Concept explainers

Comprehensive Problem for Chapters 1-5

Completing a Merchandiser’s Accounting Cycle

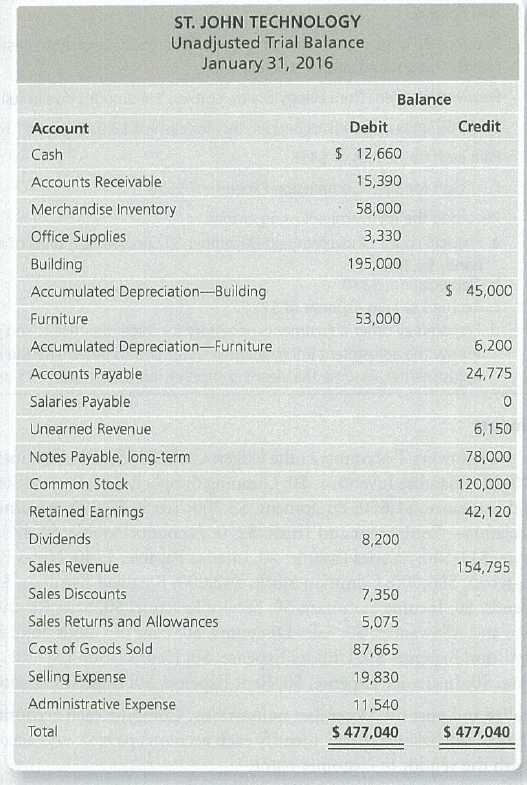

St. John Technology uses a perpetual inventory system. The end-of-month unadjusted

Additional data at January 31, 2 016:

a. Office Supplies consumed during the month, $1,780. Half is selling expense, and the other half is administrative expense.

b.

c. Unearned revenue that has been earned during January, $3,825.

d. Accrued salaries, an administrative expense, $975.

e. Merchandise Inventory on hand, $55,375. St. John uses the perpetual inventory system.

Requirements

1. Using T-accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Al so open the Income Summary account.

2. Journalize and post the

3. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2016. St. John Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense.

4. Prepare the company’s multi-step in com e statement and statement of

5. Journalize and

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- For the system shown in figure below, the per unit values of different quantities are E-1.2, V 1, X X2-0.4. Xa-0.2 Determine whether the system is stable for a sustained fault. The fault is cleared at 8-60°. Is the system stable? If so find the maximum rotor swing. Find the critical clearing angle. E25 G X'd 08 CB X2 F CB V28 Infinite busarrow_forwardGeisner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The industry average debt-to-equity ratio is 1.20. Calculate Geisner's debt-to-equity ratio and indicate whether the company's default risk is higher or lower than the average of other companies in the industry.arrow_forwardHy expert give me solution this questionarrow_forward

- Baker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forwardA pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forward

- A company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forwardhello tutor provide solutionarrow_forwardGerry Co. has a gross profit of $990,000 and $290,000 in depreciation expenses. Selling and administrative expense is $129,000. Given that the tax rate is 37%, compute the cash flow for Gerry Co. a. $700,000 b. $128,963 c. $649,730 d. $652,230arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,