Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

5th Edition

ISBN: 9780134078922

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.44BP

Preparing a multi-step income statement and journalizing closing entries

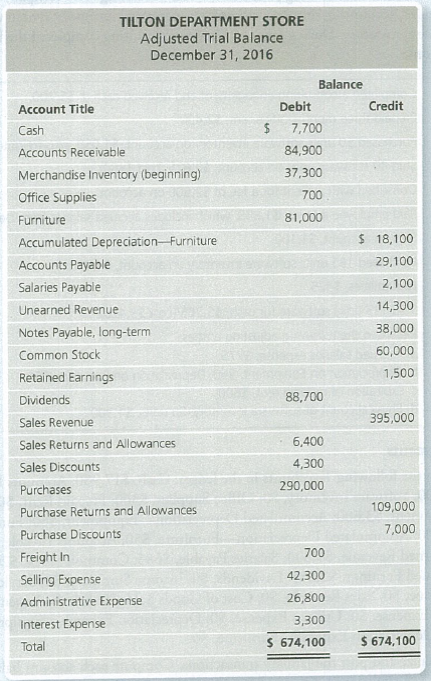

Tilton Department Store uses a periodic inventory system. The adjusted

Requirements

1. Prepare Tilton Department Store’s multi-step income statement for the year ended December 31, 2016. Assume ending Merchandise Inventory is $36,700.

2. Journalize Tilton Department Store’s closing entries.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Provide correct answer general accounting question

answer plz

The controller of Afton Manufacturing has collected the

following monthly expense data for use in analyzing the

cost behavior of maintenance costs:

⚫ January: $2,800 and 3,500 machine hours

• February: $3,200 and 4,200 machine hours

⚫ March: $3,800 and 6,000 machine hours

⚫ April: $4,500 and 7,500 machine hours

• May: $3,600 and 5,200 machine hours

• June: $5,200 and 7,000 machine hours

Using the high-low method, determine the estimated fixed

cost element and the variable cost per unit of machine

hour.

Chapter 5 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

Ch. 5 - Which account does a merchandiser use that a...Ch. 5 - The two main inventory accounting systems are the...Ch. 5 - The journal entry for the purchase of inventory on...Ch. 5 - JC Manufacturing purchase d inventory for 5,300...Ch. 5 - Prob. 5QCCh. 5 - Suppose Daves Discounts Merchandise Inventory...Ch. 5 - Which of the following accounts would be closed at...Ch. 5 - What is the order of the subtotals that appear on...Ch. 5 - Prob. 9QCCh. 5 - The journal entry for the purchase of inventory on...

