Concept explainers

Inventory: These are goods which are owned by company and expected to sell in its normal course of business

Periodic Inventory System: The physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. The cost of merchandise is calculated by opening a temporary purchase account and all purchases of merchandise are debited to purchase account.

Sales under periodic Inventory System : When merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each sales transaction as explained below

- When sale of merchandise is made as per revenue recognition principle. The revenue will be recognized by debiting "Accounts receivable" if there is credit sales or "Cash" if it cash sales and by crediting "Sales"

Purchases under periodic Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each purchase transaction as explained below

- When purchase of merchandise is made. the accounting entry will be by debiting "Purchases" by crediting "Accounts payable" if there is credit purchase if cash is paid than "Cash" will be credited

Sales under perpetual Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be two entries for each sales transaction as explained below

- When sale of merchandise is made as per revenue recognition principle. The revenue will be recognized by debiting "Accounts receivable" if there is credit sales or "Cash" if it cash sales and by crediting "Sales"

- The amount of cost of inventory which is sold the accounting entry will debiting " cost of goods sold" and crediting "Merchandise Inventory"

Purchases under perpetual Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each purchase transaction as explained below

- When purchase of merchandise is made. the accounting entry will be by debiting "Merchandise Inventory" by crediting "Accounts payable" if there is credit purchase if cash is paid than "Cash" will be credited

Cost of goods sold: The amount of cost of inventory which is sold is determined and is part of expense shown in Income statement. The formula to calculate Cost of goods sold is given below

The amount of cost of goods sold using periodic inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,500

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,300

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under FIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 28-Sep | 50 | 32 | 1600 |

The cost of goods sold as per FIFO method can be calculated using the formula is given below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from opening balances and first purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The cost of goods sold as per LIFO method can be calculated using the formula is given below

The cost of goods sold as per LIFO method is $12,500 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,300 and FIFO is $1,600 using periodic inventory system

The amount of cost of goods sold and ending inventory as per FIFO and LIFO using perpetual inventory system

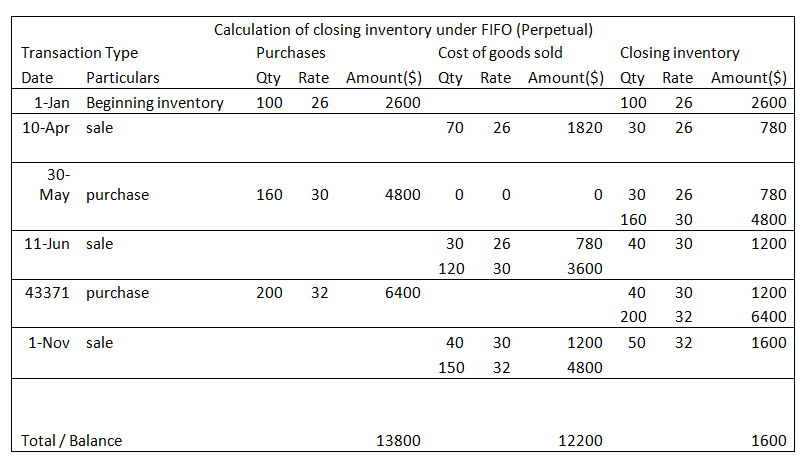

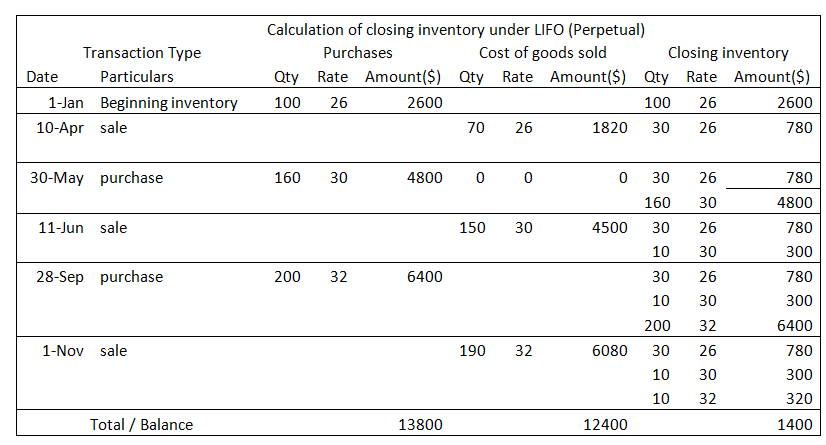

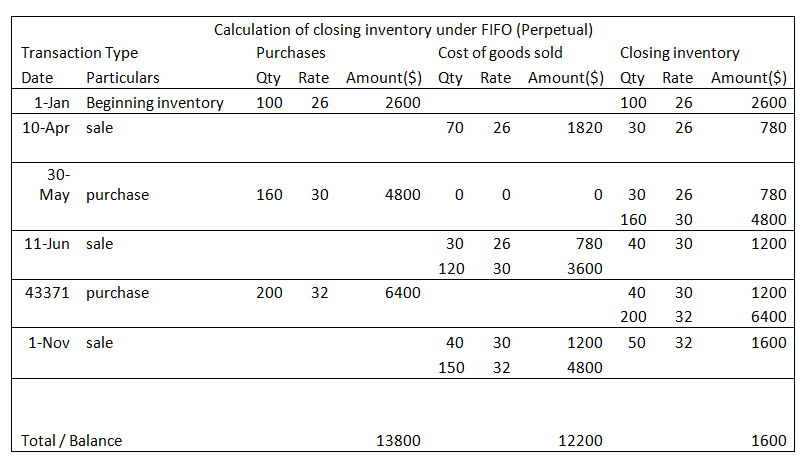

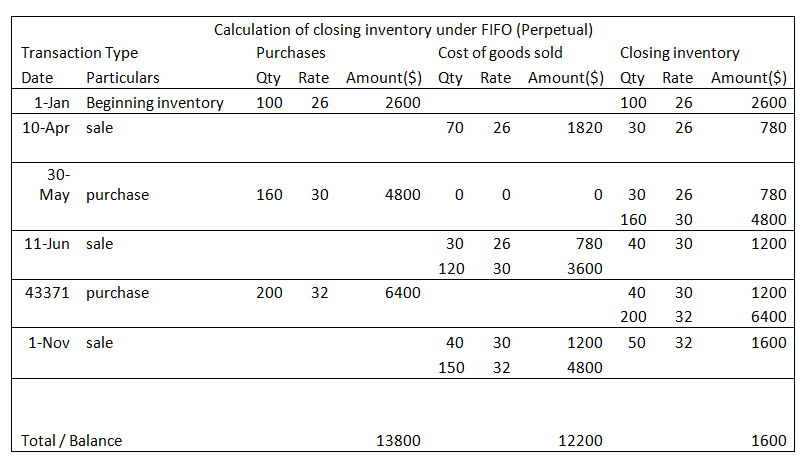

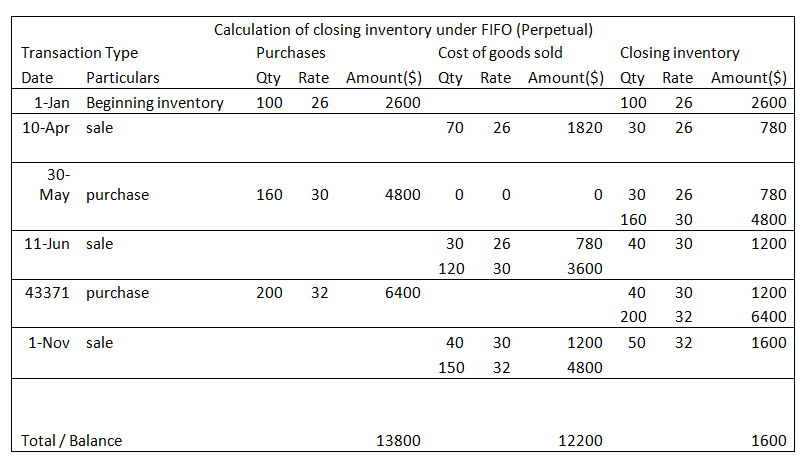

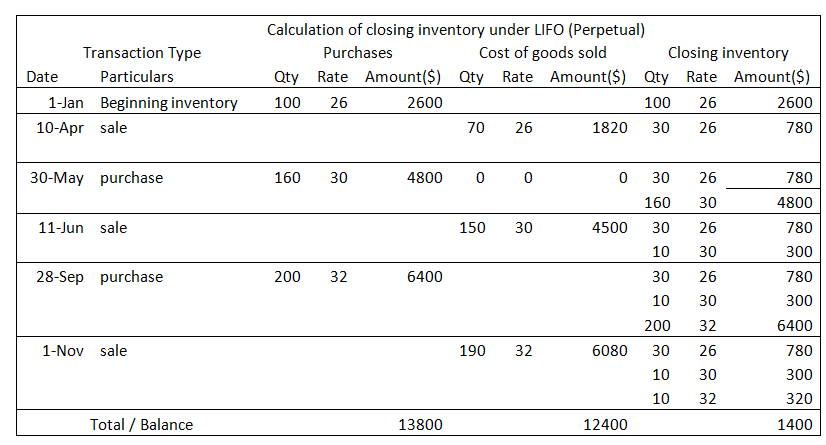

The amount of cost of goods sold using perpetual inventory system is as under

- As per FIFO method it is $12,200

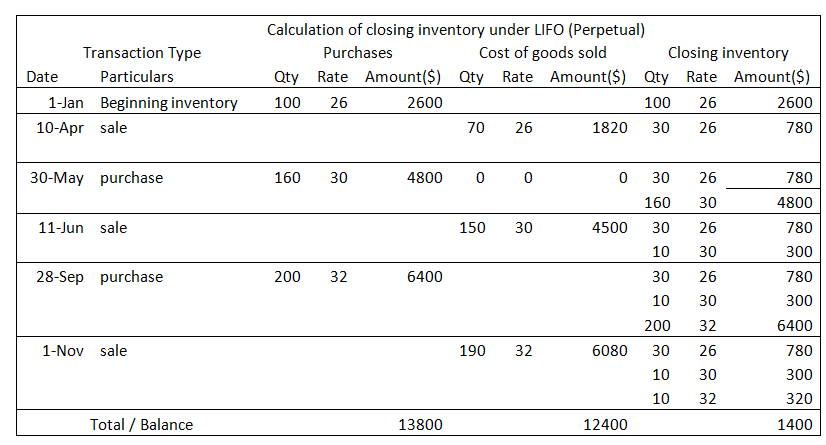

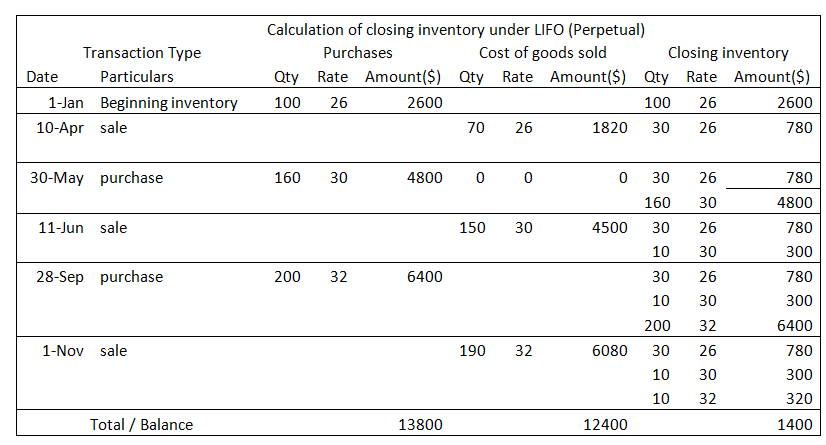

- As per LIFO method it is $12,400

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

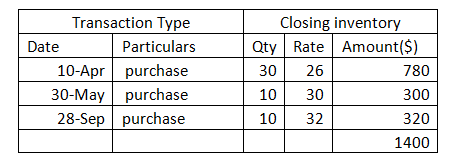

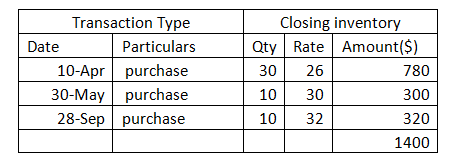

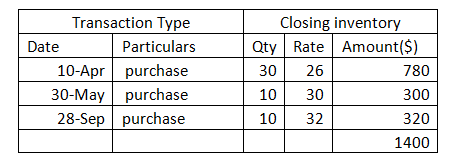

- As per LIFO method it is $1,400

The calculation of ending inventory and total goods available for sale is shown below

Date of purchases Number of units Unit cost($) Total cost($) A B C=A x B 1/1 Beginning inventory 100 26 2600 30-May 160 30 4800 28-Sep 200 32 6400 Total units available for sale I 460 13800 Date of sales 10-Apr 70 11-Jun 150 1-Nov 190 Total units sold II 410 Closing inventory III= I - II 50

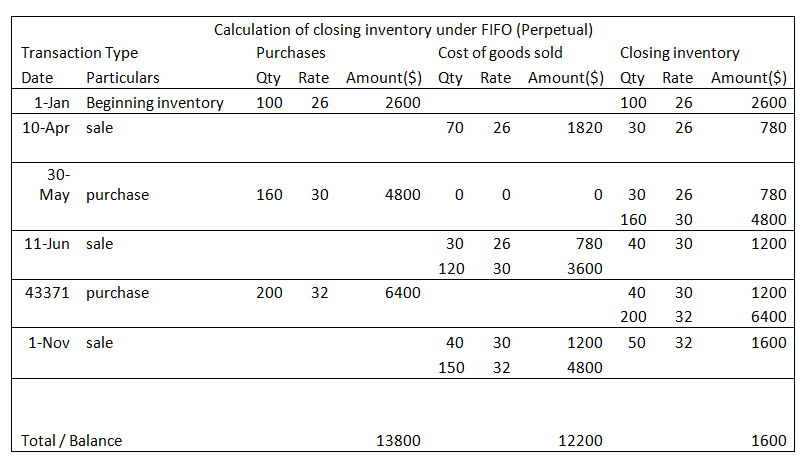

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

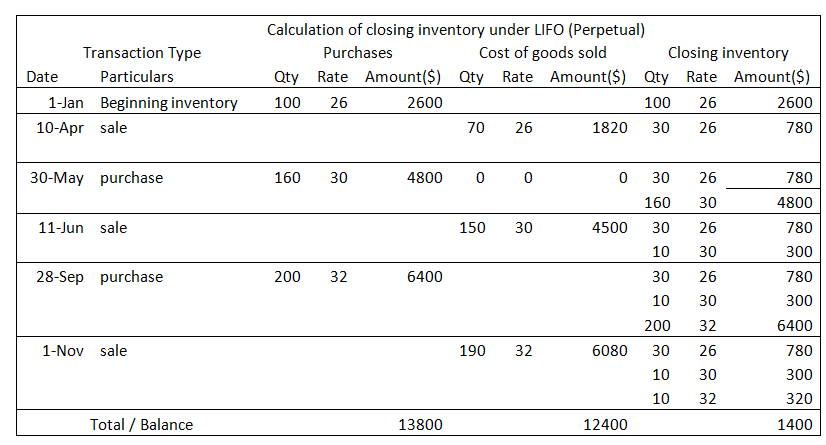

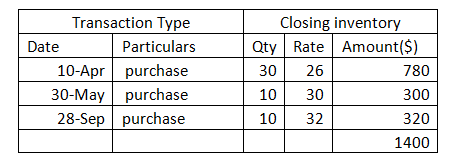

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $12,400 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,400 and FIFO is $1,600 using periodic inventory system

The reason for difference in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system and perpetual inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The reasons for difference in actual physical flow of goods in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

The reasons difference in actual physical flow of goods and valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system as follows

- As per periodic inventory system the physical inventory is not determined after every sale but physical stock is counted at period end and posted in inventory account and for all sales the cost of goods sold is debited by taking the last purchases onwards

- The actual physical flow of inventory items means the sale will take place from inventory available on the date of sale and the price of last purchase onwards will be recognized in cost of goods sold account

- In the LIFO method under periodic inventory system purchases quantity can after sales date

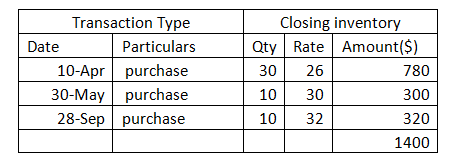

As per actual physical flow of inventory items the valuation as per LIFO method for ending balance should be as follows

But as LIFO method as per periodic inventory system it is as follows

Calculation of closing inventory under LIFO (Periodic) Date of purchases Number of units unit cost($) total cost($) 1/1 Beginning inventory 50 26 1300

The difference is actual inventory for sales is not taken for valuation of cost of goods sold on the date of sale

There will always variation in actual physical flow of inventory items and in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

The amount of cost of goods sold using perpetual inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,400

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,400

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $12,400 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,400 and FIFO is $1,600 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The reasons difference in actual physical flow of goods and valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system as follows

- As per periodic inventory system the physical inventory is not determined after every sale but physical stock is counted at period end and posted in inventory account and for all sales the cost of goods sold is debited by taking the last purchases onwards

- The actual physical flow of inventory items means the sale will take place from inventory available on the date of sale and the price of last purchase onwards will be recognized in cost of goods sold account

- In the LIFO method under periodic inventory system purchases quantity can after sales date

As per actual physical flow of inventory items the valuation as per LIFO method for ending balance should be as follows

But as LIFO method as per periodic inventory system it is as follows

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The difference is actual inventory for sales is not taken for valuation of cost of goods sold on the date of sale

There will always variation in actual physical flow of inventory items and in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

Answer to Problem 5.34P

The amount of cost of goods sold using periodic inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,500

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,300

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under FIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 28-Sep | 50 | 32 | 1600 |

The cost of goods sold as per FIFO method can be calculated using the formula is given below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from opening balances and first purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The cost of goods sold as per LIFO method can be calculated using the formula is given below

The cost of goods sold as per LIFO method is $12,500 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,300 and FIFO is $1,600 using periodic inventory system

The amount of cost of goods sold using perpetual inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,400

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,400

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $12,400 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,400 and FIFO is $1,600 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The reasons difference in actual physical flow of goods and valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system as follows

- As per periodic inventory system the physical inventory is not determined after every sale but physical stock is counted at period end and posted in inventory account and for all sales the cost of goods sold is debited by taking the last purchases onwards

- The actual physical flow of inventory items means the sale will take place from inventory available on the date of sale and the price of last purchase onwards will be recognized in cost of goods sold account

- In the LIFO method under periodic inventory system purchases quantity can after sales date

As per actual physical flow of inventory items the valuation as per LIFO method for ending balance should be as follows

But as LIFO method as per periodic inventory system it is as follows

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The difference is actual inventory for sales is not taken for valuation of cost of goods sold on the date of sale

There will always variation in actual physical flow of inventory items and in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

Explanation of Solution

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under FIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 28-Sep | 50 | 32 | 1600 |

The cost of goods sold as per FIFO method can be calculated using the formula is given below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from opening balances and first purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The cost of goods sold as per LIFO method can be calculated using the formula is given below

The cost of goods sold as per LIFO method is $12,500 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,300 and FIFO is $1,600 using periodic inventory system

The amount of cost of goods sold using perpetual inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,400

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,400

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $12,400 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,400 and FIFO is $1,600 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The reasons difference in actual physical flow of goods and valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system as follows

- As per periodic inventory system the physical inventory is not determined after every sale but physical stock is counted at period end and posted in inventory account and for all sales the cost of goods sold is debited by taking the last purchases onwards

- The actual physical flow of inventory items means the sale will take place from inventory available on the date of sale and the price of last purchase onwards will be recognized in cost of goods sold account

- In the LIFO method under periodic inventory system purchases quantity can after sales date

As per actual physical flow of inventory items the valuation as per LIFO method for ending balance should be as follows

But as LIFO method as per periodic inventory system it is as follows

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The difference is actual inventory for sales is not taken for valuation of cost of goods sold on the date of sale

There will always variation in actual physical flow of inventory items and in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

The cost of goods sold as per LIFO method is $12,500 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,300 and FIFO is $1,600 using periodic inventory system

The amount of cost of goods sold using perpetual inventory system is as under

- As per FIFO method it is $12,200

- As per LIFO method it is $12,400

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $1,600

- As per LIFO method it is $1,400

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 100 | 26 | 2600 | |

| 30-May | 160 | 30 | 4800 | |

| 28-Sep | 200 | 32 | 6400 | |

| Total units available for sale | I | 460 | 13800 | |

| Date of sales | ||||

| 10-Apr | 70 | |||

| 11-Jun | 150 | |||

| 1-Nov | 190 | |||

| Total units sold | II | 410 | ||

| Closing inventory | III= I - II | 50 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $12,400 and FIFO method is $12,200 and cost of ending inventory as per LIFO is $1,400 and FIFO is $1,600 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The reasons difference in actual physical flow of goods and valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system as follows

- As per periodic inventory system the physical inventory is not determined after every sale but physical stock is counted at period end and posted in inventory account and for all sales the cost of goods sold is debited by taking the last purchases onwards

- The actual physical flow of inventory items means the sale will take place from inventory available on the date of sale and the price of last purchase onwards will be recognized in cost of goods sold account

- In the LIFO method under periodic inventory system purchases quantity can after sales date

As per actual physical flow of inventory items the valuation as per LIFO method for ending balance should be as follows

But as LIFO method as per periodic inventory system it is as follows

| Calculation of closing inventory under LIFO (Periodic) | ||||

| Date of purchases | Number of units | unit cost($) | total cost($) | |

| 1/1 Beginning inventory | 50 | 26 | 1300 |

The difference is actual inventory for sales is not taken for valuation of cost of goods sold on the date of sale

There will always variation in actual physical flow of inventory items and in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system

Want to see more full solutions like this?

Chapter 5 Solutions

Accounting: What the Numbers Mean

- Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately. Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units): Sales $ 40,000 Variable expenses 24,000 Contribution margin 16,000 NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below. Fixed expenses 12,000 Net operating income $ 4,000 Questions: 1. What is the contribution margin per unit? 2. What is the contribution margin ratio? 3. What is…arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardGeneral accountingarrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardRobin Corporation has ordinary income from operations of $30,000, net long-term capital gain of $10,000, and net short-term capital loss of $15,000. What is the taxable income for 2010? a) $25,000. b) $27,000. c) $28,500. d) $30,000. e) None of the above.arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forward

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI need help with this financial accounting question using the proper financial approach.arrow_forward

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education