INTERMEDIATE ACCOUNTING ACCESS 540 DAY

10th Edition

ISBN: 9781264706327

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.13E

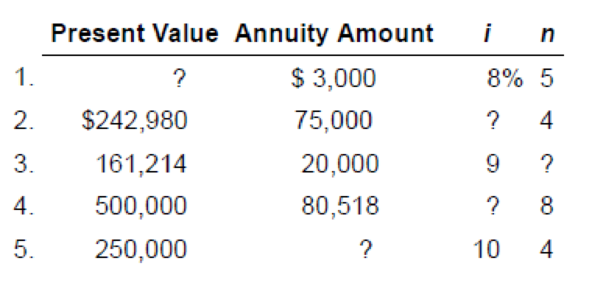

Solving for unknowns; annuities

• LO6–8

For each of the following situations involving annuities, solve for the unknown (?). Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Goodwill is an example of an indefinite-life intangible asset, meaning that public companies must test it for impairment rather than regularly amortizing to systematically reduce its value on the balance sheet of the public company.

Can anyone recap the difference between limited-life versus indefinite-life intangible assets? Any specific examples of either category?

Why are adjusting journal entries necessary at the end of an accounting period? Need he

Why are adjusting journal entries necessary at the end of an accounting period?i need help

Chapter 5 Solutions

INTERMEDIATE ACCOUNTING ACCESS 540 DAY

Ch. 5 - Prob. 5.1QCh. 5 - Explain compound interest.Ch. 5 - Prob. 5.3QCh. 5 - Prob. 5.4QCh. 5 - Prob. 5.5QCh. 5 - Prob. 5.6QCh. 5 - What is an annuity?Ch. 5 - Explain the difference between an ordinary annuity...Ch. 5 - Prob. 5.9QCh. 5 - Prepare a time diagram for the present value of a...

Ch. 5 - Prepare a time diagram for the present value of a...Ch. 5 - What is a deferred annuity?Ch. 5 - Assume that you borrowed 500 from a friend and...Ch. 5 - Compute the required annual payment in Question...Ch. 5 - Explain how the time value of money concept is...Ch. 5 - Prob. 5.1BECh. 5 - Prob. 5.2BECh. 5 - Prob. 5.3BECh. 5 - Present value; single amount LO63 John has an...Ch. 5 - Present value; solving for unknown; single amount ...Ch. 5 - Future value; ordinary annuity LO66 Leslie...Ch. 5 - Future value; annuity due LO66 Refer to the...Ch. 5 - Prob. 5.8BECh. 5 - Prob. 5.9BECh. 5 - Prob. 5.10BECh. 5 - Solve for unknown; annuity LO68 Kingsley Toyota...Ch. 5 - Price of a bond LO69 On December 31, 2018,...Ch. 5 - Lease payment LO69 On September 30, 2018,...Ch. 5 - Prob. 5.1ECh. 5 - Future value; single amounts LO62 Determine the...Ch. 5 - Prob. 5.3ECh. 5 - Prob. 5.5ECh. 5 - Prob. 5.6ECh. 5 - Prob. 5.7ECh. 5 - Prob. 5.10ECh. 5 - Deferred annuities LO67 Required: Calculate the...Ch. 5 - Solving for unknowns; annuities LO68 For each of...Ch. 5 - Solving for unknown annuity amount LO68 Required:...Ch. 5 - Prob. 5.15ECh. 5 - Price of a bond LO69 On September 30, 2018, the...Ch. 5 - Price of a bond; interest expense LO69 On June...Ch. 5 - Prob. 5.18ECh. 5 - Prob. 5.19ECh. 5 - Lease payments LO69 On June 30, 2018,...Ch. 5 - Lease payments; solve for unknown interest rate ...Ch. 5 - Analysis of alternatives LO63, LO67 Esquire...Ch. 5 - Analysis of alternatives LO63, LO67 Harding...Ch. 5 - Investment analysis LO63, LO67 John Wiggins is...Ch. 5 - Prob. 5.5PCh. 5 - Prob. 5.6PCh. 5 - Deferred annuities LO67 On January 1, 2018, the...Ch. 5 - Prob. 5.8PCh. 5 - Noninterest-bearing note; annuity and lump-sum...Ch. 5 - Prob. 5.10PCh. 5 - Solving for unknown lease payment LO68, LO69...Ch. 5 - Solving for unknown lease payment; compounding...Ch. 5 - Lease v s. buy alternatives LO63, LO67, LO69...Ch. 5 - Prob. 5.14PCh. 5 - Prob. 5.15PCh. 5 - Prob. 5.1DMPCh. 5 - Prob. 5.2DMPCh. 5 - Prob. 5.3DMPCh. 5 - Prob. 5.4DMPCh. 5 - Judgment Case 65 Replacement decision LO63, LO67...Ch. 5 - Prob. 5.6DMPCh. 5 - Prob. 5.7DMP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Calculate The Present Value of an Annuity; Author: The Organic Chemistry Tutor;https://www.youtube.com/watch?v=RU-osjAs6hE;License: Standard Youtube License