Ch. 5 - What is a merchandiser, and what is the name of...Ch. 5 - Prob. 2RQCh. 5 - Describe the operating cycle of a merchandiser.Ch. 5 - What is Cost of Goods Sold (COGS), and where is it...Ch. 5 - How is gross profit calculated, and what does it...Ch. 5 - What are the two types of inventory accounting...Ch. 5 - What is an invoice?Ch. 5 - What account is debited when recording a purchase...Ch. 5 - Prob. 9RQCh. 5 - What is a purchase return? How does a purchase...Ch. 5 - Prob. 11RQCh. 5 - How is the net cost of inventory calculated?Ch. 5 - What are the two journal entries involved when...Ch. 5 - When granting a sales allowance, is there a return...Ch. 5 - Prob. 15RQCh. 5 - Prob. 16RQCh. 5 - Prob. 17RQCh. 5 - What are the four steps involved in the closing...Ch. 5 - Prob. 19RQCh. 5 - Prob. 20RQCh. 5 - Prob. 21RQCh. 5 - Prob. 22RQCh. 5 - Prob. 23ARQCh. 5 - When recording purchase returns and purchase...Ch. 5 - What account is debited when recording the payment...Ch. 5 - Prob. 26ARQCh. 5 - Is an adjusting entry needed for inventory...Ch. 5 - Highlight the differences in the closing process...Ch. 5 - Describe the calculation of cost of goods sold...Ch. 5 - Comparing periodic and perpetual inventory systems...Ch. 5 - Journalizing purchase transactions Consider the...Ch. 5 - Journalizing purchase transactions Consider the...Ch. 5 - Journalizing sales transactions Journalize the...Ch. 5 - Journalizing purchase and sales transactions...Ch. 5 - Adjusting for inventory shrinkage Carlas...Ch. 5 - Journalizing closing entries Rockwall RV Centers...Ch. 5 - Use the following information to answer Short...Ch. 5 - Use the following information to answer Short...Ch. 5 - Computing the gross profit percentage Morris...Ch. 5 - Journalizing purchase transactions-periodic...Ch. 5 - Prob. 5.12SECh. 5 - Journalizing closing entries-periodic inventory...Ch. 5 - Computing cost of goods sold in a periodic...Ch. 5 - For all exercises, assume the perpetual inventory...Ch. 5 - Journalizing purchase transactions from an invoice...Ch. 5 - Journalizing purchase transactions Hartford...Ch. 5 - Computing missing amounts Consider the following...Ch. 5 - Journalizing sales transactions Journalize the...Ch. 5 - Journalizing purchase and sales transactions...Ch. 5 - Journalizing adjusting entries and computing gross...Ch. 5 - Use the following information to answer Exercises...Ch. 5 - Prob. 5.23ECh. 5 - Use the following information to answer Exercises...Ch. 5 - Computing the gross profit percentage Cupcake...Ch. 5 - Journalizing purchase transactionsperiodic...Ch. 5 - Journalizing sales transactions-periodic inventory...Ch. 5 - Journalizing purchase and sales...Ch. 5 - Journalizing dosing entries-periodic inventory...Ch. 5 - Computing cost of goods sold in a periodic...Ch. 5 - Journalizing purchase and sale transactions...Ch. 5 - Journalizing purchase and sale transactions...Ch. 5 - Preparing a multi-step income statement,...Ch. 5 - Journalizing adjusting entries, preparing adjusted...Ch. 5 - Preparing a single-step income statement,...Ch. 5 - Journalizing purchase and sale...Ch. 5 - A Preparing a multi-step income statement and...Ch. 5 - Journalizing purchase and sale transactions...Ch. 5 - Prob. 5.39BPCh. 5 - Prob. 5.40BPCh. 5 - Journalizing adjusting entries, preparing adjusted...Ch. 5 - Prob. 5.42BPCh. 5 - Prob. 5.43BPCh. 5 - Preparing a multi-step income statement and...Ch. 5 - Journalizing purchase and sale transactions,...Ch. 5 - Journalizing purchase and sale transactions,...Ch. 5 - Comprehensive Problem for Chapters 1-5 Completing...Ch. 5 - Prob. 5.1CTDCCh. 5 - Dobbs Wholesale Antiques makes all sales under...Ch. 5 - Rae Philippe was a warehouse manager for Atkins...Ch. 5 - Prob. 5.1CTFSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject general accountingarrow_forwardFinancial accountingarrow_forwardDelta Corp. had the following data last year: • Net income = $1,200 • Net operating profit after taxes (NOPAT) = $1,100 • Total assets = $4,500 Total operating capital = $3,500 For the just-completed year, Delta Corp. reported: • Net income = $1,500 • NOPAT = $1,375 • Total assets = $3,800 Total operating capital = $3,900 How much free cash flow (FCF) did Delta generate during the just-completed year?arrow_forward

- Slotnick Chemical received $380,000 from customers as deposits on returnable containers during 2024. Fifteen percent of the containers were not returned. The deposits are based on the container cost marked up 25%. How much profit did Slotnick realize on the forfeited deposits? Note: Do not round intermediate calculations. Multiple Choice $11,400 $0 $14,250 $57,000arrow_forwardPlease see an attachment for details financial accounting questionarrow_forwardmanufacturing overhead cost for may?arrow_forward

- Harald Dunn and his wife Evadne operate a successful snack packaging business, Healthy Snacks, in St Mary, Jamaica. The bulk buying of the raw materials (nuts, dried fruits, etc), the packaging and delivery to corporate area shops are done by the members of the family. The accounts for Mr. Dunn’s business at 31st December 2014 showed a profit of $4,500,000 after charging: $180,000 depreciation of equipment and office furniture; $750,000 for salary to his wife Evadne who supervises the office, $496,000 to his 18 year old son Shane, and $1,720,000 to himself. $78,000 interest on a loan he had obtained to expand his business 3 years ago (a) Prepare the statement; with notes where applicable; of the Healthy Snacks business showing the taxable profits and income tax liability for the year of assessment 2014 for Harold Dunn. (b) Shane is a part-time student at the University of the West Indies. What is his tax liability, if anyarrow_forwardBranch Company, a building materials supplier, has $17,400,000 of notes payable due April 12, 2025. At December 31, 2024, Branch signed an agreement with First Bank to borrow up to $17,400,000 to refinance the notes on a long-term basis. The agreement specified that borrowings would not exceed 80% of the value of the collateral that Branch provided. At the date of issue of the December 31, 2024, financial statements, the value of Branch's collateral was $19,800,000. On its December 31, 2024, balance sheet, Branch should classify the notes as follows:arrow_forwardCan you help me with financial accounting question ?arrow_forward

- products: X and Y. The company uses direct labor hours to allocate overhead costs. • Product X requires 0.5 direct labor- hours per unit • Product Y requires 0.8 direct labor- hours per unit • The predetermined overhead rate is $72.00 per direct labor-hour What is the amount of overhead cost allocated to each unit of Product Y?arrow_forwardgreenfield manufacturing?arrow_forwardI want to this question answer financial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License