EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475998

Author: Rajan

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.39P

ABC, health care. Crosstown Health Center runs two programs: drug addict rehabilitation and aftercare (counseling and support of patients after release from a mental hospital). The center’s budget for 2017 follows.

| Professional salaries: | ||

| 4 physicians × $150,000 | $600,000 | |

| 12 psychologists × $75,000 | 900,000 | |

| 16 nurses × $30,000 | 480,000 | $1,980,000 |

| Medical supplies | 242,000 | |

| Rent and clinic maintenance | 138,600 | |

| Administrative costs to manage patient charts, food, laundry | 484,000 | |

| Laboratory services | 92,400 | |

| Total | $2,937,000 |

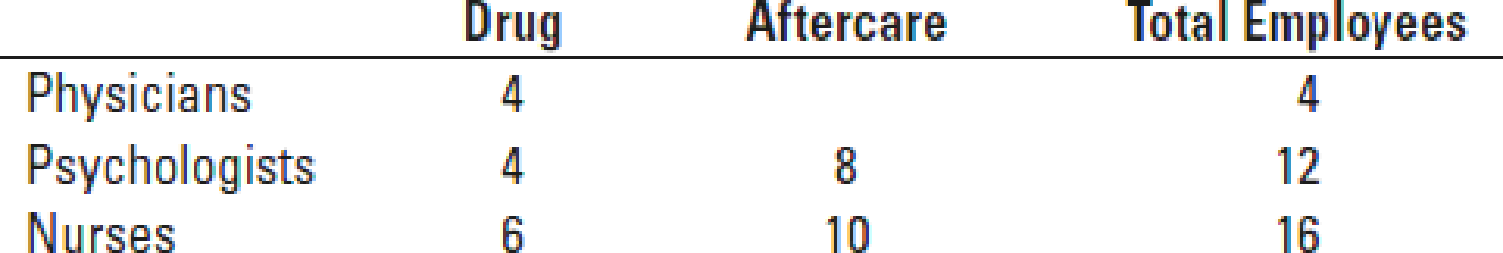

Kim Yu, the director of the center, is keen on determining the cost of each program. Yu compiles the following data describing employee allocations to individual programs:

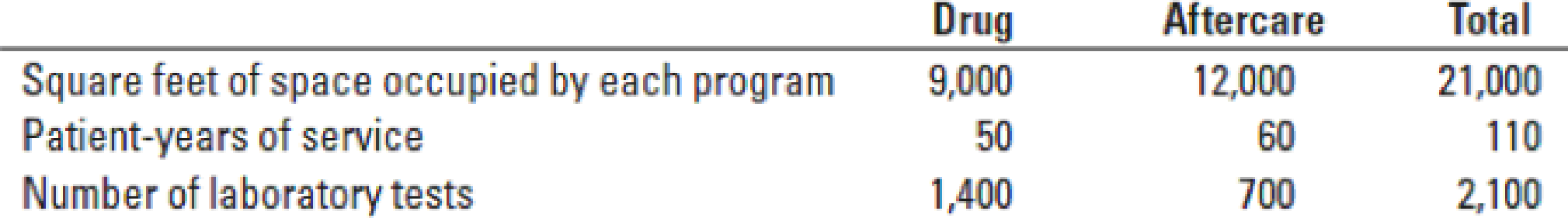

Yu has recently become aware of activity-based costing as a method to refine costing systems. She asks her accountant, Gus Gates, how she should apply this technique. Gates obtains the following budgeted

- a. Selecting cost-allocation bases that you believe are the most appropriate for allocating indirect costs to programs, calculate the budgeted indirect cost rates for medical supplies: rent and clinic maintenance; administrative costs for patient charts, food, and laundry; and laboratory services.

Required

- b. Using an activity-based costing approach to cost analysis, calculate the budgeted cost of each program and the budgeted cost per patient-year of the drug program.

- c. What benefits can Crosstown Health Center obtain by implementing the ABC system?

- 2. What factors, other than cost, do you think Crosstown Health Center should consider in allocating resources to its programs?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Provide accurate answer

What is the price sales ratio on these financial accounting question?

Net sales total $525,000.

Chapter 5 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 5 - What is broad averaging, and what consequences can...Ch. 5 - Why should managers worry about product...Ch. 5 - What is costing system refinement? Describe three...Ch. 5 - What is an activity-based approach to designing a...Ch. 5 - Describe four levels of a cost hierarchy.Ch. 5 - Why is it important to classify costs into a cost...Ch. 5 - What are the key reasons for product cost...Ch. 5 - Prob. 5.8QCh. 5 - Department indirect-cost rates are never...Ch. 5 - Prob. 5.10Q

Ch. 5 - Prob. 5.11QCh. 5 - Prob. 5.12QCh. 5 - Activity-based costing is the wave of the present...Ch. 5 - Increasing the number of indirect-cost pools is...Ch. 5 - The controller of a retail company has just had a...Ch. 5 - Conroe Company is reviewing the data provided by...Ch. 5 - Prob. 5.17MCQCh. 5 - Cost hierarchy. Roberta, Inc., manufactures...Ch. 5 - ABC, cost hierarchy, service. (CMA, adapted)...Ch. 5 - Alternative allocation bases for a professional...Ch. 5 - Plant-wide, department, and ABC Indirect cost...Ch. 5 - Plant-wide, department, and activity-cost rates....Ch. 5 - ABC, process costing. Sander Company produces...Ch. 5 - Department costing, service company. DLN is an...Ch. 5 - Activity-based costing, service company....Ch. 5 - Activity-based costing, manufacturing. Decorative...Ch. 5 - ABC, retail product-line profitability. Fitzgerald...Ch. 5 - Prob. 5.28ECh. 5 - Activity-based costing. The job-costing system at...Ch. 5 - ABC, product costing at banks,...Ch. 5 - Problems 5-31 Job costing with single direct-cost...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - Department and activity-cost rates, service...Ch. 5 - Activity-based costing, merchandising. Pharmahelp,...Ch. 5 - Choosing cost drivers, activity-based costing,...Ch. 5 - ABC, health care. Crosstown Health Center runs two...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - ABC, implementation, ethics. (CMA, adapted) Plum...Ch. 5 - Activity-based costing, activity-based management,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the price earnings ratio?arrow_forwardLydia's Bakery has $920,000 in sales. The profit margin is 5 percent, and the firm has 8,000 shares of stock outstanding. The market price per share is $18.25. What is the price-earnings ratio? Answerarrow_forwardHow much overhead was applied to each job ??arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License