a.

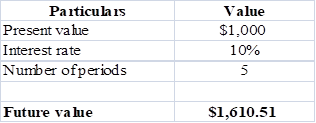

To calculate: Future value of $1,000 after 5 years at 10% annual interest rate.

Introduction:

a.

Explanation of Solution

Calculation in spreadsheet by “FV” formula,

Table (1)

Steps required to calculate

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $1,610.50.

Future value of $1,000 is $1,610.51.

b.

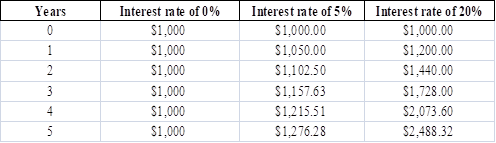

To calculate: Investments future value at 0%,5% and 20% rate after 0,1,2,3,4 and 5 years.

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

b.

Explanation of Solution

Calculation spreadsheet by “FV” formula,

Table (2)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in required field.

Investment future values are different for the different years with 0%, 5% and 20% interest rate.

c.

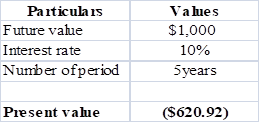

To calculate: Present value due of $1,000 in 5 years at the discount rate of 10%.

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

c.

Explanation of Solution

Calculation in spreadsheet by “PV” formula,

Table (3)

Steps required to calculate present value by using “PV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $620.92.

Present value of $1,000 is $620.92 at 10 % discount rate.

d.

To calculate:

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

d.

Explanation of Solution

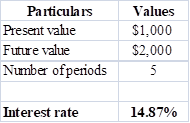

Calculationin spreadsheet by “RATE” formula,

Table (4)

Steps required to calculate present value by using “RATE” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “RATE” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is 14.87%

The rate of return is14.87%.

e.

To calculate: Time taken by 36.5 million populations to double with annual growth rate of 2%

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

e.

Explanation of Solution

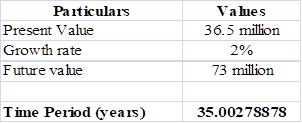

Calculation is solved in spreadsheet by “NPER” formula

Table (5)

Steps required to calculate present value by using “NPER” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “NPER” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is 35 years.

Conclusion:

It will take 35 years to double the population from 36.5 million to 73 million.

f.

To calculate: Present and future value of

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

f.

Explanation of Solution

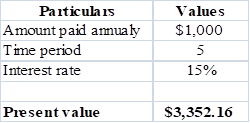

Calculation in spreadsheet by “PV” formula,

Table (6)

Steps required to calculate present value by using “PV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $3,352.16.

So, the present value is $3,352.16.

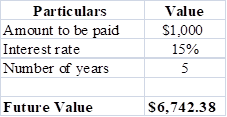

Calculation of future value of

Table (7)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $6,742.38.

So the future value is $6,742.38.

Present value is $3,352.16 and future value is $6,742.38 of

g.

To calculate: Present and future value of part ‘f’ if the

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

g.

Explanation of Solution

Calculation in spreadsheet by “PV” function,

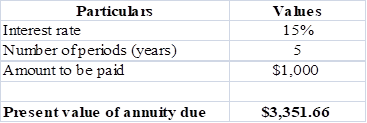

Table (8)

Steps required to calculate present value by using “PV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $3,351.66.

Present value of

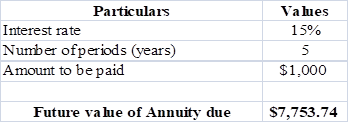

Future value of annuity in spreadsheet by “FV” function,

Table (9)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $7,753.74

Future value of annuity due is $7,753.74.

Present value of

h.

To calculate: Present and future value for $1,000, due in 5 years with 10% semiannual compounding.

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

h.

Explanation of Solution

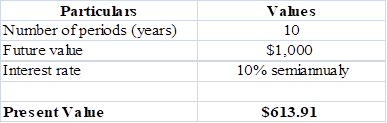

Calculation in spreadsheet by “PV” formula,

Table (10)

Steps required to calculate present value by using “PV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $613.91.

Present value is $613.91.

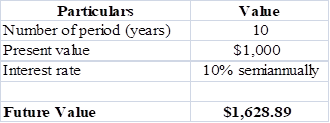

Calculation in spreadsheet by “FV” formula,

Table (11)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $1,628.89.

Future value of

Present andfuture value for $1,000, due in 5 years with 10% semiannual compoundingwill be $613.91 and $1,628.89, respectively.

i.

To calculate: Annual payments for an ordinary

Introduction:

Time Value of Money: It is a vital concept to the investors, as it suggests them the money they are having today is worth more than the value promised in the future.

i.

Explanation of Solution

Calculation in spreadsheet by “PMT” formula,

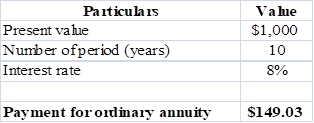

Table (12)

Steps required to calculate present value by using “PMT” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PMT” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $1,628.89.

Payment of ordinary

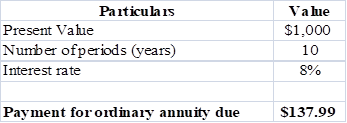

Calculation in spreadsheet by “PMT” formula,

Table (13)

Steps required to calculate present value by using “PMT” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PMT” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $1,628.89.

Payment of ordinary annuity due is $137.99.

Annual payments are$149.03 for an ordinary

j.

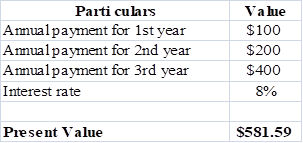

To calculate: Present value and future value of an investment that pays 8% annually and makes the year end payments of $100, $200,$300.

j.

Explanation of Solution

Calculation in spreadsheet by “

Table (14)

Steps required to calculate present value by using “NPV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “NPV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $581.59.

Present value is $581.59.

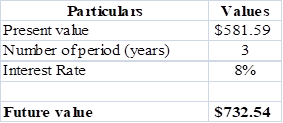

Calculation in spreadsheet by “FV” formula,

Table (15)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

- Final answer will be shown by the formula that is $732.54.

Future value is $732.54.

Present value is $581.89 while future value is $732.54.

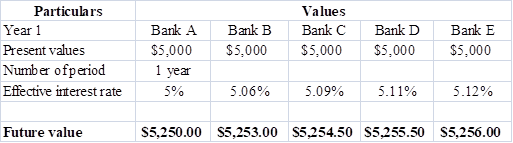

k.1.

To calculate: Effective annual rate each bank pays and the future value of $5,000 at the end of 1 and 2 year.

k.1.

Explanation of Solution

Given for Bank A,

Nominal interest rate is 5%.

Compounding is annual.

Formula to calculate effective annual rate is,

Where,

- EFF is the effective annual rate.

- INOM is the nominal interest rate.

- M is the compounding period.

Substitute 5% for INOM and 1 for M.

So, effective annual rate for Bank A is 5%.

Given for Bank B,

Nominal interest rate is 5%.

Compounding is semiannual.

Formula to calculate effective annual rate is,

Where,

- EFF is the effective annual rate.

- INOM is the nominal interest rate.

- M is the compounding period.

Substitute 5% for INOM and 2 for M.

So,effective annual rate for Bank B is 5.06%.

Given for Bank C,

Nominal interest rate is 5%.

Compounding is quarterly.

Formula to calculate effective annual rate is,

Where,

- EFF is the effective annual rate.

- INOM is the nominal interest rate.

- M is the compounding period.

Substitute 5% for INOM and 4 for M.

So, effective annual rate for Bank C is 5.09%.

Given for Bank D,

Nominal interest rate is 5%.

Compounding ismonthly.

Formula to calculate effective annual rate is,

Where,

- EFF is the effective annual rate.

- INOM is the nominal interest rate.

- M is the compounding period.

Substitute 5% for INOM and 12 for M.

So, effective annual rate for Bank D is 5.11%.

Given for Bank E,

Nominal interest rate is 5%.

Compounding is daily.

Formula to calculate effective annual rate is,

Where,

- EFF is the effective annual rate.

- INOM is the nominal interest rate.

- M is the compounding period.

Substitute 5% for INOM and 365 for M.

So, effective annual rate for Bank E is 5.12%.

Calculation of future value in spreadsheet by “FV” formula,

Table (16)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

So, the future value at different effective rate after a year are $5, 250, $5,253,$5,254.50, $5,255.50 and $5,256.

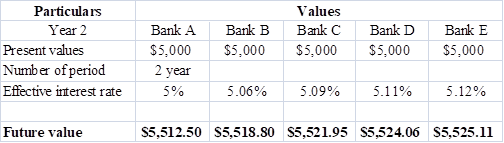

Calculation of future value in spreadsheet by “FV” formula,

Table (17)

Steps required to calculate present value by using “FV” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “FV” and then press OK.

- A window will pop up.

- Input data in the required field.

So, the future value at different effective rate after a year are $5, 512, $5,518.80, $5,521.95, $5,524.06 and $5,525.11.

Each bank pays different effective rate as there compounding is different, the rates are5% for bank A, 5.06% Bank B, 5.09% Bank C, 5.11% Bank D, 5.12% Bank E, also the future values also change on the basis of their number of periods.

2.

To explain: If banks are insured by the government and are equally risky, will they be equally able to attract funds and at what nominal rate all banks provide equal effective rate as Bank A.

2.

Answer to Problem 41SP

No, it is not possible for the banks to equally attract funds.

The nominal rate which causes same effective rate for all banks are,

| Particulars | A | B | C | D | E |

| Nominalrate | 5% | 5.06% | 5.09% | 5.11% | 5.12% |

Table (18)

Explanation of Solution

- Bank will not be equally able to attract funds because of compounding, as people prefer to invest in that bank which have more frequent compounding in comparison to the bank which have lesser frequent compounding.

- Nominal rate is opposite of the effective rate which is calculated in part ‘1’. The nominal rate indicated in above table will cause same effective rate for all banks as it is for A bank.

Due to frequent compounding, banks will not be able to equally attract funds and the nominal rate will be 5% for Bank A, 5.06% Bank B, 5.09% Bank C, 5.11% Bank D, 5.12% Bank E.

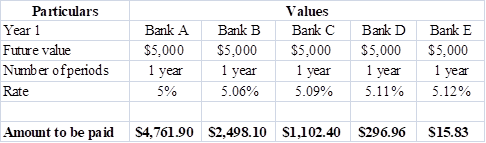

3.

To calculate: Present value of amount to get $5,000 after 1 year.

3.

Explanation of Solution

Calculation of payment to be made in spreadsheet by “PMT” formula,

Table (19)

Steps required to calculate present value by using “PMT” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PMT” and then press OK.

- A window will pop up.

- Input data in the required field.

So, the amounts to be paid are$4,761.90,$2498.10,$1,102.40,$296.96 and $15.83.

4.

To explain: If all banks are providing a same effective interest rate would rational investor be indifferent between the banks.

4.

Answer to Problem 41SP

Yes, a rational investor would be indifferent between the banks.

Explanation of Solution

Rational investor chooses the bank which will provide him better return so he would be indifferent, if all the banks are giving same effective rate because he chooses the bank which will have more frequent compounding than others.

A bank offers frequent compounding is able to attract more number of customers than others.

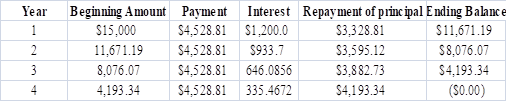

To prepare: Amortization schedule to show annual payments, interest payments, principal payments, and beginning and ending loan balances.

Amortization:

Amotization means to write off or pay the debt over the priod of time it can be for loan or intangible assets. Its main purpose is to get cost recovery. Example of amortization is ,an automobile company that spent $20 million dollars on a design patent with a useful life of 20 years. The amortization value for that company will be $1 million each year.

Explanation of Solution

Calculation of annual installment is done by using “PMT” formula in spreadsheet at the amortization schedule.

Amortization schedule is prepared below,

Table (20)

Steps required to calculate present value by using “PMT” function in excel are given,

- Select ‘Formulas’ option from Menu Bar of Excel sheet.

- Select insert Function that is (fx).

- Choose category of Financial.

- Then select “PMT” and then press OK.

- A window will pop up.

- Input data in the required field.

Amortization schedule represents annual payments, interest payments, principal payments, and beginning and ending loan balances.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

- John and Jane Doe, a married couple filing jointly, have provided you with their financial information for the year, including details of federal income tax withheld. They need assistance in preparing their tax return. W-2 Income: John earns $150,000 with $35,000 withheld for federal income tax. Jane earns $85,000 with $15,500 withheld for federal income tax. Interest Income: They received $2500 in interest from a savings account, with no tax withheld. Child Tax Credit: They have two children under the age of 17. Mortgage Interest: Paid $28,000 in mortgage interest on their primary residence. Property Taxes: Paid $4,800 in property taxes on their primary residence. Charitable Donations: Donated $22,000 to qualifying charitable organizations. Other Deductions: They have no other deductions to claim. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, and Schedule B in preparation of their tax file.arrow_forwardOn the issue date, you bought a 20-year maturity, 5.85% semi-annual coupon bond. The bond then sold at YTM of 6.25%. Now, 5 years later, the similar bond sells at YTM of 5.25%. If you hold the bond now, what is your realized rate of return for the 5-year holding period?arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 11% coupon rate, payable semiannually. The bonds mature in 17 years, have a face value of $1,000, and a yield to maturity of 9.5%. What is the price of the bonds? Round your answer to the nearest cent.arrow_forward

- analyze at least three financial banking products from both the liability side (like time deposits, fixed income, stocks, structure products, etc). You will need to examine aspects such as liquidity, risk, and profitability from a company and an individual point of view.arrow_forwardHow a does researcher ensure that consulting recommendations are data-driven? What does make it effective, and sustainable? Please help explain and give the example How does DMAC help researchers to improve their business processes? How to establish feedback loops for ongoing refinement. Please give the examplesarrow_forwardDon't used hand raiting and don't used Ai solutionarrow_forward

- Explain what the business model of payday lenders, title pawn lenders, and “credit approved” used car dealers.arrow_forwardThe current NPV of a $30 million bond with 9% interest, 8% coupon rate, and discounted at $95arrow_forwardCould you please help to explain the DMAIC phases and how a researcher would use them to conduct a consulting project? What is a measure process performance and how to analyze the process? What is an improve process performance and how the control improves process and future process performance?arrow_forward

- Consider the two stocks below. Graph the frontier of combinations of the two stocks. Show the effect on the frontier of varying the correlation from −1 to +1. 1 2 3 Mean A B C D TWO STOCKS Varying the correlation coefficient Stock A Stock B 3.00% 8.00% 4 Sigma 15.00% 22.00% 5 Correlation 0.3000 Farrow_forwardLindsay is 30 years old and has a new job in web development. She wants to make sure that she is financially sound by the age of 55, so she plans to invest the same amount into a retirement account at the end of every year for the next 25 years. (a) Construct a data table in Excel that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $10,000 at return of 6%, what would be the balance at the end of the 25th year? Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. Round your answer to a whole dollar amount. $ (b) Develop a two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. From the 2-way table, what are the minimum annual investments Lindsay must contribute for annual rates ranging from 6% to 11%, if she wants to…arrow_forwardDoes Airbnb have any impaired assets? If so, what are they?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education