Concept explainers

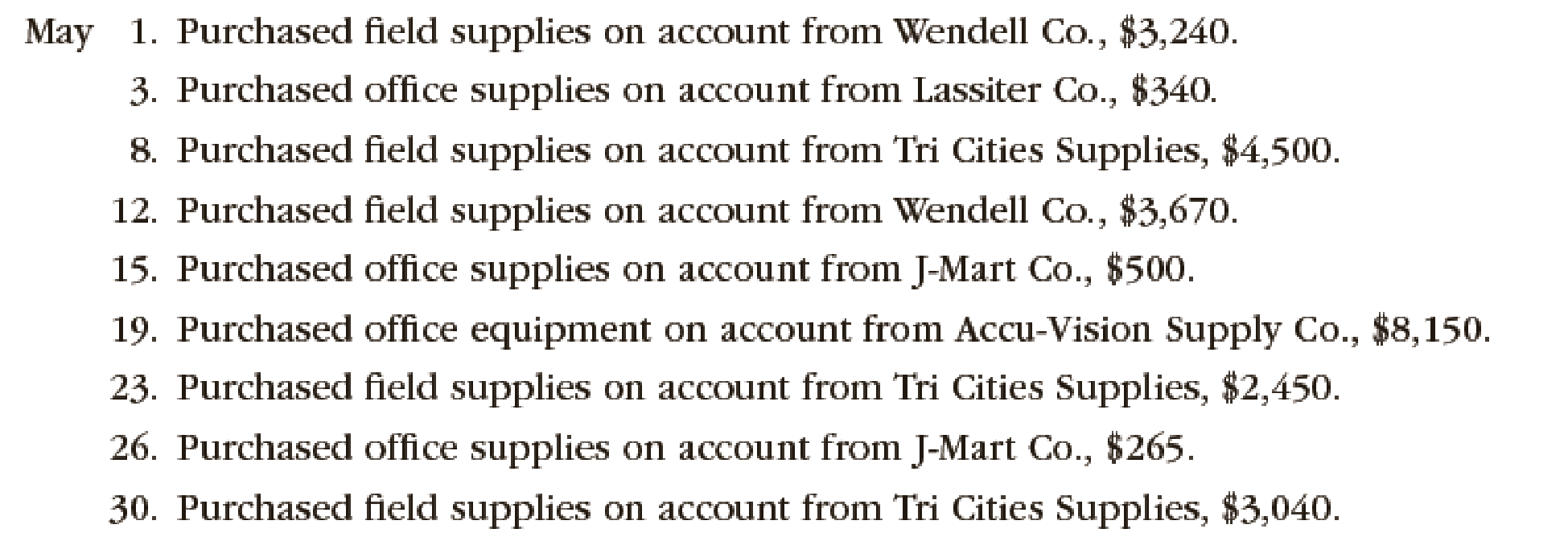

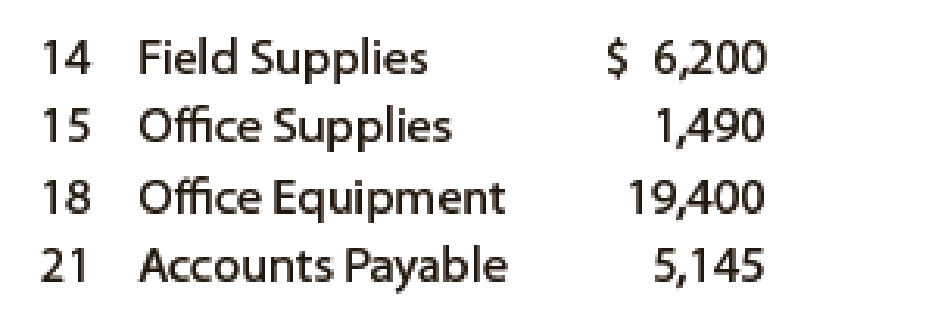

Plumb Line Surveyors provides survey work for construction projects. The office staff use office supplies, while surveying crews use field supplies. Purchases on account completed by Plumb Line Surveyors during May are as follows:

Instructions

- 1. Insert the following balances in the general ledger as of May 1:

- 2. Insert the following balances in the accounts payable subsidiary ledger as of May 1:

- 3. Journalize the transactions for May, using a purchases journal (p. 30) similar to the one illustrated in this chapter. Prepare the purchases journal with columns for Accounts Payable, Field Supplies, Office Supplies, and Other Accounts. Post to the creditor accounts in the accounts payable subsidiary ledger immediately after each entry.

- 4. Post the purchases journal to the accounts in the general ledger.

- 5. a. What is the sum of the creditor balances in the subsidiary ledger at May 31?

b. What is the balance of the accounts payable controlling account at May 31?

- 6. What type of e-commerce application would be used to plan and coordinate transactions with suppliers?

(1)

Record the transactions in general ledger.

Answer to Problem 3PB

The balances of different accounts are posted in the general ledger of PLS.

General Ledger

| Field Supplies | Account Number 14 | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| May | 1 | Balance | 6,200 | ||||

| 31 | P30 | 16,900 | 23,100 | ||||

Table (1)

Explanation of Solution

General Journal: It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount. It has two columns i.e. Debit column and Credit column.

Special Journal: Special journal records a single kind of transactions that occurs frequently. For example: Revenue Journal is a special journal which records all revenue earned on account.

General ledger: It is the primary ledger, which contains all balance sheet and income statement accounts. For example: Cash Account, Equipment Accounts, and Rent Accounts etc.

