ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

18th Edition

ISBN: 9781307515596

Author: RECK

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 24EP

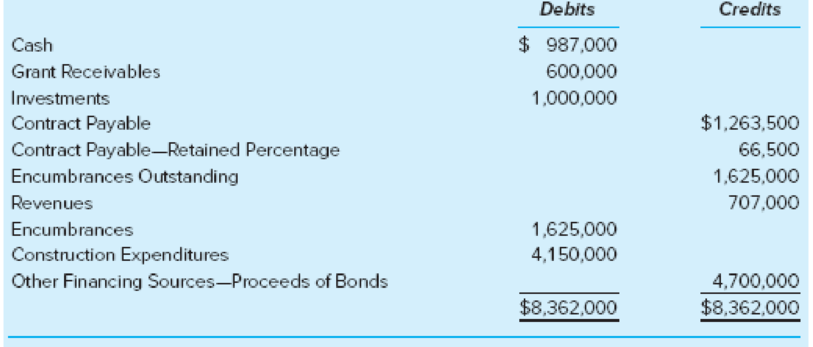

The year-end pre-closing

Required

- a. Prepare the year-end statement of revenues, expenditures, and changes in fund balances for the capital projects fund.

- b. Has the capital project been completed? Explain your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

financial accounting answer is.

Provide correct answer general Accounting question

What is the interest coverage ratio of this financial accounting question?

Chapter 5 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

Ch. 5 - What are general capital assets? How are they...Ch. 5 - Explain what disclosures the GASB requires for...Ch. 5 - Prob. 3QCh. 5 - Prob. 4QCh. 5 - Prob. 5QCh. 5 - What is the accounting difference between using...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - What is a service concession arrangement, and why...

Ch. 5 - Prob. 13CCh. 5 - Prob. 14CCh. 5 - Prob. 15CCh. 5 - Under GASB standards, which of the following would...Ch. 5 - Two new copiers were purchased for use by the city...Ch. 5 - Maxim County just completed construction of a new...Ch. 5 - A capital projects fund would probably not be used...Ch. 5 - Machinery and equipment depreciation expense for...Ch. 5 - Prob. 17.6EPCh. 5 - Prob. 17.7EPCh. 5 - Callaway County issued 10,000,000 in bonds at 101...Ch. 5 - Neighborville enters into a lease agreement for...Ch. 5 - Neighborville enters into a lease agreement for...Ch. 5 - Prob. 17.11EPCh. 5 - Prob. 17.12EPCh. 5 - Prob. 17.13EPCh. 5 - Arbitrage rules under the Internal Revenue Code a....Ch. 5 - Prob. 17.15EPCh. 5 - Make all necessary entries in the appropriate...Ch. 5 - Prob. 19EPCh. 5 - Prob. 20EPCh. 5 - In the current year, the building occupied by...Ch. 5 - Prob. 22EPCh. 5 - Make all necessary entries in a capital projects...Ch. 5 - The year-end pre-closing trial balance for the...Ch. 5 - Prob. 25EPCh. 5 - This year Riverside began work on an outdoor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License