Concept explainers

1.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the

To calculate: Cost assigned to ending inventory and cost of goods sold using FIFO method.

1.

Answer to Problem 4PSB

Cost of goods available for is $249,300 and number of units available for sale is 680

Explanation of Solution

Cost of goods available for sale and number of units available for sale is as follows:

| Date | Particular | Units | Per unit cost | Total cost |

| 1st May | Opening inventory | 150 | 300 | 45000 |

| 6th May | Purchase | 350 | 350 | 122500 |

| 17th May | Purchase | 80 | 450 | 36000 |

| 25th May | purchase | 100 | 458 | 45800 |

| Total | 680 | 249,300 | ||

Thus, cost of goods available for is $249,300 and number of units available for sale is 680

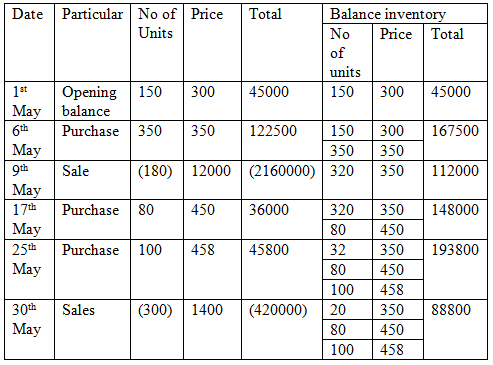

Thus the cost assigned to ending inventory under FIFO method is $88800.

2.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To calculate: Cost assigned to ending inventory and cost of goods sold using FIFO method.

2.

Answer to Problem 4PSB

The number of units in ending inventory is 200 units

Explanation of Solution

The number of units in closing inventory is as follows:

The number of units in ending inventory is 200 units

3.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: Cost assigned to ending inventory and cost of goods sold using LIFO method.

3.

Answer to Problem 4PSB

Cost assigned to ending inventory under FIFO method is $88800, under LIFO method is $62500, using weighted average method is $75600, using specific identification method is $$74,500

Explanation of Solution

- Cost assigned under FIFO method:

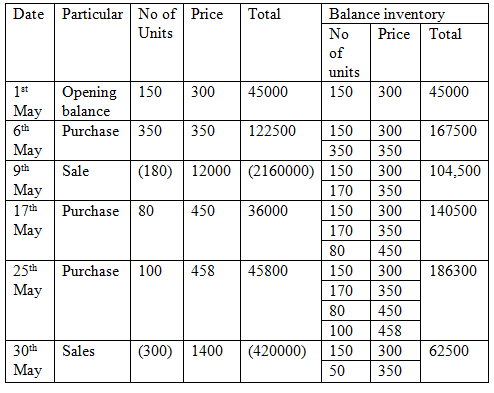

- LIFO method:

Thus the cost assigned to ending inventory under FIFO method is $88800.

Thus the cost assigned to ending inventory under LIFO method is $62500.

- Calculating the assigned amount of ending inventory according to weighted average method:

- Cost assigned to total inventory using specific identification method:

| Date | Particular | Unit | Cost per unit | Total | Balance inventory | ||

| Units | Cost per unit | Total cost | |||||

| 1st May | Opening balance | 150 | 300 | 45000 | 150 | 300 | 45000 |

| 6th may | Purchase | 350 | 350 | 122500 | 500 | 335 | 167500 |

| 9th may | Sales | 180 | 335 | 60300 | 320 | 335 | 107200 |

| 17th may | Purchase | 80 | 450 | 3600 | 400 | 358 | 143200 |

| 25th may | Purchase | 100 | 458 | 45800 | 500 | 378 | 189000 |

| 30th may | Sales | 300 | 378 | 113400 | 200 | 378 | 75600 |

Thus, cost assigned to ending inventory using weighted average method is $75600

Using specific identification method closing inventory will consist

| Particular | Units | Per unit ($) | Amount ($) |

| Opening Inventory | 70 | 300 | 21000 |

| 6th May | 50 | 350 | 17500 |

| 17th May | 80 | 450 | 36000 |

| Total | $74,500 |

Thus, cost assigned to ending inventory using specific identification method is $$74,500

4.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The gross profit earn by the company is cost assigned to ending inventory for the company A using FIFO,LIFO and weighted average and specific identification.

4.

Answer to Problem 4PSB

Gross using FIFO methods is $636000 , using LIFO method is $449200, using weighted average method is $460024, and specific identification method is $461200.

Explanation of Solution

Gross profit earn by the company:

Cost of Goods sold:

For FIFO method

For LIFO methods

For weighted average method:

For specific identification:

| Particular | FIFO method | LIFO method | Weighted average method | Specific identification method |

| Total Sales | $636000 | $636000 | $636000 | $636000 |

| Cost of goods sold | $160500 | $186800 | $173700 | $174800 |

| Total | $475,500 | $449200 | $462300 | $461200 |

Thus, gross using FIFO methods is $636000 , using LIFO method is $449200, using the weighted average method is $460024, and specific identification method is $461200.

5.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The gross profit earn by the company is cost assigned to ending inventory for the company A using FIFO,LIFO and weighted average and specific identification.

5.

Answer to Problem 4PSB

The manager will prefer FIFO method for costing inventory as gross profit is highest in FIFO method so using this method manager will earn more bonuses.

Explanation of Solution

FIFO method yield $475,500 gross profit which highest among other methods. So, the manager will prefer FIFO method for costing inventory as gross profit is highest in the FIFO method so using this method manager will earn more bonuses.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting: Information for Decisions

- A business had: • Assets on Dec 31, Year 1: $820,000 • Liabilities on Dec 31, Year 1: $310,000 • Owner investments in Year 2: $45,000 Dividends paid in Year 2: $25,000 • Assets on Dec 31, Year 2: $870,000 • Liabilities on Dec 31, Year 2: $290,000 What is net income for Year 2?arrow_forwardWHICH OF THE FOLLOWING IS AN EXAMPLE OF A LABOR COST STANDARD? A. $40 PER DIRECT LABOR HOUR B. 50 SQUARE FEET PER UNIT C. $0.95 PER SQUARE FOOT D. 0.5 DIRECT LABOR HOURS PER UNITarrow_forwardAlpine Tech Corporation has a marginal tax rate of 40% and an average tax rate of 25%. If the company earns $120,000 in taxable income, how much will it owe in taxes? a. $30,000 b. $35,000 c. $40,000 d. $48,000arrow_forward

- What is the effective rate of interest if the loan is discounted ? accountingarrow_forwardWhat amount of indirect cost would be assigned if services to a project required $40,000 ofarrow_forwardPlease given correct answer for Financial accounting question I need step by step explanationarrow_forward

- I want to this question answer for General accounting question not need ai solutionarrow_forwardAccountingarrow_forwardOrion Co. produced 200,000 units in December with maintenance costs of $160,000, and 100,000 units in May with costs of $100,000. Estimate the maintenance cost if Orion produces 150,000 units in a given month.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub