alternate way to determine the future value of the lump sum with the effective annual rate as long it is utilized for 12 periods. The solution would be the same in either way.

Now the today’s value of the last year’s back pay is calculated as follows:

Compute the future value annuity:

Hence, the future value of the annuity is $47,457.81.

Next, it is essential to determine today’s value of the 5 year’s future salary.

Formulae to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity for without fee:

Hence, the present value of the annuity is $207,276.79.

The today’s value of the jury award is calculated by adding the sum of salaries, the court costs, and the compensation for the pain and sufferings. The award amount is calculated as follows:

Hence, the award amount or the size of the settlement is $527,202.72.

Want to see more full solutions like this?

Chapter 5 Solutions

ESSENTIALS CORPORATE FINANCE + CNCT A.

- Your firm is considering an expansion of its operations into a nearby geographic area that the firm is currently not serving. This would require an up-front investment (startup cost) of $989,060.00, to be made immediately. Here are the forecasts that were prepared for this project, shown in the image. The long-term growth rate for cash flows after year 4 is expected to be 4.73%. The cost of capital appropriate for this project is 12.48%. What is the NPV, Profitability Index, IRR and payback in this case?arrow_forwardUse the binomial method to determine the value of an American Put option at time t = 0. The option expires at time t = T = 1/2 and has exercise price E = 55. The current value of the underlying is S(0) = 50 with the underlying paying continuous dividends at the rate D = 0.05. The interest rate is r = 0.3. Use a time step of St = 1/6. Consider the case of p = 1/2 and suppose the volatility is σ = 0.3. Perform all calculations using a minimum of 4 decimal places of accuracy. =arrow_forwardConsider a European chooser option with exercise price E₁ and expiry date T₁ where the relevant put and call options, which depend on the value of the same underlying asset S, have the same exercise price E2 and expiry date T₂. Determine, in terms of other elementary options, the value of the chooser option for the special case when T₁ = T2. Clearly define all notation that you use.arrow_forward

- The continuous conditional probability density function pc(S, t; S', t') for a risk neutral lognormal random walk is given by Pc(S, t; S', t') = 1 σS'√2π(t' - t) - (log(S/S) (ro²)(t − t)] exp 202 (t't) In the binomial method, the value of the underlying is Sm at time step môt and the value of the underlying at time step (m + 1)St is Sm+1. For this case evaluate Ec[(Sm+1)k|Sm] = [°° (S')*pc(S™, mdt; S', (m + 1)8t)dS' showing all steps, where k is a positive integer with k ≥ 1. You may assume that 1 e (x-n)2 2s2dx = 1 for all real numbers n and s with s > 0.arrow_forwardJohn and Jane Doe, a married couple filing jointly, have provided you with their financial information for the year, including details of federal income tax withheld. They need assistance in preparing their tax return. W-2 Income: John earns $150,000 with $35,000 withheld for federal income tax. Jane earns $85,000 with $15,500 withheld for federal income tax. Interest Income: They received $2500 in interest from a savings account, with no tax withheld. Child Tax Credit: They have two children under the age of 17. Mortgage Interest: Paid $28,000 in mortgage interest on their primary residence. Property Taxes: Paid $4,800 in property taxes on their primary residence. Charitable Donations: Donated $22,000 to qualifying charitable organizations. Other Deductions: They have no other deductions to claim. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, and Schedule B in preparation of their tax file.arrow_forwardOn the issue date, you bought a 20-year maturity, 5.85% semi-annual coupon bond. The bond then sold at YTM of 6.25%. Now, 5 years later, the similar bond sells at YTM of 5.25%. If you hold the bond now, what is your realized rate of return for the 5-year holding period?arrow_forward

- Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 11% coupon rate, payable semiannually. The bonds mature in 17 years, have a face value of $1,000, and a yield to maturity of 9.5%. What is the price of the bonds? Round your answer to the nearest cent.arrow_forwardanalyze at least three financial banking products from both the liability side (like time deposits, fixed income, stocks, structure products, etc). You will need to examine aspects such as liquidity, risk, and profitability from a company and an individual point of view.arrow_forwardHow a does researcher ensure that consulting recommendations are data-driven? What does make it effective, and sustainable? Please help explain and give the example How does DMAC help researchers to improve their business processes? How to establish feedback loops for ongoing refinement. Please give the examplesarrow_forward