Subsidiary ledger: A large number of individual accounts with a common characteristic can be grouped together in a separate ledger called subsidiary ledger. For example: Accounts Receivable subsidiary ledger or customer ledger.

Controlling Account: Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. For example: Accounts Receivable Subsidiary ledger is represented in Accounts Receivable ledger.

Field supplies are assets for the business, so the balance is posted in the debit column.

| Account: Office Supplies | Account Number 15 | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| May | 1 | Balance | 1,490 | ||||

| 31 | P30 | 1,105 | 2,595 | ||||

Table (2)

Office supplies are assets for the business, so the balance is posted in the debit column.

| Account: Office Equipment | Account Number 18 | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| May | 1 | Balance | 19,400 | ||||

| 5 | P30 | 8,150 | 27,550 | ||||

Table (3)

Office equipment is an asset for the business, so the balance is posted in the debit column.

| Account: Accounts Payable | Account Number 21 | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| May | 1 | Balance | 5,145 | ||||

| 31 | P30 | 26,155 | 31,300 | ||||

Table (4)

Accounts payable is liability for the business, so the balance is posted in the credit column.

(2) and (3)

Record the balances in the accounts payable subsidiary ledger and the transactions for October in journal.

Answer to Problem 3PB

The balances in the accounts payable subsidiary ledger and the transactions for October in journal are recorded.

Accounts Payable Subsidiary Ledger

| Name: AVS Co. | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| May. | 1 | Balance | 3,900 | |||

| 19 | P30 | 8,150 | 12,050 | |||

Table (5)

| Name: JM Co. | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| May. | 1 | Balance | 730 | |||

| 15 | P30 | 500 | 1,230 | |||

| 26 | P30 | 265 | 1,495 | |||

Table (6)

| Name: L Co. | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| May. | 1 | Balance | 515 | |||

| 3 | P30 | 340 | 855 | |||

Table (7)

| Name: TS Co. | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| May. | 8 | P30 | 4,500 | 4,500 | ||

| 23 | P30 | 2,450 | 6,950 | |||

| 30 | P30 | 3,040 | 9,990 | |||

Table (8)

| Name: W Co. | ||||||

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| May. | 1 | P30 | 3,240 | 3,240 | ||

| 12 | P30 | 3,670 | 6,910 | |||

Table (9)

Explanation of Solution

The above transactions were transacted on account. Hence they are posted in the account payable subsidiary ledger of AVS, JM, L, TS, and W Company.

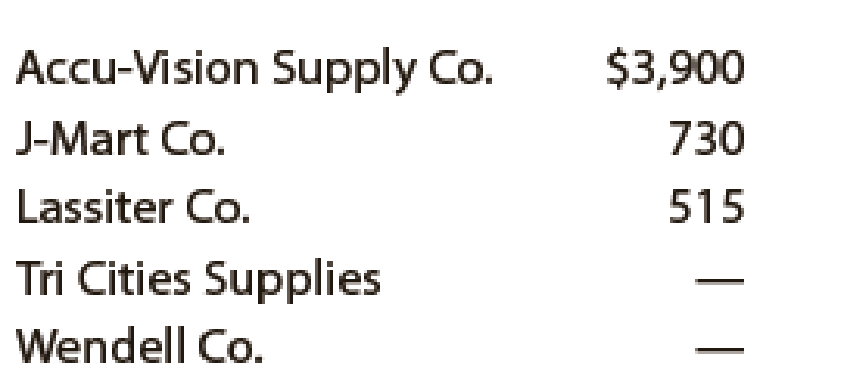

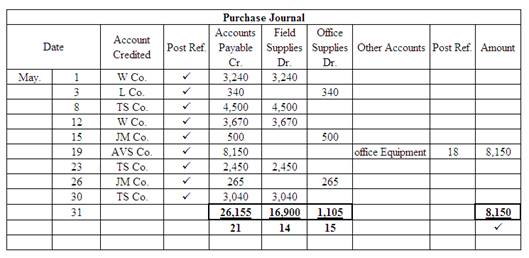

(3) and (4)

Prepare the purchase journal.

Answer to Problem 3PB

The purchase journal of PLS Company for the month of May is as follows:

Figure (1)

Explanation of Solution

All the purchase transactions which are on account for the month of May are recorded in the Purchase journal.

(5)

a.

Determine the sum of the balances of the creditors accounts in the subsidiary ledger at 31st May.

Answer to Problem 3PB

The sum of balances of creditors’ accounts in subsidiary ledger accounts is shown in the following table.

| Creditors | Amount |

| AVS Co. | $12,050 |

| JM Co. | $1,495 |

| L Co. | $855 |

| TS Co. | $9,990 |

| W Co. | $6,910 |

| Total | $31,300 |

Table (10)

Explanation of Solution

The sum of balances of creditors’ accounts in subsidiary ledger accounts is calculated by adding the balances of creditors’ accounts.

b.

Determine the balance of the accounts receivable controlling account.

Answer to Problem 3PB

The balance of the accounts payable controlling account is 31,300.

Explanation of Solution

Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. Since the balance of accounts payable ledger is 31,300, so the balance of the accounts payable controlling account is 31,300.

(6)

Indicate the type of e-commerce application would be used to plan and coordinate transactions with suppliers.

Explanation of Solution

The type of e-commerce application would be used to plan and coordinate transactions with suppliers is the Supply Chain Management (SCM). It is an internet application to plan supply needs and coordinate with suppliers.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL ACCOUNTING

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning