Concept explainers

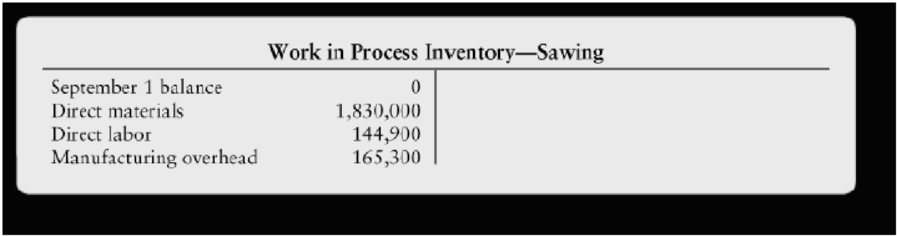

The Timberbrook Furniture Company produces dining tables in a three-stage process: Sawing, Assembly, and Staining. Costs incurred in the Sawing Department during September are summarized as follows:

5.4-40 Full Alternative Text

Direct materials (lumber) are added at the beginning of the sawing process, while conversion costs are incurred evenly throughout the process. September activity in the Sawing Department included sawing of 12,000 meters of lumber, which were transferred to the Assembly Department. Also, work began on 3,000 meters of lumber, which on September 30 were 70% of the way through the sawing process.

Requirements

- 1. Draw a time line for the Sawing Department.

- 2. Use the time line to help you compute the number of equivalent units and the cost per equivalent unit in the Sawing Department for September.

- 3. Show that the sum of (a) cost of goods transferred out of the Sawing Department and (b) ending Work in Process Inventory—Sawing equals the total cost accumulated in the department during September.

- 4. Journalize all transactions affecting the company’s sawing process during September, including those already posted. Assume the wages are unpaid.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

- Determine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forwardChapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forward

- hello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forwardProvide accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning