a.

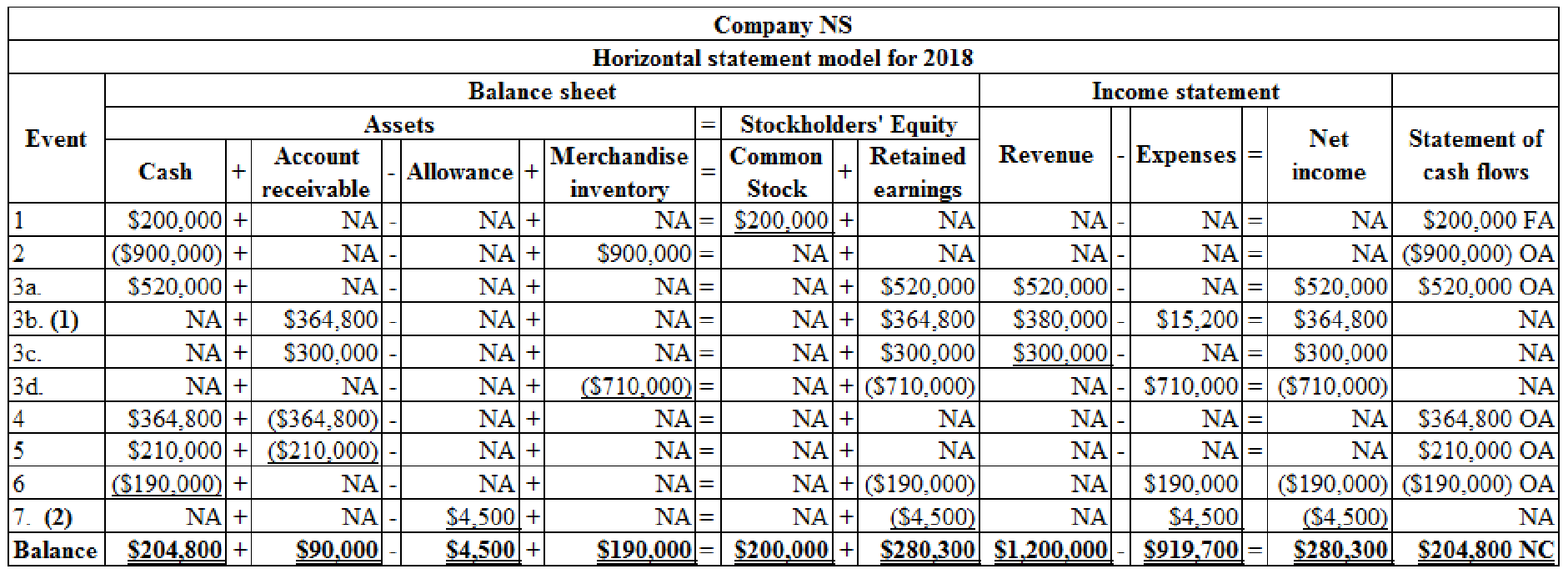

Record these events in a horizontal statements model and indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA) or not affected (NA).

a.

Explanation of Solution

Horizontal statements model: The model that represents all the financial statements,

Record these events in a horizontal statements model and indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA) or not affected (NA):

Table (1)

Note:

OA refers to operating activities.

FA refers to financing activities.

NA refers to does not affected.

3a. this transaction records the cash sale.

3b. this transaction records the credit card sale.

3c. this transaction records the sales made on account.

3d. this transaction records the cost of merchandise sold.

Working Note:

(1) Calculate the amount of credit card sales made to customers.

The merchandise sold to credit card customers for $380,000 and the company charges a fee of 4% on sales. So, the credit card expense (A) is

(2) Calculate the amount for uncollectible accounts expense.

b)

Prepare income statement, statement of changes in

b)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of Cash flows: Statement of cash flows is a statement reports the source and application of cash between two balance sheet dates. It shows how the cash is sourced and used for the company’s operating, investing, and financing activities.

Prepare the income statement for Company NS for the year ended 2018.

| Company NS | ||

| Statement of income | ||

| For the year ended 2018 | ||

| Particulars | Amount | Amount |

| Service revenue | $1,200,000 | |

| Less: Cost of goods sold | ($710,000) | |

| Gross margin | $490,000 | |

| Operating expenses | ||

| Credit card expense | $15,200 | |

| Selling and administrative expenses | $190,000 | |

| Uncollectible accounts expense | $4,500 | |

| Total operating expenses | ($209,700) | |

| Net income | $280,300 | |

Table (2)

Hence, the net income of Company NS for the year ended December 31, 2018 is $280,300.

Prepare the statement of changes in stockholders’ equity of Company NS for the year ended December 31, 2018.

| Company NS | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2018 | ||

| Particulars | Amount | Amount |

| Beginning Common Stock | $0 | |

| Add: Stock Issued | $200,000 | |

| Ending Common Stock | $200,000 | |

| Beginning | $0 | |

| Add/Less: Net Income (Loss) | $280,300 | |

| Ending Retained Earnings | $280,300 | |

| Total stockholder's equity | $480,300 | |

Table (3)

Hence, the total stockholders’ equity of Company NS for the year ended December 31, 2018 is $480,300.

Prepare the balance sheet of Company NS as on December 31, 2018.

| Company NS | ||

| Balance sheet | ||

| As on December 31, 2018 | ||

| Assets | Amount | Amount |

| Cash | $204,800 | |

| $90,000 | ||

| Less: Allowance for doubtful accounts | ($4,500) | $85,500 |

| Merchandise Inventory | $190,000 | |

| Total Assets | $480,300 | |

| Liabilities and stockholders' equity | ||

| Liabilities | ||

| Total Liabilities | $0 | |

| Stockholders’ Equity | ||

| Common Stock | $200,000 | |

| Retained Earnings | $280,300 | |

| Total Stockholders’ Equity | $480,300 | |

| Total liabilities and stockholders' equity | $480,300 | |

Table (4)

Hence, the total of assets and liabilities and stockholders’ equity of Company NS as on December 31, 2018 is $480,300.

Prepare the statement of cash flows of Company NS for the year ended December 31, 2018.

| Company NS | ||

| Statement of cash flows | ||

| For the year ended December 31, 2018 | ||

| Particulars | Amount | Amount |

| Cash flow from operating activities: | ||

| Cash Receipts from Customers | $1,094,800 | |

| Outflow for inventory | ($900,000) | |

| Outflow for expenses | ($190,000) | |

| Net Cash Flow from Operating Activities | $4,800 | |

| Cash Flows From Investing Activities: | ||

| Net Cash Flow From Investing Activities | $0 | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | $200,000 | |

| Net Cash Flow From Financing Activities | $200,000 | |

| Net Change in Cash | $204,800 | |

| Add: Beginning Cash Balance | $0 | |

| Ending Cash Balance | $204,800 | |

Table (5)

Hence, the net change in cash of Company NS during 2018 is $204,800.

Working note:

Determine the amount of cash collected from customers.

Want to see more full solutions like this?

Chapter 5 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College