Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.58P

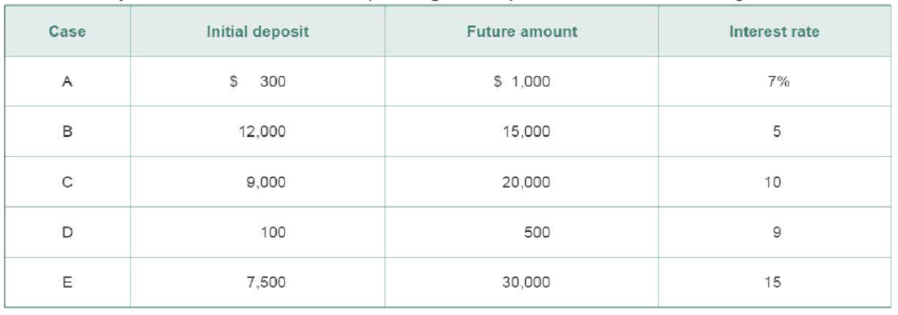

Number of years needed to acccumulate a future amount For each of the following cases, determine the number of years it will take for the initial deposit to grow to equal the future amount at the given interest rate.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 5 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 5.1 - What is the difference between future value and...Ch. 5.1 - Define and differentiate among the three basic...Ch. 5.2 - Prob. 5.3RQCh. 5.2 - Prob. 5.4RQCh. 5.2 - Prob. 5.5RQCh. 5.2 - Prob. 5.6RQCh. 5.2 - Prob. 5.7RQCh. 5.3 - What is the difference between an ordinary annuity...Ch. 5.3 - What are the most efficient ways to calculate the...Ch. 5.3 - How can the formula for the future value of an...

Ch. 5.3 - Prob. 5.13RQCh. 5.3 - What is a perpetuity? Why is the present value of...Ch. 5.4 - How do you calculate the future value of a mixed...Ch. 5.5 - What effect does compounding interest more...Ch. 5.5 - Prob. 5.21RQCh. 5.5 - Differentiate between a nominal annual rate and an...Ch. 5.6 - How can you determine the size of the equal,...Ch. 5.6 - Prob. 5.27RQCh. 5.6 - How can you determine the unknown number of...Ch. 5 - Learning Goals 2, 5 ST5-1 Future values for...Ch. 5 - Learning Goal 3 ST5-2 Future values of annuities...Ch. 5 - Prob. 5.3STPCh. 5 - Learning Goal 6 ST5-4 Deposits needed to...Ch. 5 - Assume that a firm makes a 2,500 deposit into a...Ch. 5 - Prob. 5.2WUECh. 5 - Prob. 5.3WUECh. 5 - Your firm has the option of making an investment...Ch. 5 - Joseph is a friend of yours. He has plenty of...Ch. 5 - Jack and Jill have just had their first child. If...Ch. 5 - Prob. 5.1PCh. 5 - Learning Goal 2 P5-2 Future value calculation...Ch. 5 - Prob. 5.4PCh. 5 - Prob. 5.5PCh. 5 - Learning Goal 2 P5- 6 Time value As part of your...Ch. 5 - Learning Goal 2 P5-7 Time value you can deposit...Ch. 5 - Learning Goal 2 P5-8 Time value Misty needs to...Ch. 5 - Learning Goal 2 P5- 9 Single-payment loan...Ch. 5 - Prob. 5.10PCh. 5 - Prob. 5.11PCh. 5 - Prob. 5.12PCh. 5 - Prob. 5.13PCh. 5 - Time value An Iowa state savings bond can be...Ch. 5 - Time value and discount rates You just won a...Ch. 5 - Prob. 5.16PCh. 5 - Cash flow investment decision Tom Alexander has an...Ch. 5 - Learning Goal 2 P5-18 Calculating deposit needed...Ch. 5 - Future value of an annuity for each case in the...Ch. 5 - Present value of an annuity Consider the following...Ch. 5 - Learning Goal 3 P5-21 Time value: Annuities Marian...Ch. 5 - Learning Goal 3 P5-22 Retirement planning Hal...Ch. 5 - Learning Goal 3 P5-23 Value of a retirement...Ch. 5 - Learning Goal 2, 3 P5-25 Value of an annuity...Ch. 5 - Prob. 5.26PCh. 5 - Prob. 5.30PCh. 5 - Learning Goal 4 P5-31 Value of a single amount...Ch. 5 - Value of mixed streams Find the present value of...Ch. 5 - Prob. 5.33PCh. 5 - Prob. 5.34PCh. 5 - Prob. 5.36PCh. 5 - Prob. 5.37PCh. 5 - Changing compounding frequency Using annual,...Ch. 5 - Prob. 5.39PCh. 5 - Prob. 5.40PCh. 5 - Compounding frequency and time value You plan to...Ch. 5 - Learning Goals 3, 5 P5-42 Annuities and...Ch. 5 - Prob. 5.43PCh. 5 - Prob. 5.44PCh. 5 - Prob. 5.45PCh. 5 - Prob. 5.46PCh. 5 - Prob. 5.47PCh. 5 - Loan amortization schedule Joan Messineo borrowed...Ch. 5 - Prob. 5.49PCh. 5 - Prob. 5.50PCh. 5 - Prob. 5.52PCh. 5 - Prob. 5.53PCh. 5 - Prob. 5.54PCh. 5 - Prob. 5.55PCh. 5 - Prob. 5.56PCh. 5 - Prob. 5.57PCh. 5 - Number of years needed to acccumulate a future...Ch. 5 - Prob. 5.59PCh. 5 - Prob. 5.60PCh. 5 - Time to repay Installment loan Mia Saito wishes to...

Additional Business Textbook Solutions

Find more solutions based on key concepts

A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediat...

Engineering Economy (17th Edition)

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

E8-13 Identifying internal controls

Learning Objective 1

Consider each situation separately. Identify the missi...

Horngren's Accounting (12th Edition)

Quick ratio and current ratio (Learning Objective 7) 1520 min. Consider the following data: COMPANY A B C D Cas...

Financial Accounting, Student Value Edition (5th Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

How can a management accountant help formulate strategy?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

5 Steps to Setting Achievable Financial Goals | Brian Tracy; Author: Brian Tracy;https://www.youtube.com/watch?v=aXDuLxEJqBo;License: Standard Youtube License