Fundamental Accounting Principles -Hardcover

22nd Edition

ISBN: 9780077632991

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

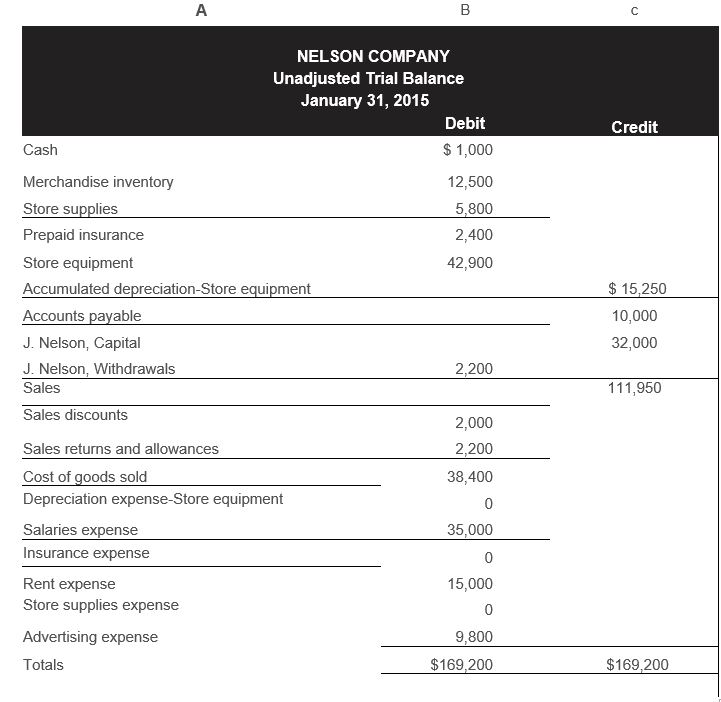

Chapter 5, Problem 3GLP

Based on Problem 5-5A

Problem 5-5A

Preparing

Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Nelson Company uses a perpetual inventory system.

Required

- Prepare adjusting

journal entries to reflect each of the following: - Store supplies still available at fiscal year-end amount to $1,750.

- Expired insurance, an administrative expense, for the fiscal year is $1,400.

Depreciation expense on store equipment, a selling expense, is $1.525 for the fiscal year.- To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows S10.900 of inventory is still available at fiscal year-end.

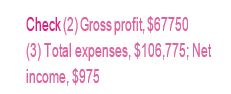

- Prepare a multiple-step income statement for fiscal year 2015.

- Prepare a single-step income statement for fiscal year 2015.

- Compute the

current ratio , acid-test ratio, and gross margin ratio as of January 31, 2015. (Round ratios to two decimals.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve this question general accounting

General accounting

Need help with this general accounting question

Chapter 5 Solutions

Fundamental Accounting Principles -Hardcover

Ch. 5 - Prob. 1DQCh. 5 - 2. In comparing the accounts of a merchandising...Ch. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Prob. 10DQ

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - Prob. 14DQCh. 5 - Prob. 15DQCh. 5 - Prob. 1QSCh. 5 - Prob. 2QSCh. 5 - Prob. 3QSCh. 5 - Prob. 4QSCh. 5 - Prob. 5QSCh. 5 - Prob. 6QSCh. 5 - Prob. 7QSCh. 5 - Prob. 8QSCh. 5 - Prob. 9QSCh. 5 - Prob. 10QSCh. 5 - Prob. 11QSCh. 5 - Prob. 12QSCh. 5 - Prob. 13QSCh. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Prob. 17QSCh. 5 - Prob. 18QSCh. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Exercise 5-6 Recording purchase returns and...Ch. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Prob. 10ECh. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Exercise 5-17A Recording purchases and...Ch. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Prob. 20ECh. 5 - Prepare journal entries to record the following...Ch. 5 - (

Problem 5-2A

Preparing journal entries for...Ch. 5 - Prob. 3APSACh. 5 - Prob. 4APSACh. 5 - Prob. 5APSACh. 5 - Prob. 6APSACh. 5 - Prob. 1BPSBCh. 5 - Prepare journal entries to record the following...Ch. 5 - Prob. 3BPSBCh. 5 - Prob. 4BPSBCh. 5 - Prob. 5BPSBCh. 5 - Problem 5-6BE Refer to the data and information in...Ch. 5 - Prob. 5SPCh. 5 - Prob. 1GLPCh. 5 - Prepare journal entries to record the following...Ch. 5 - Based on Problem 5-5A Problem 5-5A Preparing...Ch. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Prob. 6BTNCh. 5 - Prob. 7BTNCh. 5 - Prob. 8BTNCh. 5 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License