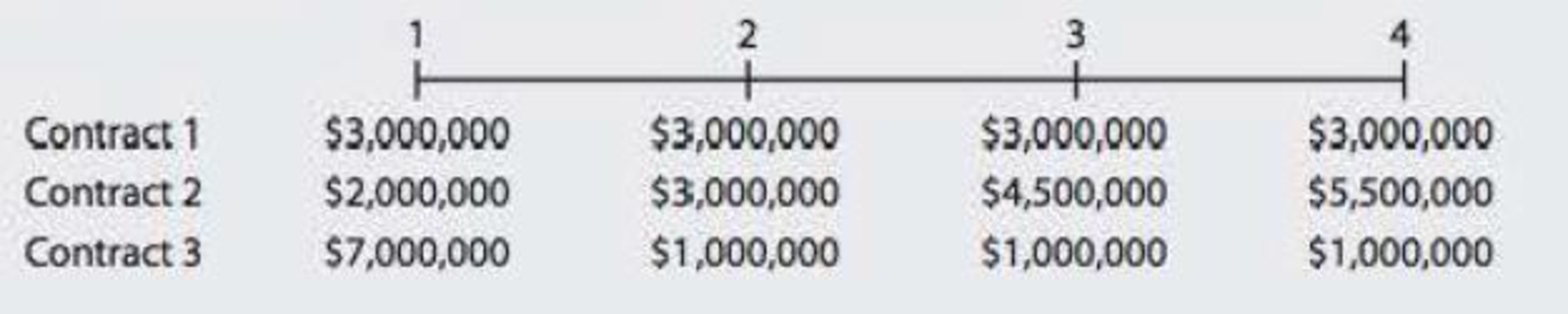

PV OF A CASH FLOW STREAM A rookie quarterback is negotiating his first NFL contract. His

As his adviser, which contract would you recommend that he accept?

To calculate: The best stream for present value of cash flow

Introduction:

Future Value of Cash Flow:

If single cash flow put in an investment today which pays us compound interest how much does it grow over the period of time is known as future value of cash flow.

Explanation of Solution

Calculation of present value of cash flow stream at 7% compounding rate

| Contract 1 | Contract 2 | Contract 3 | ||||

| Year | Cash in flow | Present Value | Cash in flow | Present Value | Cash in flow | Present Value |

| 1 | 3,000,000 | 2,803,738 | 2,000,000 | 1,869,159 | 7,000,000 | 6,542,056 |

| 2 | 3,000,000 | 2,620,316 | 3,000,000 | 2,620,316 | 1,000,000 | 873,439 |

| 3 | 3,000,000 | 2,448,894 | 4,500,000 | 3,673,340 | 1,000,000 | 816,298 |

| 4 | 3,000,000 | 2,288,686 | 5,500,000 | 4,195,924 | 1,000,000 | 762,895 |

| Total PV | 10,161,634 | 12,358,739 | 8,994,688 | |||

Table (1)

Working Note for present value:

Present value for year 1 and contract 1

Present value for year 2 and contract 1

Present value for year 3 and contract 1

Present value for year 4 and contract 1

Present value for year 1 and contract 2

Present value for year 2 and contract 2

Formula to calculate present value for year 3 and contract 2

Formula to calculate present value for year 4 and contract 2

Formula to calculate present value for year 1 and contract 3

Formula to calculate present value for year 2 and contract 3

Formula to calculate present value for year 3 and contract 3

Formula to calculate present value for year 4 and contract 3

So, the contract 2 is the best option as total present value is highest for contract 2.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals of Financial Management, Concise Edition

- Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.7 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 5.05 percent. What is the dollar price of the bond?arrow_forwardA trip goa quesarrow_forwardWhat is the benefit of the finance subject? explain.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning