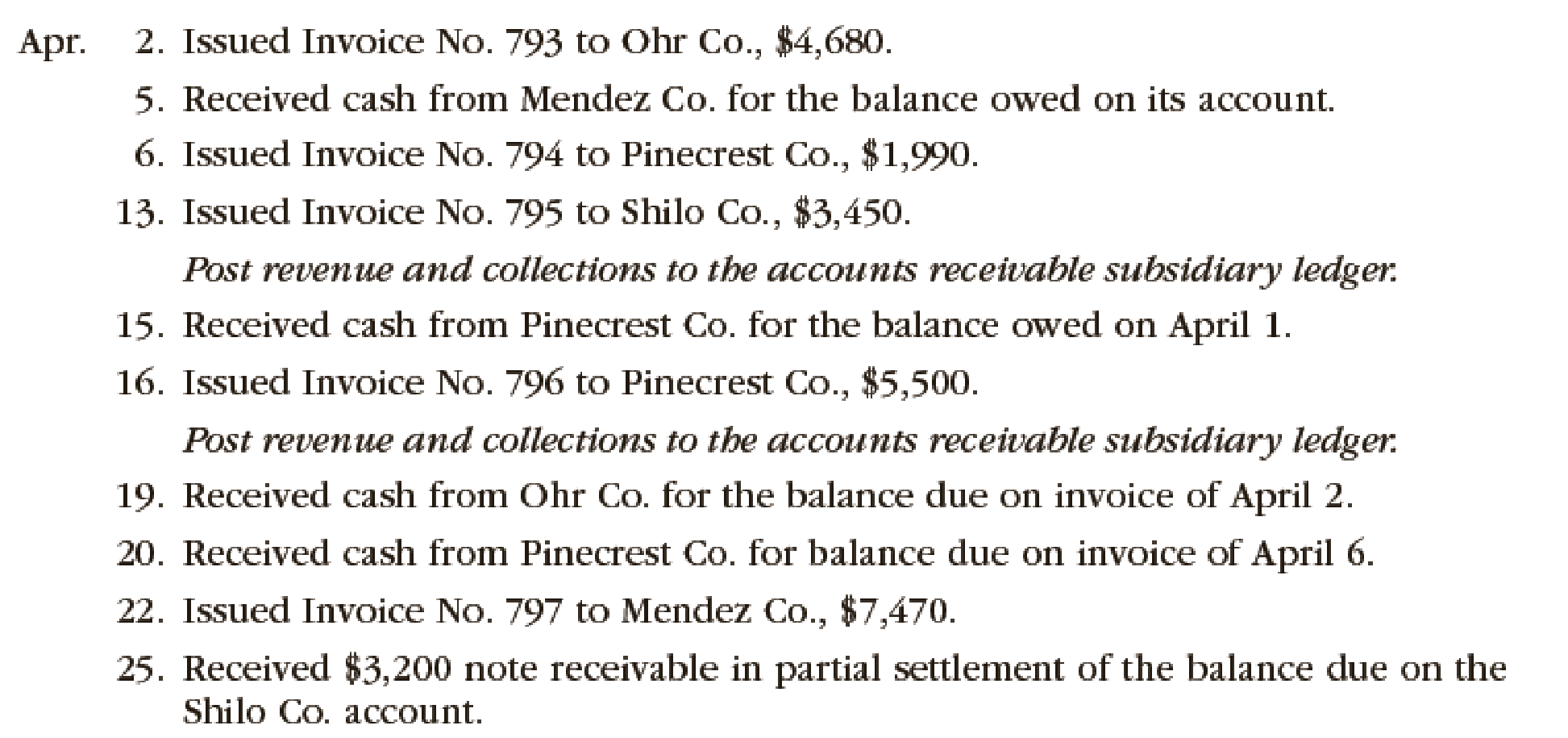

Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period April 2–30 are as follows:

Post revenue and collections to the

Instructions

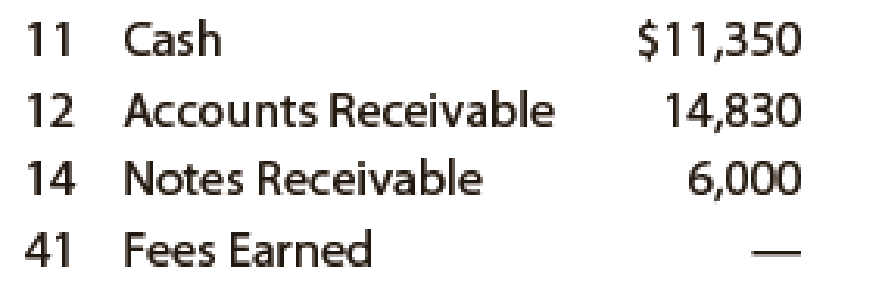

- 1. Insert the following balances in the general ledger as of April 1:

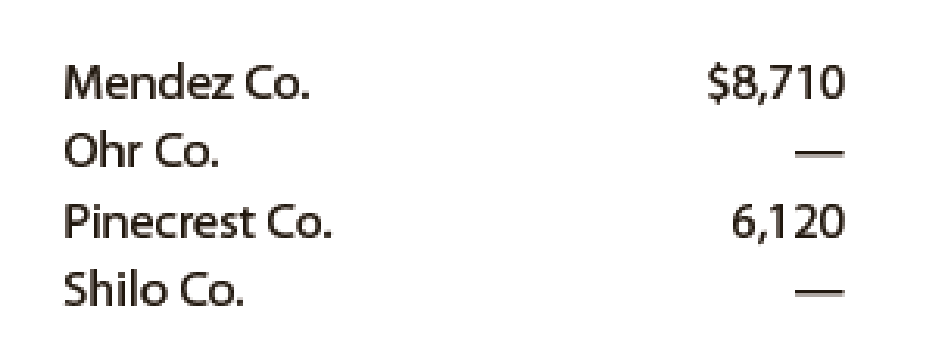

- 2. Insert the following balances in the accounts receivable subsidiary ledger as of April 1:

- 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark (✓) in the Post. Ref. column when recording cash fees.

- 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for April. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customer’s account before recording a cash receipt.

- 5. Total each of the columns of the special journals and

post the individual entries and totals to the general ledger. Insert account balances after the last posting. - 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger.

- 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable?

1. and 5.

Prepare general ledger for given accounts.

Explanation of Solution

General Ledger: General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts receivable subsidiary ledger: Account receivable subsidiary ledger is the ledger which is used to post the customer transaction in one particular ledger account. It helps the business to locate the error in the customer ledger balance. After all transactions are posted, the balances in the accounts receivable subsidiary ledger should be totaled, and compared with the balance in the general ledger of accounts receivable. If both the balance does not agree, the error has to be located and corrected.

Revenue journal: Revenue journal refers to the journal that is used to record the fees earned on account. In the revenue journal, all revenue transactions are recorded only when the business renders service to customer on account (credit).

Cash receipts journal:Cash receipts journal refers to the journal that is used to record all the transaction that involves cash receipts. For example, the business received cash from customer (service performed in cash).

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 11,350 | |||

| 30 | CR36 | 34,390 | 45,740 | ||||

Table (1)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 14,830 | |||

| 25 | J1 | 3,200 | 11,630 | ||||

| 30 | R40 | 23,090 | 34,720 | ||||

| 30 | CR36 | 21,500 | 13,220 | ||||

Table (2)

| Account: Notes Receivable Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | Balance | ✓ | 6,000 | |||

| 25 | J1 | 3,200 | 9,200 | ||||

Table (3)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | Balance | R40 | 23,090 | 23,090 | ||

| 30 | CR36 | 12,890 | 35,980 | ||||

Table (4)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| April | 25 | Notes receivable | 14 | 3,200 | |

| Accounts receivable | 12/ | 3,200 | |||

| (To record payable note raised against the accounts receivable from customer Company S) | |||||

Table (5)

2. and 4.

Prepare accounts receivable subsidiary ledger for given customers.

Explanation of Solution

The accounts receivable subsidiary ledger for given customers are as follows:

Accounts receivable subsidiary ledger

| Name: Company M | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 1 | Balance | ✓ | 8,710 | ||

| 5 | R40 | 8,710 | - | |||

| 22 | CR36 | 7,470 | 7,470 | |||

Table (6)

| Name: Company O | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 2 | R40 | 4,680 | 4,680 | ||

| 19 | CR36 | 4,680 | - | |||

Table (7)

| Name: Company P | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 1 | Balance | ✓ | 6,120 | ||

| 6 | R40 | 1,990 | 8,110 | |||

| 15 | CR36 | 6,120 | 1,990 | |||

| 16 | R40 | 5,500 | 7,490 | |||

| 20 | CR36 | 1,990 | 5,500 | |||

Table (8)

| Name: Company S | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 13 | R40 | 3,450 | 3,450 | ||

| 25 | J1 | 3,200 | 250 | |||

Table (9)

3.

Prepare single column revenue journal and cash receipt journal.

Explanation of Solution

Revenue journal: Revenue journal of C Business service in the month of April is as follows:

Revenue journal

Page 40

| Date | Invoice No. | Account debited | Post Ref. |

Account receivable Dr. Fees earned Cr. ($) | |

| April | 2 | 793 | Company O | ✓ | 4,680 |

| 6 | 794 | Company P | ✓ | 1,990 | |

| 13 | 795 | Company S | ✓ | 3,450 | |

| 16 | 796 | Company P | ✓ | 5,500 | |

| 22 | 797 | Company M | ✓ | 7,470 | |

| 30 | $23,090 | ||||

| (12) (41) | |||||

Table (10)

Cash receipt journal: Cash receipt journal of C Business service in the month of April is as follows:

Cash receipt journal

Page 36

| Date | Account Credited | Post Ref. | Fees earned Cr. | Accounts receivable Cr. | Cash Dr. | |

| April | 5 | Company M | ✓ | 8,710 | 8,710 | |

| 15 | Company P | ✓ | 6,120 | 6,120 | ||

| 19 | Company O | ✓ | 4,680 | 4,680 | ||

| 20 | Company P | ✓ | 1,990 | 1,990 | ||

| 30 | Fees earned | 12,890 | 12,890 | |||

| 30 | 12,890 | 21,500 | 34,390 | |||

| (41) | (12) | (11) | ||||

Table (11)

6.

Prepare accounts receivable customers balance, and verify that the total agrees with the ending balance of accounts receivable control account.

Explanation of Solution

Accounts receivable customer balance: Accounts receivable customers balance is as follows:

| C Business service | |

| Accounts receivable customers balances | |

| April 30 | |

| Particulars | Amount ($) |

| Company M | 7,740 |

| Company P | 5,500 |

| Company S | 250 |

| Total accounts receivable | 13,220 |

Table (12)

Accounts receivable controlling account: Ending balance of accounts receivable controlling account is as follows:

| C Business service | |

| Accounts receivable (Controlling account) | |

| April 30 | |

| Particulars | Amount ($) |

| Opening balance on April 1 | 14,830 |

| Add: | |

| Total debits (from revenue journal) | 23,090 |

| 11,210 | |

| Less: | |

| Total credits (from cash receipts journal and journal) (1) | (24,700) |

| Total accounts receivable | 13,220 |

Table (13)

Working note 1: Calculate the total credits in the accounts receivable

In this case, accounts receivable subsidiary ledger is used to identify and locate the error by way of cross checking the customer balance and accounts receivable controlling account. From the above calculation, we can understand that the both balance of accounts receivable is agreed, hence there is no error in the recording and posting of transactions.

7.

Explain the reasons for omitting the postings to a control account by an automated system.

Explanation of Solution

At the time of the original transactions are entered, the individual sales transactions are posted automatically in the computer system. So, there is no need to post the summary totals to the general ledger accounts.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL ACCOUNTING

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub