INTERMEDIATE ACCOUNTING ACCESS 540 DAY

10th Edition

ISBN: 9781264706327

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.2E

Future value; single amounts

• LO6–2

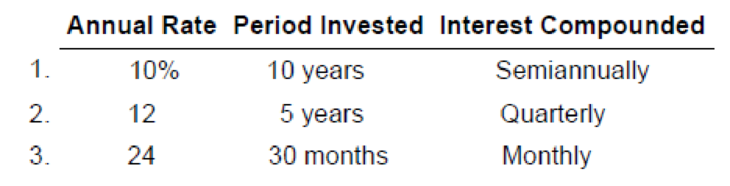

Determine the future value of $10,000 under each of the following sets of assumptions:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Formulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions).

Current assets, end of year

$2,010.1

Noncurrent liabilities, end of year

$5,962.1

Cash, end of year

169.9

Stockholders' equity, end of year

8,140.1

Cash for investing activities

(355.5)

Cash from operating activities

1,136.3

Cost of product sold

5,298.2

Total assets, beginning of year

16,284.2

Total liabilities, end of year

7,914.9

Revenue

7,998.9

Cash for financing activities

(945.2)

Total expenses, other than cost of product sold

2,069.0

Stockholders' equity, beginning of year

8,124.8

Dividends paid

(418.1)

Requireda. Prepare the income statement for the year.

J.M. Smucker Company, Inc.

Income Statement ($ millions)

Answer 1

Answer 2

Answer 3

Answer 4

Answer 5

Answer 6

Answer 7

Answer 8

Answer 9

Answer 10

b. Prepare the balance sheet at the end of the year.

J.M.…

Calculate Total Fixed Cost With General Accounting Method

Im Waiting for Solution of this General Accounting Question

Chapter 5 Solutions

INTERMEDIATE ACCOUNTING ACCESS 540 DAY

Ch. 5 - Prob. 5.1QCh. 5 - Explain compound interest.Ch. 5 - Prob. 5.3QCh. 5 - Prob. 5.4QCh. 5 - Prob. 5.5QCh. 5 - Prob. 5.6QCh. 5 - What is an annuity?Ch. 5 - Explain the difference between an ordinary annuity...Ch. 5 - Prob. 5.9QCh. 5 - Prepare a time diagram for the present value of a...

Ch. 5 - Prepare a time diagram for the present value of a...Ch. 5 - What is a deferred annuity?Ch. 5 - Assume that you borrowed 500 from a friend and...Ch. 5 - Compute the required annual payment in Question...Ch. 5 - Explain how the time value of money concept is...Ch. 5 - Prob. 5.1BECh. 5 - Prob. 5.2BECh. 5 - Prob. 5.3BECh. 5 - Present value; single amount LO63 John has an...Ch. 5 - Present value; solving for unknown; single amount ...Ch. 5 - Future value; ordinary annuity LO66 Leslie...Ch. 5 - Future value; annuity due LO66 Refer to the...Ch. 5 - Prob. 5.8BECh. 5 - Prob. 5.9BECh. 5 - Prob. 5.10BECh. 5 - Solve for unknown; annuity LO68 Kingsley Toyota...Ch. 5 - Price of a bond LO69 On December 31, 2018,...Ch. 5 - Lease payment LO69 On September 30, 2018,...Ch. 5 - Prob. 5.1ECh. 5 - Future value; single amounts LO62 Determine the...Ch. 5 - Prob. 5.3ECh. 5 - Prob. 5.5ECh. 5 - Prob. 5.6ECh. 5 - Prob. 5.7ECh. 5 - Prob. 5.10ECh. 5 - Deferred annuities LO67 Required: Calculate the...Ch. 5 - Solving for unknowns; annuities LO68 For each of...Ch. 5 - Solving for unknown annuity amount LO68 Required:...Ch. 5 - Prob. 5.15ECh. 5 - Price of a bond LO69 On September 30, 2018, the...Ch. 5 - Price of a bond; interest expense LO69 On June...Ch. 5 - Prob. 5.18ECh. 5 - Prob. 5.19ECh. 5 - Lease payments LO69 On June 30, 2018,...Ch. 5 - Lease payments; solve for unknown interest rate ...Ch. 5 - Analysis of alternatives LO63, LO67 Esquire...Ch. 5 - Analysis of alternatives LO63, LO67 Harding...Ch. 5 - Investment analysis LO63, LO67 John Wiggins is...Ch. 5 - Prob. 5.5PCh. 5 - Prob. 5.6PCh. 5 - Deferred annuities LO67 On January 1, 2018, the...Ch. 5 - Prob. 5.8PCh. 5 - Noninterest-bearing note; annuity and lump-sum...Ch. 5 - Prob. 5.10PCh. 5 - Solving for unknown lease payment LO68, LO69...Ch. 5 - Solving for unknown lease payment; compounding...Ch. 5 - Lease v s. buy alternatives LO63, LO67, LO69...Ch. 5 - Prob. 5.14PCh. 5 - Prob. 5.15PCh. 5 - Prob. 5.1DMPCh. 5 - Prob. 5.2DMPCh. 5 - Prob. 5.3DMPCh. 5 - Prob. 5.4DMPCh. 5 - Judgment Case 65 Replacement decision LO63, LO67...Ch. 5 - Prob. 5.6DMPCh. 5 - Prob. 5.7DMP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide Solutions Pleasearrow_forwardFinancial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forward

- General Accounting Question Solution with Step by step methodarrow_forwardVal Sims is a self-employed CPA and is the sole practitioner in her tax practice. She has had several situations arise this year involving client representation, client records, and client fee arrangements. Val is concerned that her actions may be in violation of the Circular 230 regulations governing practice before the Internal Revenue Service (IRS). Indicate whether Val is in violation of the regulations for each of the actions described. 1. Howard Corporation's prior-year income tax return was prepared and filed by the company's controller. The return was audited and Howard Corporation paid the additional income taxes assessed by the IRS, including penalties and interest. Although Howard Corporation agreed with income tax assessment, it did not agree with the penalties and interest determined by the IRS. Howard Corporation engaged Val to file a refund claim in connection with the penalties and interest assessed. Val charged the client a fee based on 30 percent of the amount by…arrow_forwardHello I'm Waiting For This General Accounting Question Solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License