Borealis Manufacturing has just completed a major change in its quality control (QC) process. Previously, products had been reviewed by QC inspectors at the end of each major process, and the company’s 10 QC inspectors were charged as direct labor to the operation or job. In an effort to improve efficiency and quality, a computerized video QC system was purchased for $250,000. The system consists of a minicomputer, 15 video cameras, other peripheral hardware, and software. The new system uses cameras stationed by QC engineers at key points in the production process. Each times an operation changes or there is a new operation, the cameras are moved, and a new master picture is loaded into the computer by a QC engineer. The camera takes pictures of the units in process, and the computer compares them to the picture of a “good” unit. Any differences are sent to a QC engineer, who removes the bad units and discusses the flaws with the production supervisors. The new system has replaced the 10 QC inspectors with two QC engineers.

The operating costs of the new QC system, including the salaries of the QC engineers, have been included as factory

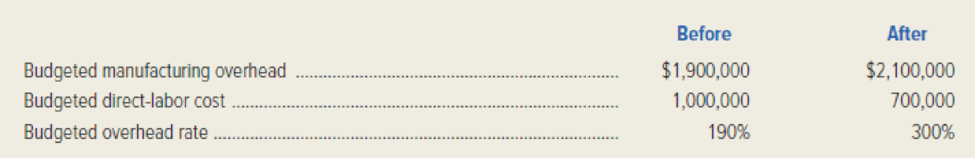

“Three hundred percent,” lamented the president. “How can we compete with such a high overhead rate?”

Required:

- 1. a.

Define “manufacturing overhead.” and cite three examples of typical costs that would be included in manufacturing overhead.

b. Explain why companies develop predetermined overhead rates.

- 2. Explain why the increase in the overhead rate should not have a negative financial impact on Borealis Manufacturing.

- 3. Explain how Borealis Manufacturing could change its overhead application system to eliminate confusion over product costs.

- 4. Discuss how an activity-based costing system might benefit Borealis Manufacturing.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

MANAGERIAL ACCOUNTING-CUSTOM EBOOK>I<

- On the basis of the following data, what is the estimated cost of the inventory on May 31 using the retail method? Date Line Item Description Cost Retail May 1 Inventory $23,800 $39,670 May 1-31 Purchases 42,600 67,540 May 1-31 Sales 91,090 a. $24,690 b. $19,580 c. $29,564 d. $9,984arrow_forward00000000 The following lots of Commodity Z were available for sale during the year. Line Item Description Units and Cost Beginning inventory 12 units at $48 First purchase 15 units at $53 Second purchase 55 units at $56 Third purchase 13 units at $61 The firm uses the periodic inventory system, and there are 25 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using LIFO? a. $1,465 b. $1,265 c. $5,244 d. $1,200arrow_forwardBeginning inventory 8 units at $51 First purchase 17 units at $55 Second purchase 26 units at $58 Third purchase 15 units at $63 The firm uses the periodic inventory system, and there are 23 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using FIFO? a. $1,173 b. $1,409 c. $3,773 d. $3,796arrow_forward

- 00000arrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 4 Sold 19 units at $23 8 units 10 Purchased 32 units at $21 25 units 17 Sold 30 Purchased 21 units at $23 Using a perpetual system, what is the cost of goods sold for November if the company uses LIFO? a. $731 b. $861 c. $962 Od. $709arrow_forwardI got the 3rd incorrect. can you help me go step by step. Date Line Item Description Units and Cost Amount Mar. 1 Inventory 21 units @ $31 $651 June 16 Purchase 29 units @ $33 957 Nov. 28 Purchase 39 units @ $39 1,521 Total 89 units $3,129 There are 13 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the inventory cost using the weighted average cost methods. $arrow_forward

- 3arrow_forwardBoxwood Company sells blankets for $31 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date Blankets Units Cost May 3 Purchase 8 $15 10 Sale 5 17 Purchase 10 $18 20 Sale 7 23 Sale 2 30 Purchase 12 $19 Determine the cost of goods sold for the sale of May 20 using the FIFO inventory costing method. a. $201 b. $114 c. $117 O d. $171arrow_forwardIn the month of March, Horizon Textiles Ltd. had 7,500 units in beginning work in process that were 65% complete. During March, 29,500 units were transferred into production from another department. At the end of March, there were 3,800 units in ending work in process that were 40% complete. Compute the equivalent units of production for materials and conversion costs using the weighted-average method.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub