Concept explainers

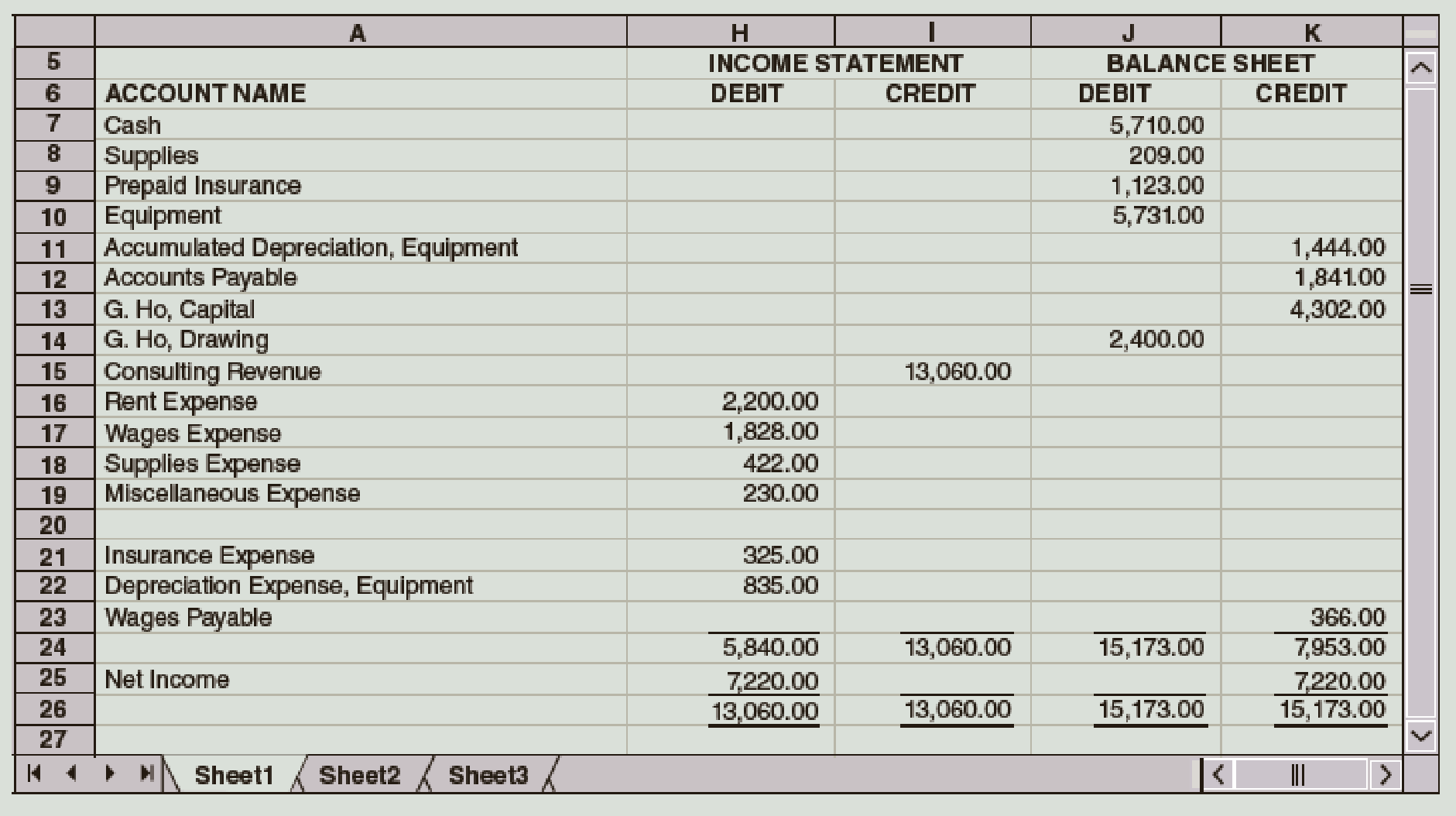

The partial work sheet for Ho Consulting for May follows:

Required

If you are using working papers, complete the following:

- 1. a. Write the owner’s name on the Capital and Drawing T accounts.

b. Record the account balances in the T accounts for owner’s equity, revenue, and expenses.

- 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4.

- 3.

Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number the closing entries 1 through 4.

Check Figure

Debit to Income Summary, second entry, $5,840

Trending nowThis is a popular solution!

Chapter 5 Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Accounting (12th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning