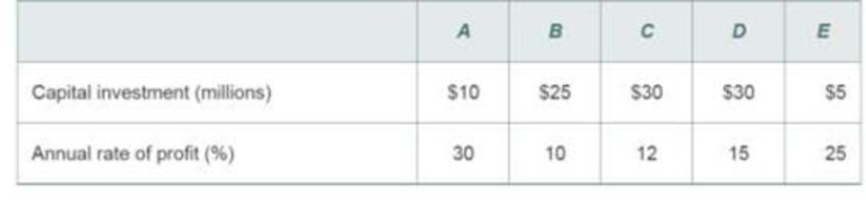

Tennessee Tool Works (TTW) is considering investment in five independent projects,

Any profitable combination of them is feasible.

TTW has$50million available to invest, and these funds are currently earning 7% interest annually from municipal bonds. If the funds available are limited to $50 million, what is TTW’s MARR that is implied by this particular situation? (5.2)

Selection of the project.

Explanation of Solution

The firm has limited investment. It can select the project that give more profit rate in order to maximize the profit. Thus, the firm can select the project A, E and D. The MARR for the firm is equal the best return of the rejected projects. Since the best return from the rejected project is 12%, the firm’s MARR is 12%.

Want to see more full solutions like this?

Chapter 5 Solutions

EBK ENGINEERING ECONOMY

Additional Business Textbook Solutions

Foundations Of Finance

Operations Management

MARKETING:REAL PEOPLE,REAL CHOICES

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

- Use the figure below to answer the following question. Let I represent Income when health, let Is represent income when ill. Let E[I] represent expected income. Point D represents Utility 100000 B у いいつ income есва Ін Is the expected utility from income with no insurance an actuarially fair and partial contract an actuarially fair and full contract an actuarially unfair and full contract an actuarially unfair and partial contractarrow_forwardOutline the principles of opportunity cost and comparative advantage. Describe how these principles can be applied to address the scarcity of resources in a real-world scenario involving a company or industry.arrow_forwardNot use ai pleasearrow_forward

- 3. Consider the case of everyone being wealthier in the future, such as from a positive productivity shock (computers, internet, robotics, AI). A. Begin from the baseline preferences and endowments. Give both people an endowment of 1000 pounds for the first period and 1100 pounds for the second. AI increases the supply of second period goods by 10%. Note that there is now a total of 2000 pounds in the first period and 2200 pounds in the second. Determine the equilibrium interest rate. r = % B. Begin from the baseline preferences and endowments. Give both people an endowment of 1100 pounds for the first and 1100 pounds for the second periods. AI increases the supply in all periods by 10%. Note that there are now 2200 pounds in the first period and 2200 pounds in the second. Determine the equilibrium interest rate. r = % C. Explain how productivity and the real rate are connected. Write at least five sentences.arrow_forwardNot use ai pleasearrow_forwardNot use ai pleasearrow_forward

- Not use ai pleasearrow_forwardJim's Bank Account for the Year to 30 April 2008: We will start by calculating the balance of the business bank account, using the transactions provided. Opening Balance: Jim initially deposited €150,000 into his business bank account on 1 May 2007. Transactions: Receipts: Cash Sales (May 2007 to April 2008): €96,000 Credit Sales (Business customers): €19,600 (Note: This amount is not yet received as it is on credit, but it will be included in the Income Statement and not the bank balance at this stage.) Bank receipts from credit customers (amount owed at 30 April 2008): €6,800 Total Receipts:€96,000 (Cash Sales) + €6,800 (credit customer payments) = €102,800 Payments/Expenditures: Lease Payment (Paid in advance for five years): €50,000 Shop Fitting: €10,000 Assistant’s Wages: €250 per month × 12 months = €3,000 Telephone expenses: €800 Heat & Light expenses: €1,000 Jim’s withdrawals for personal expenditure: €1,000 × 12 months = €12,000 Accounting Fee (after the year-end):…arrow_forwardSolve the problemarrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning