Concept explainers

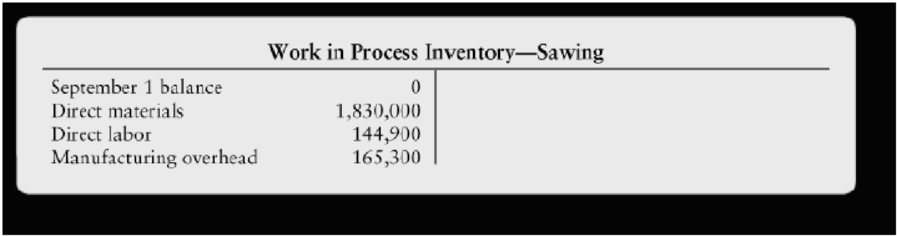

The Timberbrook Furniture Company produces dining tables in a three-stage process: Sawing, Assembly, and Staining. Costs incurred in the Sawing Department during September are summarized as follows:

5.4-40 Full Alternative Text

Direct materials (lumber) are added at the beginning of the sawing process, while conversion costs are incurred evenly throughout the process. September activity in the Sawing Department included sawing of 12,000 meters of lumber, which were transferred to the Assembly Department. Also, work began on 3,000 meters of lumber, which on September 30 were 70% of the way through the sawing process.

Requirements

- 1. Draw a time line for the Sawing Department.

- 2. Use the time line to help you compute the number of equivalent units and the cost per equivalent unit in the Sawing Department for September.

- 3. Show that the sum of (a) cost of goods transferred out of the Sawing Department and (b) ending Work in Process Inventory—Sawing equals the total cost accumulated in the department during September.

- 4. Journalize all transactions affecting the company’s sawing process during September, including those already posted. Assume the wages are unpaid.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning