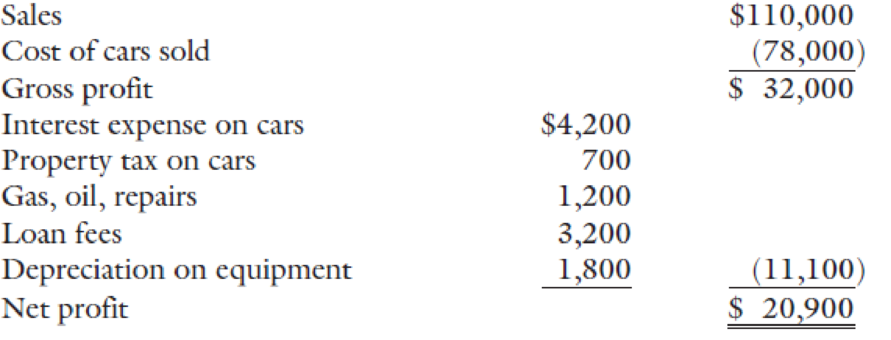

Ray, 83, is a used car dealer. He lives in a rural community and operates the business out of his home. One room in his 6-room house is used exclusively for his business office. He parks the cars in his front yard, and when customers come along, they sit on the front porch and negotiate a sale price. The income statement for Ray’s auto business is as follows:

If Ray’s home were rental property, the annual

Write a letter to Ray explaining the proper treatment of this information on his tax return.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

EBK CONCEPTS IN FEDERAL TAXATION 2019

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT