Concept explainers

Production-Based Costing versus Activity-Based Costing, Assigning Costs to Activities, Resource Drivers

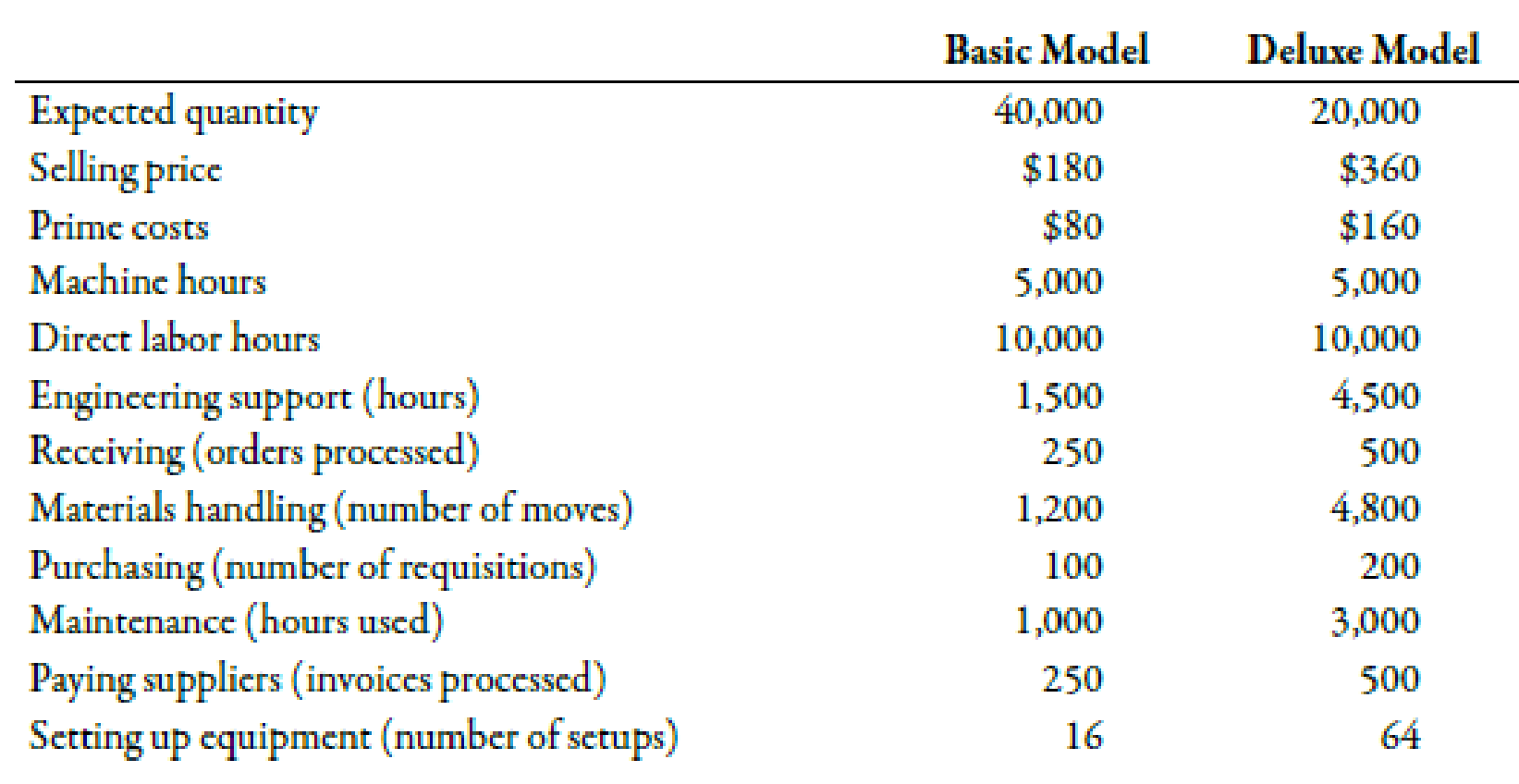

Willow Company produces lawnmowers. One of its plants produces two versions of mowers: a basic model and a deluxe model. The deluxe model has a sturdier frame, a higher horsepower engine, a wider blade, and mulching capability. At the beginning of the year, the following data were prepared for this plant:

Additionally, the following

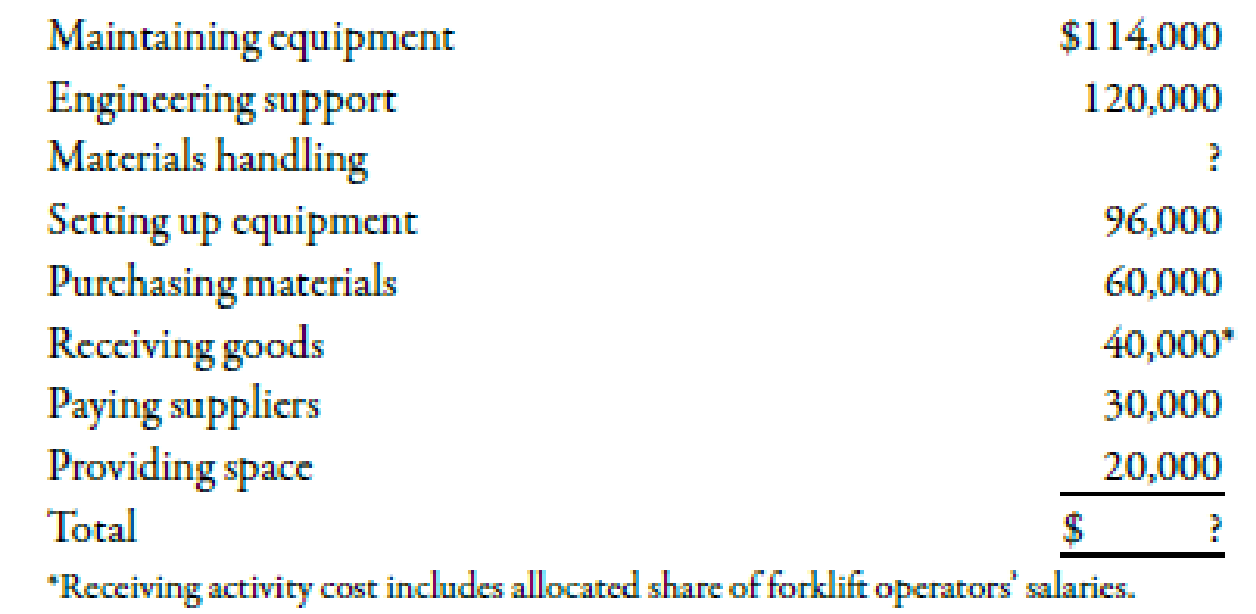

Facility-level costs are allocated in proportion to machine hours (provides a measure of time the facility is used by each product). Receiving and materials handling use three inputs: two forklifts, gasoline to operate the forklift, and three operators. The three operators are paid a salary of $40,000 each. The operators spend 25% of their time on the receiving activity and 75% on moving goods (materials handling). Gasoline costs $3 per move.

Required:

(Note: Round answers to two decimal places.)

- 1. Calculate the cost of the materials handling activity. Label the cost assignments as driver tracing or direct tracing. Identify the resource drivers.

- 2. Calculate the cost per unit for each product by using direct labor hours to assign all overhead costs.

- 3. Calculate activity rates, and assign costs to each product. Calculate a unit cost for each product, and compare these costs with those calculated in Requirement 2.

- 4. Calculate consumption ratios for each activity.

- 5. CONCEPTUAL CONNECTION Explain how the consumption ratios calculated in Requirement 4 can be used to reduce the number of rates. Calculate the rates that would apply under this approach.

1.

Compute the costs of the material handling activity and label the activities into driver tracing or direct tracing. Also, identify the resource drivers of the various activities.

Explanation of Solution

Activity Based Costing (ABC):

Activity based costing is an apportionment of costs that first considers the activity drivers that helps in the allocation of costs to various activities and then allocates costs to different cost objects by using the drivers.

| Particulars |

Rate (R) ($) |

Quantity (Q) |

Amount ($) |

| Labor | 120,000 | 0.75 | 90,000 |

| Gasoline | 3 | 6,000 | 18,000 |

| Depreciation | 16,000 | 0.75 | 12,000 |

| Total Cost | 120,000 |

Table (1)

Labor and Gasoline are driver tracing.

Identification of resource driver:

| Activity | Resource driver |

| Labor | Time |

| Gasoline | Number of moves |

| Depreciation | Time |

Table (2)

2.

Compute the costs per unit for each product with the help of direct labor hours.

Explanation of Solution

Computation of costs per account by customer category:

| Particulars |

Basic ($) |

Deluxe ($) |

| Prime costs | 80 | 160 |

| Overhead costs | 7.501 | 152 |

| Total costs | 87.50 | 175 |

Table (3)

Working Note:

1. Calculation of overhead costs:

First, the amount of plant wide rate is computed so as to calculate the overhead costs of basic:

2. Calculation of overhead costs of deluxe:

3.

Compute the activity rates and assign this cost to each product. Compute unit cost for each product and compare the costs.

Explanation of Solution

Computation of costs per account by customer category:

| Activity | Rate(R) | Quantity (Q) |

Basic |

Deluxe ($) |

| (A)Prime costs | 80 | 40,000 | 3,200,000 | |

| 160 | 20,000 | 3,200,000 | ||

| (B)Maintenance | 28.501 | 1,000 | 28,500 | |

| 28.501 | 3,000 | 85,500 | ||

| (C)Engineering | 20.002 | 1,500 | 30,000 | |

| 20.002 | 4,500 | 90,000 | ||

| (D)Materials handling | 20.003 | 1,200 | 24,000 | |

| 20.003 | 4,800 | 96,000 | ||

| (E)Setting up | 1,2004 | 16 | 19,200 | |

| 1,2004 | 64 | 76,800 | ||

| (F)Purchasing | 2005 | 100 | 20,000 | |

| 2005 | 200 | 40,000 | ||

| (G)Receiving | 53.336 | 250 | 13,333 | |

| 53.336 | 500 | 26,665 | ||

| (H)Paying Suppliers | 407 | 250 | 10,000 | |

| 407 | 250 | 20,000 | ||

| (I)Paying Space | 28 | 5,000 | 10,000 | |

| 28 | 5,000 | 10,000 | ||

|

Total Cost | 3,355,033 | 3,644,965 | ||

| Units produced | 40,000 | 20,000 | ||

|

Units costs (ABC) | 83.88 | 182.25 | ||

| Units Costs(Traditional) | 87.50 | 175.00 |

Table (4)

The ABC approach is more accurate in assigning the cost to each product as compared to the traditional approach. The traditional approach shows that the basic model was overstated and deluxe model was understated because traditional model used the plant wide overhead rate.

Working Note:

1. Calculation of maintenance rates:

2. Calculation of engineering rate:

3. Calculation of material handling rate:

4. Calculation of setting up rate:

5. Calculation of purchasing rate:

6. Calculation of receiving rate:

7. Calculation of paying suppliers rate:

8. Calculation of providing space rate:

4.

Compute the consumption ratios for each activity.

Explanation of Solution

Use the following formula to calculate consumption ratio of basic model:

| Consumption Ratio | |||

| Overhead Activity | Amount of Activity Driver Per Product | Total Driver Quantity | Basic |

| (A) | (B) | (A/B) | |

| Maintenance | 1,000 | 4,000 | 0.25 |

| Engineering | 1,500 | 6,000 | 0.25 |

| Material handling | 1,200 | 6,000 | 0.20 |

| Setups | 16 | 80 | 0.20 |

| Purchasing | 100 | 300 | 0.33 |

| Receiving | 250 | 750 | 0.33 |

| Paying suppliers | 250 | 750 | 0.33 |

| Providing space | 5,000 | 10,000 | 0.50 |

Table (5)

Use the following formula to calculate consumption ratio of deluxe model:

| Consumption Ratio | |||

| Overhead Activity | Amount of Activity Driver Per Product | Total Driver Quantity | Deluxe |

| (A) | (B) | (A/B) | |

| Maintenance | 3,000 | 4,000 | 0.75 |

| Engineering | 4,500 | 6,000 | 0.75 |

| Material handling | 4,800 | 6,000 | 0.80 |

| Setups | 64 | 80 | 0.80 |

| Purchasing | 200 | 300 | 0.67 |

| Receiving | 500 | 750 | 0.67 |

| Paying suppliers | 500 | 750 | 0.67 |

| Providing space | 5,000 | 10,000 | 0.50 |

Table (6)

Working Note:

Total driver quantity hours are computed by adding total hours of basic hours and deluxe hours. Total hours are 4,000

5.

Discuss the impact of consumption ratio on reducing the taxes. Also, compute the rate of taxes that would apply under this approach.

Explanation of Solution

The activities with the same proportions are combined into one pool, if the products are consumed in same proportion. The pooled activity costs will be apportioning in the similar proportion according to the individual activity costs. Therefore, the rate of pool is reduced from 8 to 4 with the help of consumption ratio. The calculation of pool is explained below:

Calculation of pool rate by grouping together maintenance activity and engineering activity:

| Particulars |

Amount ($) |

| Maintenance | 114,000 |

| Engineering | 120,000 |

| Total | 234,000 |

| Maintenance hours | 4,000 |

|

Pool rate | 58.50 |

Table (7)

Therefore, the pool rate of same consumption ratio activities is $58.50.

Calculation of pool rate by grouping together material handling activity and setups activity:

| Particulars |

Amount ($) |

| Material handling | 120,000 |

| Setups | 96,000 |

| Total | 216,000 |

| Number of moves | 6,000 |

|

Pool rate | 36 |

Table (8)

Therefore, the pool rate of same consumption ratio activities is $36.00.

Calculation of pool rate by grouping together purchasing, receiving and paying suppliers activity:

| Particulars |

Amount ($) |

| Purchasing | 60,000 |

| Receiving | 40,000 |

| Paying suppliers | 30,000 |

| Total | 130,000 |

| Orders processed | 750 |

|

Pool rate | 173.33 |

Table (9)

Therefore, the pool rate of same consumption ratio activities is $173.33.

Calculation of pool rate of providing space:

| Particulars |

Amount ($) |

| Providing space | 20,000 |

| Machine hours | 10,000 |

|

Pool rate | 2 |

Table (10)

Therefore, the pool rate of providing space is $2.

Want to see more full solutions like this?

Chapter 5 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College