Concept explainers

ABC, product costing at banks, cross-subsidization. United Savings Bank (USB) is examining the profitability of its Premier Account, a combined savings and checking account. Depositors receive a 2% annual interest rate on their average deposit. USB earns an interest rate spread of 3% (the difference between the rate at which it lends money and the rate it pays depositors) by lending money for home-loan purposes at 5%. Thus. USB would gain $60 on the interest spread if a depositor had an average Premier Account balance of $2,000 in 2017 ($2, 000 × 3% = $60).

The Premier Account allows depositors unlimited use of services such as deposits, withdrawals, checking accounts, and foreign currency drafts.

Depositors with Premier Account balances of $1,000 or more receive unlimited free use of services. Depositors with minimum balances of less than $1,000 pay a $22-a-month service fee for their Premier Account.

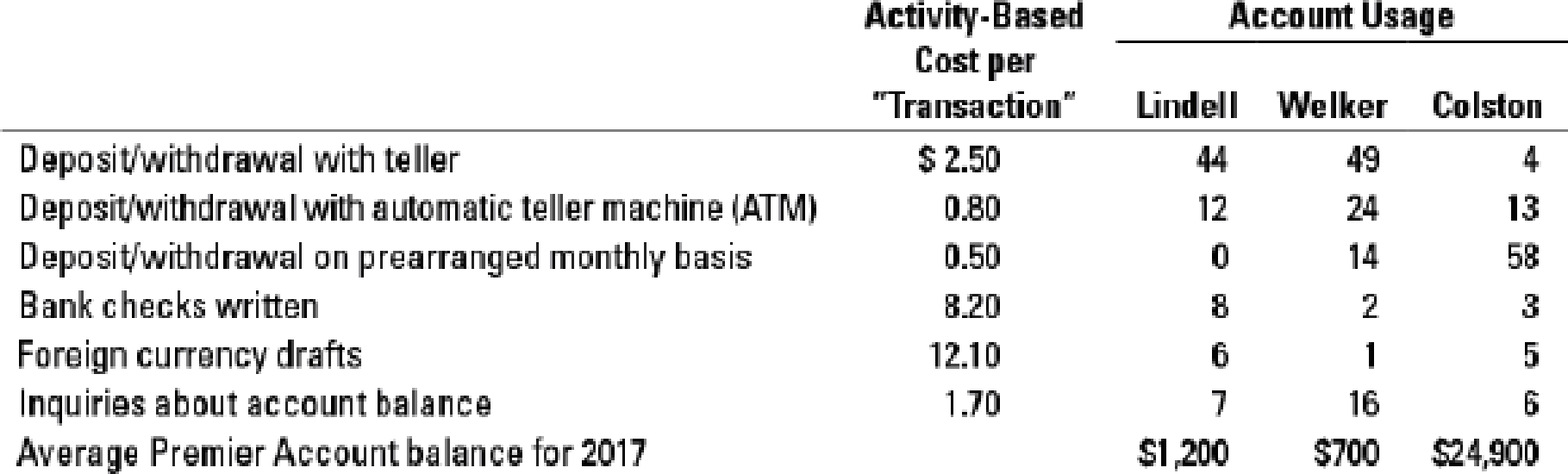

USB recently conducted an activity-based costing study of its services. It assessed the following costs for six individual services. The use of these services in 2017 by three customers is as follows:

Assume Lindell and Colston always maintain a balance above $1,000, whereas Welker always has a balance below $1,000.

- 1. Compute the 2017 profitability of the Lindell, Welker, and Colston Premier Accounts at USB.

Required

- 2. Why might USB worry about the profitability of Individual customers if the Premier Account product offering is profitable as a whole?

- 3. What changes would you recommend for USB’s Premier Account?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- Please given correct answer general accountingarrow_forwardHello tutor please provide correct answer general Accounting questionarrow_forwardQuestion: 2.7 Bolsa Corporation produces high-quality leather belts. The company's plant in Boise uses a standard costing system and has set the following standards for materials and labor: Leather (4 strips @ $5.00) $20.00 Direct labor (0.25 hr. @ $11.00) 2.75 Total prime cost $22.75 During the first month of the year, Boise plant produced 30,000 belts. Actual leather purchased was 130,000 strips at $3.00 per strip. There were no beginning or ending inventories of leather. Actual direct labor was 35,000 hours at $13.50 per hour. Compute the costs of leather and direct labor that should be incurred for the production of 30,000 leather belts. Answer: Total standard cost of leather = $600,000 Total standard cost of direct labor = $82,500arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT