Concept explainers

1.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the

To calculate: The total cost of goods available for sale and the number of units available for sales.

1.

Answer to Problem 2PSB

The total cost of goods available for sale is 235,500 and the total number of goods available for sale is 65 units

Explanation of Solution

Cost of goods available for sales and the number of goods available for sales:

| Date | Particular | Unit | Rate ($) | Total Cost ($) |

| 1st April | Opening inventory | 20 | 3000 | 60000 |

| 6th April | Purchases | 30 | 3500 | 105,000 |

| 17th April | Purchases | 5 | 4500 | 22,500 |

| 25st April | Purchases | 10 | 4800 | 48,000 |

| Total | 65 | 235,500 | ||

So, the total cost of goods available for sale is $23,500 and the total number of goods available for sale is 65 units

2.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The number of unit in ending inventory for the company M.

2.

Answer to Problem 2PSB

The number of units in ending inventory is 5 units.

Explanation of Solution

The number of units in closing inventory is as follows:

The number of units in ending inventory is 5 units

3.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The cost assigned to ending inventory for the company M using FIFO, LIFO and weighted average and specific identification.

3.

Answer to Problem 2PSB

Cost assigned to ending inventory using FIFO is $24,000, using LIFO is $15,000, using weighted average is $ 20000 and specific Identification is $22,500.

Explanation of Solution

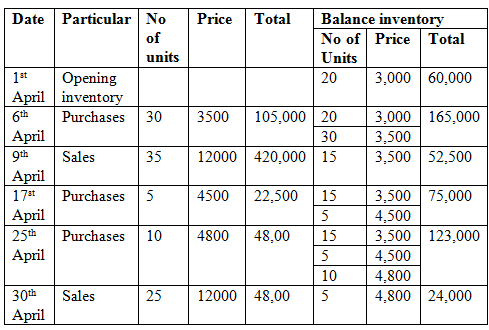

- Cost assigned to ending inventory for the company A using FIFO :

- Calculating the assigned amount of ending inventory according to LIFO method:

Using FIFO method closing inventory of 5 units will consist:

Thus, cost assigned to ending inventory using FIFO is $24,000.

Using the LIFO method closing inventory of 5 units will consist

Thus, the cost of assigned to ending inventory using LIFO is $15,000

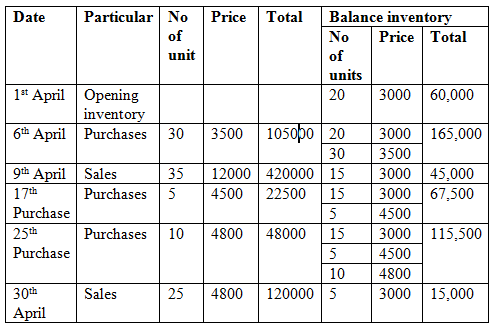

Calculating the assigned amount of ending inventory according to the weighted-average method:

The weighted average cost is calculated as:

| Date | Particular | No of unit | Price | Total | Balance inventory | ||

| No of units | Price | Total | |||||

| 1st April | Opening inventory | 20 | 3,000 | 60,000 | 20 | 3,000 | 60,000 |

| 6th April | Purchase | 30 | 3,500 | 105,000 | 50 | 3,300 | 165,000 |

| 9th April | Sales | (35) | 3,300 | (115,500) | 15 | 3,300 | 49,500 |

| 17th April | Purchase | 5 | 4,500 | 22,500 | 20 | 3,600 | 72,000 |

| 25th April | Purchase | 10 | 4,800 | 48,000 | 30 | 4,000 | 120,000 |

| 30th April | Sales | (25) | 4,000 | (100,000) | 5 | 4,000 | 20,000 |

Thus, cost assigned to ending inventory of $ 20,000

Cost assigned to total inventory using the specific identification method:

Using specific identification method closing inventory of 5 units will consist

Thus, the cost assigned to ending inventory is $22,500.

4.

Introduction:

Inventory is a record of finished goods of a company which they can sell to the customer, work in progress which can be transformed into finish goods and raw material which is a means of production. Inventory is also classified as a current asset in the balance sheet and it is valued by FIFO LIFO and weighted average method.

To compute: The gross profit earn by the company is cost assigned to ending inventory for the company A using FIFO,LIFO and weighted average and specific identification.

4.

Answer to Problem 2PSB

Gross using FIFO methods is $558,500, using LIFO method is $549,500, using weighted average method is $55,4500, and specific identification method is $557,000.

Explanation of Solution

| Particular | FIFO | LIFO | weighted average | Specific identification |

| Cost of goods available for sale | 235500 | 235500 | 235500 | 235500 |

| Less: closing stock 5 units | 24000 | 15000 | 200,000 | 22500 |

| Cost of goods sold | 211,500 | 220,500 | 215,500 | 213,000 |

Gross profit earned by the company:

| Particular | FIFO method | LIFO method | Weighted average method | Specific identification method |

| Total Sales | $770,000 | $770,000 | $770,000 | $770,000 |

| Less: Cost of goods sold | 211,500 | 220,500 | 215,500 | 213,000 |

| Total | $558,500 | $549,500 | $554,500 | 557,000 |

Thus, gross using FIFO methods is $558,500, using the LIFO method is $549,500, using the weighted average method is $554500, and the specific identification method is $557,000.

Want to see more full solutions like this?

Chapter 5 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

- Can you help me with Financial accounting question?arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardMadison Industries uses the FIFO (first-in, first-out) method in its process costing system. The mixing department had $4,800 in material cost in its beginning work in process inventory, and $68,000 in material cost was added during the period. The equivalent units of production for materials during the period were 17,000 units. What is the cost per equivalent unit for materials?arrow_forward

- ABC Company has December unit sales of 12,000 units. Assuming a 5 percent growth, what is the projected unit sales? am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI want to this question answer for financial accounting question not need ai solutionarrow_forwardIn its first year of operation, Summit Publications produced 72,000 books and had 1,800 books in inventory at year end. The cost of goods sold for the year was $425,000. What were the total manufacturing costs for the year if the average unit cost was $7.50 per book?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub