Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

10th Edition

ISBN: 9781305793217

Author: Gary A. Porter, Curtis L. Norton

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.3E

Perpetual and Periodic Inventory Systems

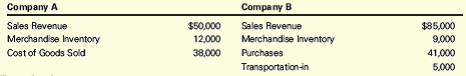

Following is a partial list of account balances for two different merchandising companies. The amounts in the accounts represent the balances at the end of the year before any adjustments are made or the books are closed.

Required

- Identify which inventory system, perpetual or periodic, each of the two companies uses. Explain how you know which systemeach company uses by looking at the types of accounts on its books.

- How much inventory should Company A have on hand at the end of the year? What is its cost of goods sold for the year?

- Explain why you cannot determine Company B’s cost of goods sold for the year from the information available.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the beginning raw materials inventory? Accounting.

Determine the correct inventory amount to be reported in Kwok's 2018 balance sheet.

Solve asap. General Accounting.

Chapter 5 Solutions

Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

Ch. 5 - Merchandise Accounting Merchandise Inventory Raw...Ch. 5 - Inventory Valuation Specific identification method...Ch. 5 - Inventoriable Costs During the first month of...Ch. 5 - Perpetual and Periodic Inventory Systems Following...Ch. 5 - Missing Amounts in Cost of Goods Sold Model For...Ch. 5 - Purchase Discounts For each of the following...Ch. 5 - Working Backward: Gross Profit Ratio Acmes gross...Ch. 5 - Inventory Costing Methods VanderMeer Inc. reported...Ch. 5 - Cost of Goods Sold, FIFO, and LIFO Kramer began...Ch. 5 - Comparison of Inventory Costing Methods—Periodic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide this question solution general accountingarrow_forwardAccountingarrow_forwardWhat would a 5-year projection for a startup Accounting Firm business look like with 50 clients? Include units, dollars, and assumptions in the projection. How would a startup Accounting Firm present the sales projection in a narrative that includes the description of the units you plan to sell, the services (amount of them) you plan to provide, and your growth projections of these numbers? When will a startup Accounting Firm start making a profit and have the break-even point?arrow_forward

- general account this is questionsarrow_forwardWhat would a 5-year projection for a startup Accounting Firm business look like starting from 2024? Include units, dollars, and assumptions in the projection. How would a startup Accounting Firm present the sales projection in a narrative that includes the description of the units you plan to sell, the services (amount of them) you plan to provide, and your growth projections of these numbers? When will a startup Accounting Firm start making a profit and have the break-even point?arrow_forwardFinancial accounting questionarrow_forward

- General accountingarrow_forwardNonearrow_forwardYumYum Meat Company uses a process costing system. The following information relates to one month's activity in the company's Curing Department: Conversion Percentage Units Complete Beginning work in process 10,000 inventory Units started 21,000 Units completed and 26,000 transferred out Ending work in process 5,000 inventory 20% 80% The conversion cost of the beginning inventory was $6,500. During the month, $112.000 in additional conversion costs was incurred. Assume that the company uses the weighted-average cost method. Compute the equivalent units of production for conversion for the month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License