Concept explainers

Sales-related transactions using perpetual inventory system

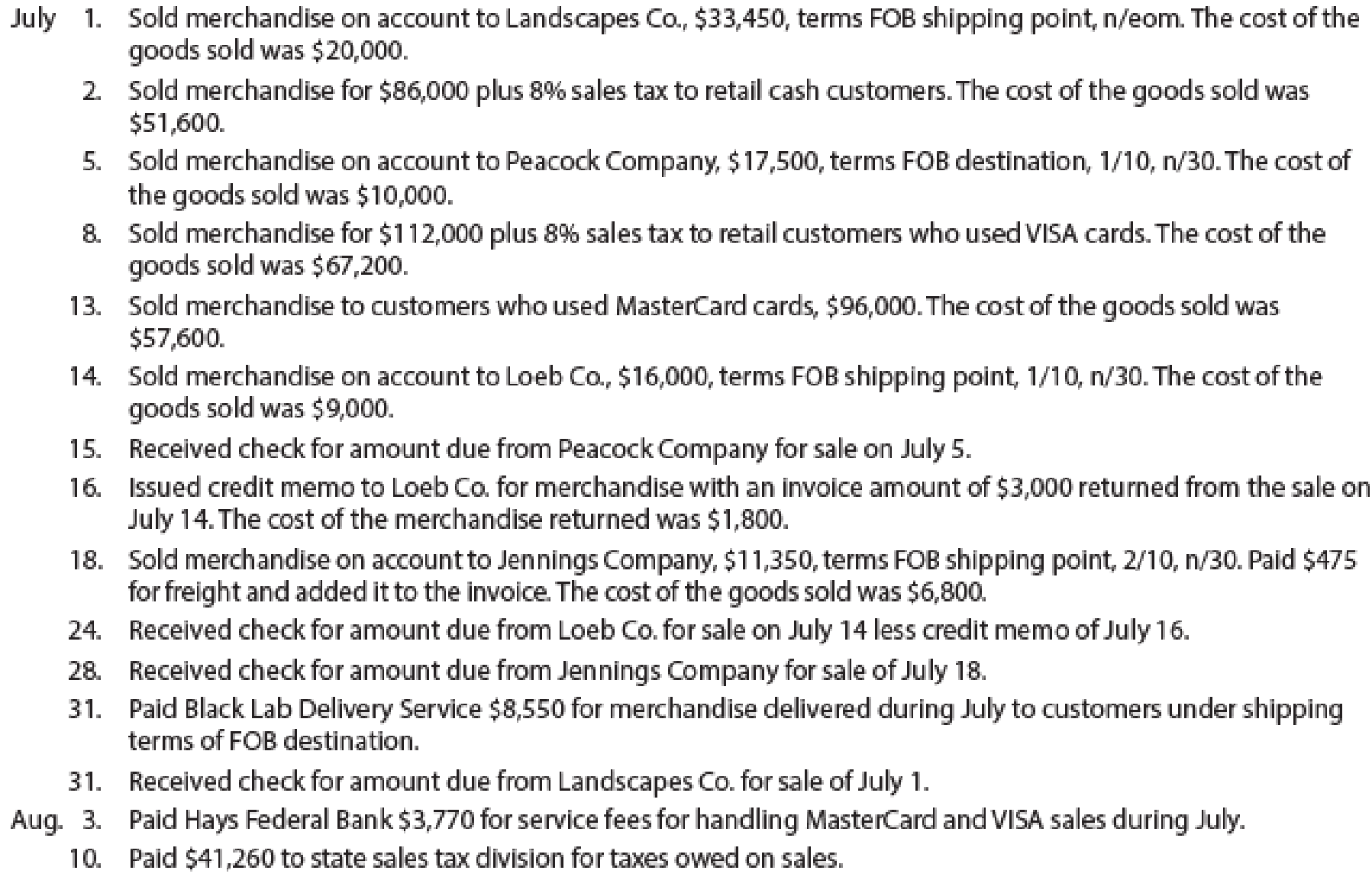

The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to other businesses and occasionally to retail customers:

Instructions

Sales is an activity of selling the inventory of a business.

To Record: The sale transactions of the company.

Explanation of Solution

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Accounts receivable | 18,711 (1) | |

| Sales Revenue | 18,711 | ||

| (To record the sale of inventory on account) |

Table (1)

Working Note:

Calculate the amount of accounts receivable.

Sales = $18,900

Discount percentage = 1%

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

- Sales revenue is revenue and it increases the value of equity by $18,711. Therefore, credit sales revenue with $18,711.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Cost of Sold | 13,300 | |

| Inventory | 13,300 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of sold is an expense account and it decreases the value of equity by $13,300. Therefore, debit cost of sold account with $13,300.

- Inventory is an asset and it is decreased by $13,300. Therefore, credit inventory account with $13,300.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cash | 12,031 (3) | |

| Sales Revenue | 11,350 | ||

| Sales Tax Payable | 681 (2) | ||

| (To record the sale of inventory for cash) |

Table (3)

Working Notes:

Calculate the amount of sales tax payable.

Sales revenue = $11,350

Sales tax percentage = 6%

(2)

Calculate the amount of cash received.

Sales revenue = $11,350

Sales tax payable = $681 (2)

(3)

- Cash is an asset and it is increased by $12,031. Therefore, debit cash account with $12,031.

- Sales revenue is revenue and it increases the value of equity by $11,350. Therefore, credit sales revenue with $11,350.

- Sales tax payable is a liability and it is increased by $681. Therefore, credit sales tax payable account with $681.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cost of Sold | 7,000 | |

| Inventory | 7,000 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of sold is an expense account and it decreases the value of equity by $7,000. Therefore, debit cost of sold account with $7,000.

- Inventory is an asset and it is decreased by $7,000. Therefore, credit inventory account with $7,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Accounts receivable | 55,400 | |

| Sales Revenue | 55,400 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

- Sales revenue is revenue and it increases the value of equity by $55,400. Therefore, credit sales revenue with $55,400.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Cost of Sold | 33,200 | |

| Inventory | 33,200 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of sold is an expense account and it decreases the value of equity by $33,200. Therefore, debit cost of sold account with $33,200.

- Inventory is an asset and it is decreased by $33,200. Therefore, credit inventory account with $33,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cash | 31,800 (5) | |

| Sales Revenue | 30,000 | ||

| Sales Tax Payable | 1,800 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

Working Notes:

Calculate the amount of sales tax payable.

Sales revenue = $30,000

Sales tax percentage = 6%

(4)

Calculate the amount of cash received.

Sales revenue = $30,000

Sales tax payable = $1,800 (2)

(5)

- Cash is an asset and it is increased by $31,800. Therefore, debit cash account with $31,800.

- Sales revenue is revenue and it increases the value of equity by $30,000. Therefore, credit sales revenue with $30,000.

- Sales tax payable is a liability and it is increased by $1,800. Therefore, credit sales tax payable account with $1,800.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cost of Sold | 19,400 | |

| Inventory | 19,400 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of sold is an expense account and it decreases the value of equity by $19,400. Therefore, debit cost of sold account with $19,400.

- Inventory is an asset and it is decreased by $19,400. Therefore, credit inventory account with $19,400.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 12 | Cash | 18,711 | |

| Accounts Receivable | 18,711 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $18,711. Therefore, debit cash account with $18,711.

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cash | 13,700 | |

| Sales Revenue | 13,700 | ||

| (To record the sale of inventory for cash) |

Table (10)

- Cash is an asset and it is increased by $13,700. Therefore, debit cash account with $13,700.

- Sales revenue is revenue and it increases the value of equity by $13,700. Therefore, credit sales revenue with $13,700.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cost of Sold | 8,350 | |

| Inventory | 8,350 | ||

| (To record the cost of goods sold) |

Table (11)

- Cost of sold is an expense account and it decreases the value of equity by $8,350. Therefore, debit cost of sold account with $8,350.

- Inventory is an asset and it is decreased by $8,350. Therefore, credit inventory account with $8,350.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Accounts receivable | 27,225 (6) | |

| Sales Revenue | 27,225 | ||

| (To record the sale of inventory on account) |

Table (12)

Working Note:

Calculate the amount of accounts receivable.

Sales = $27,500

Discount percentage = 1%

- Accounts Receivable is an asset and it is increased by $27,225. Therefore, debit accounts receivable with $27,225.

- Sales revenue is revenue and it increases the value of equity by $27,225. Therefore, credit sales revenue with $27,225.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Cost of Sold | 16,000 | |

| Inventory | 16,000 | ||

| (To record the cost of goods sold) |

Table (13)

- Cost of sold is an expense account and it decreases the value of equity by $16,000. Therefore, debit cost of sold account with $16,000.

- Inventory is an asset and it is decreased by $16,000. Therefore, credit inventory account with $16,000.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Customer Refunds Payable | 4,752 (7) | ||

| Accounts Receivable | 4,752 | |||

| (To record sales returns) |

Table (14)

Calculate the amount of refund owed to the customer.

Sales return = $4,800

Discount percentage = 1%

(7)

- Customer refunds payable is a liability account and it is decreased by $4,752. Therefore, debit customer refunds payable account with $4,752.

- Accounts Receivable is an asset and it is decreased by $4,752. Therefore, credit account receivable with $4,752.

Record the journal entry for the return of the .

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 18 | Inventory | 2,900 | |

| Estimated Returns Inventory | 2,900 | ||

| (To record the return of the ) |

Table (15)

- Inventory is an asset and it is increased by $2,900. Therefore, debit inventory account with $2,900.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $2,900. Therefore, credit estimated returns inventory account with $2,900.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Accounts receivable | 8,085 (8) | |

| Sales Revenue | 8,085 | ||

| (To record the sale of inventory on account) |

Table (16)

Working Note:

Calculate the amount of accounts receivable.

Sales = $8,250

Discount percentage = 2%

- Accounts Receivable is an asset and it is increased by $8,085. Therefore, debit accounts receivable with $8,085.

- Sales revenue is revenue and it increases the value of equity by $8,085. Therefore, credit sales revenue with $8,085.

Record the journal entry.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Accounts Receivable | 75 | ||

| Cash | 75 | |||

| (To record freight charges paid) |

Table (17)

- Accounts Receivable is an asset and it is increased by $75. Therefore, debit accounts receivable with $75.

- Cash is an asset and it is decreased by $75. Therefore, credit cash account with $75.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Cost of Sold | 5,000 | |

| Inventory | 5,000 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of sold is an expense account and it decreases the value of equity by $5,000. Therefore, debit cost of sold account with $5,000.

- Inventory is an asset and it is decreased by $5,000. Therefore, credit inventory account with $5,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 26 | Cash | 22,473 (9) | |

| Accounts Receivable | 22,473 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

Calculate the amount of cash received.

Net accounts receivable = $22,473

Customer refunds payable = $4,752

(9)

- Cash is an asset and it is increased by $22,473. Therefore, debit cash account with $22,473.

- Accounts Receivable is an asset and it is increased by $22,473. Therefore, debit accounts receivable with $22,473.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 28 | Cash | 8,160 (10) | |

| Accounts Receivable | 8,160 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

Calculate the amount of cash received.

Net accounts receivable = $8,085

Freight charges = $75

(10)

- Cash is an asset and it is increased by $8,160. Therefore, debit cash account with $8,160.

- Accounts Receivable is an asset and it is increased by $8,160. Therefore, debit accounts receivable with $8,160.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 31 | Cash | 55,400 | |

| Accounts Receivable | 55,400 | ||

| (To record the receipt of cash against accounts receivables) |

Table (21)

- Cash is an asset and it is increased by $55,400. Therefore, debit cash account with $55,400.

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 31 | Delivery expense | 5,600 | |

| Cash | 5,600 | ||

| (To record the payment of delivery expenses) |

Table (22)

- Delivery expense is an expense account and it decreases the value of equity by $5,600. Therefore, debit delivery expense account with $5,600.

- Cash is an asset and it is decreased by $5,600. Therefore, credit cash account with $5,600.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 3 | Credit card expense | 940 | |

| Cash | 940 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $940. Therefore, debit credit card expense account with $940.

- Cash is an asset and it is decreased by $940. Therefore, credit cash account with $940.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 15 | Sales tax payable | 6,544 | |

| Cash | 6,544 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $6,544. Therefore, debit customer refunds payable account with $6,544.

- Cash is an asset and it is decreased by $6,544. Therefore, credit cash account with $6,544.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial and Managerial Accounting

- Merchandise is sold on account to a customer for $12,500, terms FOB shipping point, 1/10, n/30. The seller paid the freight of $400. Determine the following. a. the amount of the sale b. the amount debited to Accounts Receivable c. the amount of the discount for early payment d. the amount due within the discount periodarrow_forwardIf a company’s revenue is $65,000, the cost of goods sold is $38,000, and operating expenses are $10,000, what is the company’s gross profit?arrow_forwardIf a company’s revenue is $65,000, the cost of goods sold is $38,000, and operating expenses are $10,000, what is the company’s gross profit? Provide Answerarrow_forward

- Do fast answer of this accounting questionsarrow_forwardIf an asset is purchased on credit, what is the effect on the accounting equation? (a) Assets decrease; equity decreases (b) Assets increase; liabilities increase (c) Liabilities decrease; equity increases (d) No effect on the accounting equation ?arrow_forwardPlease answer the accounting question not use aiarrow_forward

- For the year ended December 31, 2015, Pering Co. reported pretax financial income of $550,000. Its current tax expense was $144,000. Pering reported a difference between pretax financial statement income and taxable income. This difference is due to accelerated depreciation for income tax purposes. Pering?s effective income tax rate is 30% and Pering made estimated tax payments during 2015 of $75,000. What amount did Paring report as taxable income for 2015? a. $405,000 b. $475,000 c. $480,000 d. $550,000arrow_forwardCompute the labor quantity variance?arrow_forwardI want to correct answer accounting questionsarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning