Concept explainers

Comprehensive Problem for Chapters 1-5

Completing a Merchandiser’s Accounting Cycle

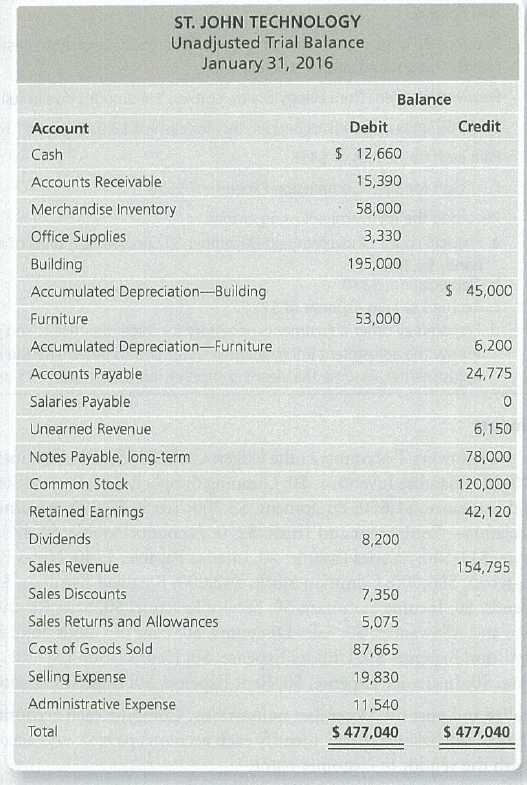

St. John Technology uses a perpetual inventory system. The end-of-month unadjusted

Additional data at January 31, 2 016:

a. Office Supplies consumed during the month, $1,780. Half is selling expense, and the other half is administrative expense.

b.

c. Unearned revenue that has been earned during January, $3,825.

d. Accrued salaries, an administrative expense, $975.

e. Merchandise Inventory on hand, $55,375. St. John uses the perpetual inventory system.

Requirements

1. Using T-accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Al so open the Income Summary account.

2. Journalize and post the

3. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2016. St. John Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense.

4. Prepare the company’s multi-step in com e statement and statement of

5. Journalize and

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (5th Edition)

- What will be the steady state receivables balance of this general accounting question?arrow_forwardSuppose that in 2020, the federal government of Arlington Nation spent $850 billion and collected $620 billion in taxes. In 2021, government spending decreased to $790 billion, while government revenue increased to $910 billion. If the government debt was $6.2 trillion at the beginning of 2020, what will it be at the end of 2021? Answerarrow_forwardMM Manufacturing estimates that overhead costs for the next year will be $4,750,000 for indirect labor and $620,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 140,000 machine hours are planned for the next year, what is the company's plantwide overhead rate?arrow_forward

- General accountingarrow_forwardOn the factory overhead budget for the montharrow_forwardProblem 19-63 (LO 19-5) (Algo) [The following information applies to the questions displayed below.] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its remaining inventory and paying off its remaining liabilities, ROF had the following tax accounting balance sheet: Cash Building Land FMV $ 399,000 84,000 315,000 Adjusted Tax Basis $ 399,000 27,250 405,000 Total $ 798,000 $ 831,250 Appreciation (Depreciation) 56,750 (90,000) $ (33,250) Under the terms of the agreement, Tiffany will receive the $399,000 cash in exchange for her 50 percent interest in ROF. Tiffany's tax basis in her ROF stock is $59,000. Carlos will receive the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $121,000. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,