Concept explainers

Posting a purchases journal

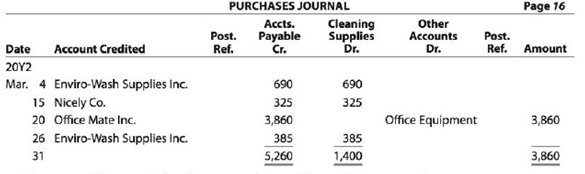

The purchases journal for Newmark Exterior Cleaners Inc. follows. The accounts payable account has a March 1, 20Y2, balance of $580 for an amount owed to Nicely Co. No payments were made on creditor invoices during March.

a. Prepare a T account for the accounts payable creditor accounts.

b. Post the transactions from the purchases journal to the creditor accounts and determine their ending balances.

c. Prepare T accounts for the accounts payable control and cleaning supplies accounts. Post control totals to the two accounts, and determine their ending balances. Cleaning Supplies had a zero balance at the beginning of the month.

d. Prepare a schedule of the creditor account balances to verify the equality of the sum of the accounts payable creditor balances and the accounts payable controlling account balance.

c. How might a computerized accounting system differ from the use of a purchases journal in recording purchase transactions?

Trending nowThis is a popular solution!

Chapter 5 Solutions

CENGAGENOW 6 TERMS ACCESS CARD 27TH ED.

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning