Concept explainers

Recording Transactions and Adjustments, Reconciling Items, and Preparing Financial Statements

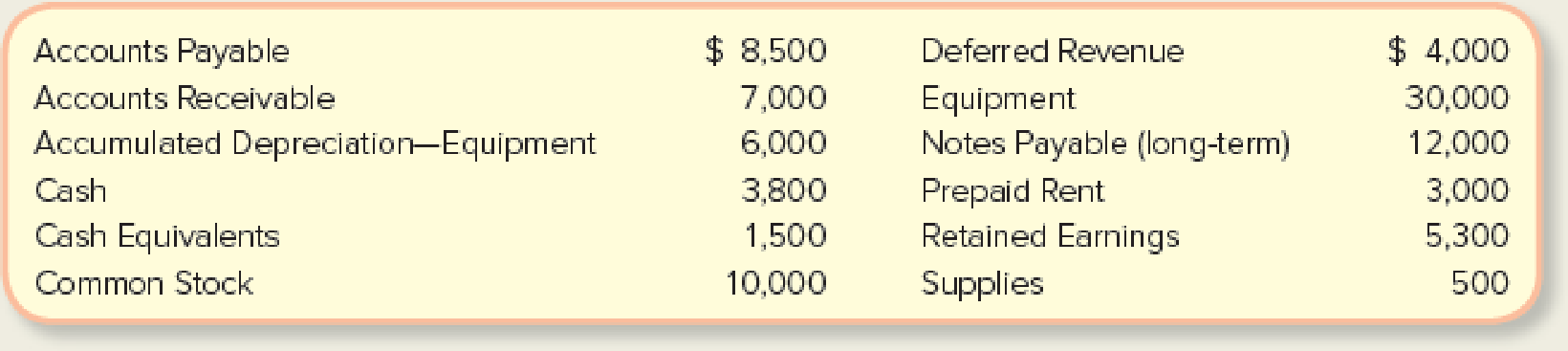

On January 1, Pulse Recording Studio (PRS) had the following account balances.

The following transactions occurred during January.

- a. Received $2,500 cash on 1/1 from customers on account for recording services completed in December.

- b. Wrote checks on 1/2 totaling $4,000 for amounts owed on account at the end of December.

- c. Purchased and received supplies on account on 1/3, at a total cost of $200.

- d. Completed $4,000 of recording sessions on 1/4 that customers had paid for in advance in December.

- e. Received $5,000 cash on 1/5 from customers for recording sessions started and completed in January.

- f. Wrote a check on 1/6 for $4,000 for an amount owed on account.

- g. Converted $1,000 of cash equivalents into cash on 1/7.

- h. On 1/15, completed EFTs for $1,500 for employees’ salaries and wages for the first half of January.

- i. Received $3,000 cash on 1/31 from customers for recording sessions to start in February.

Required:

- 1. Prepare journal entries for the January transactions.

- 2. Enter the January 1 balances into T-accounts,

post the journal entries from requirement 1, and calculate January 31 balances. (If you are completing this requirement in Connect, this requirement will be completed for you.) - 3. Use the January 31 balance in Cash from requirement 2 and the following information to prepare a bank reconciliation. PRS’s bank reported a January 31 balance of $6,300.

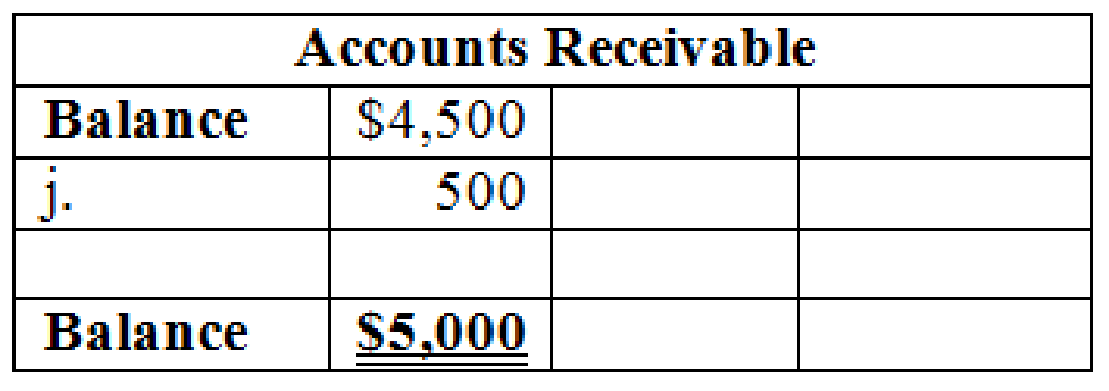

- j. The bank deducted $500 for an NSF check from a customer deposited on January 5.

- k. The check written January 6 has not cleared the bank, but the January 2 payment has cleared.

- l. The cash received and deposited on January 31 was not processed by the bank until February 1.

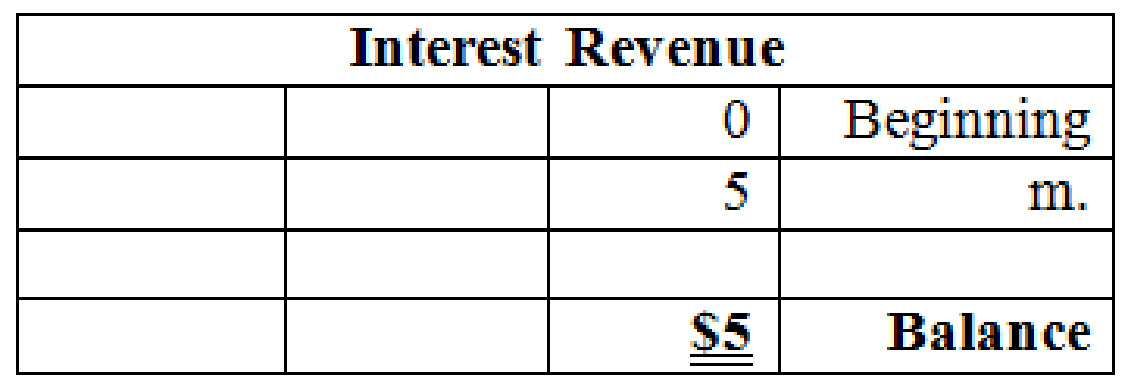

- m. The bank added $5 cash to the account for interest earned in January.

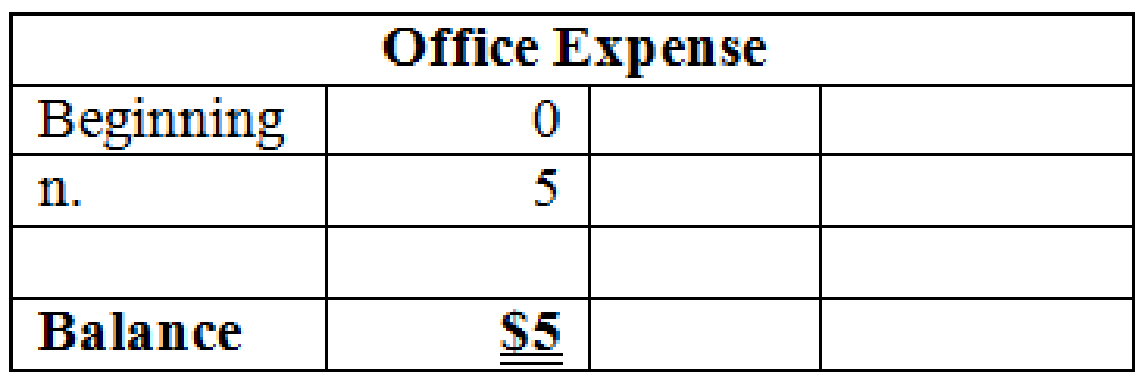

- n. The bank deducted $5 for service charges.

- 4. Prepare journal entries for items (j)-(n) from the bank reconciliation, if applicable, and post them to the T-accounts. If a

journal entry is not required for one or more of the reconciling items, indicate “no journal entry required.” (If you are using Connect, journal entries will be automatically posted after you enter them.) - 5. Prepare

adjusting journal entries on 1/31, using the following information.- o.

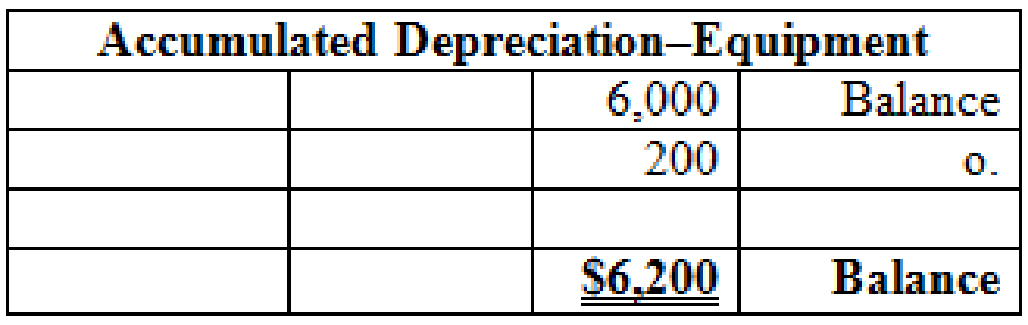

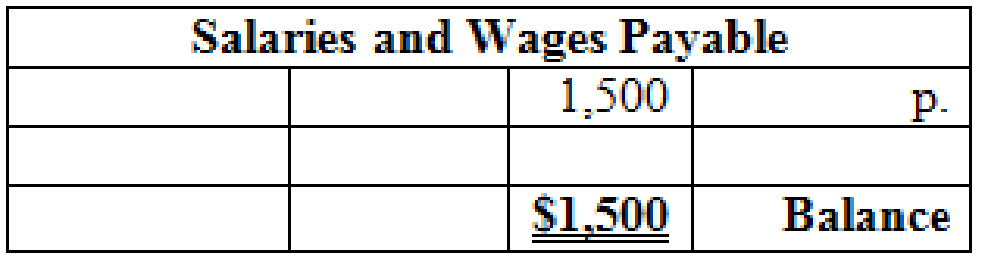

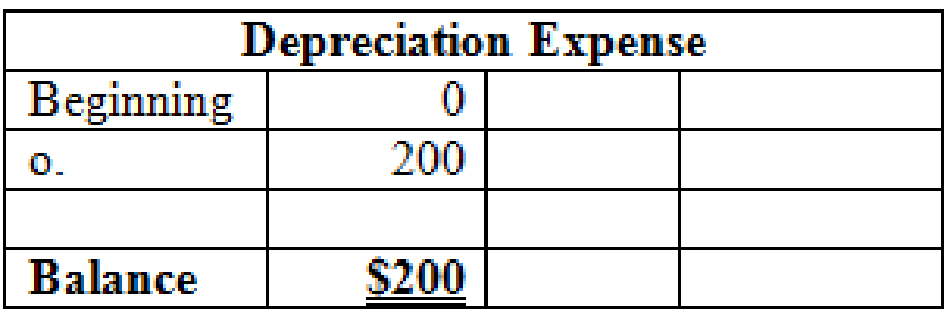

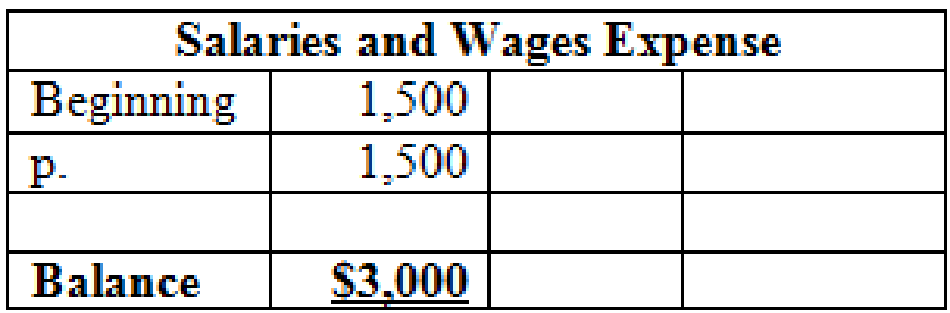

Depreciation for the month is $200. - p. Salaries and wages totaling $1,500 have not yet been recorded for January 16–31.

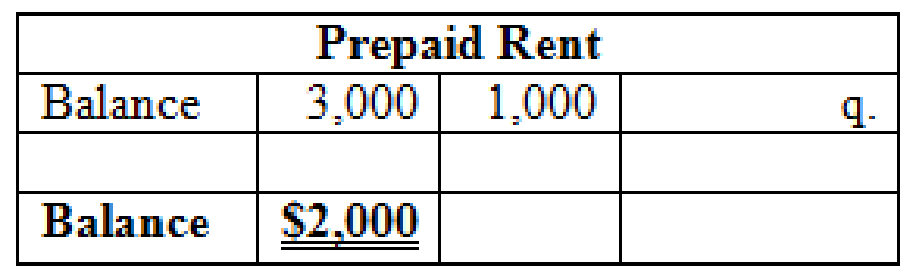

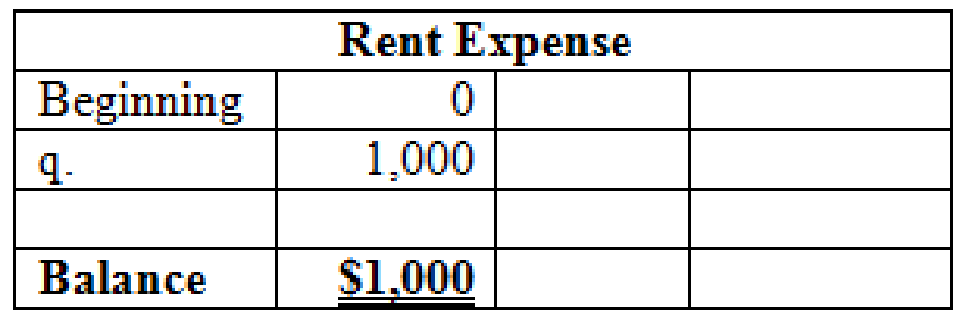

- q. Prepaid Rent will be fully used up by March 31.

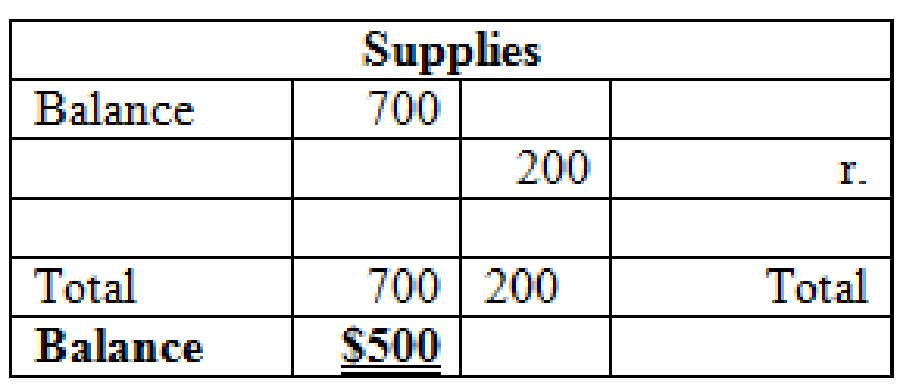

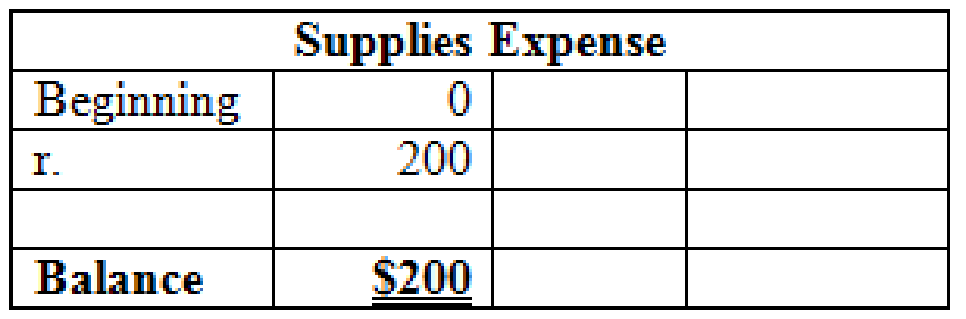

- r. Supplies on hand at January 31 were $500.

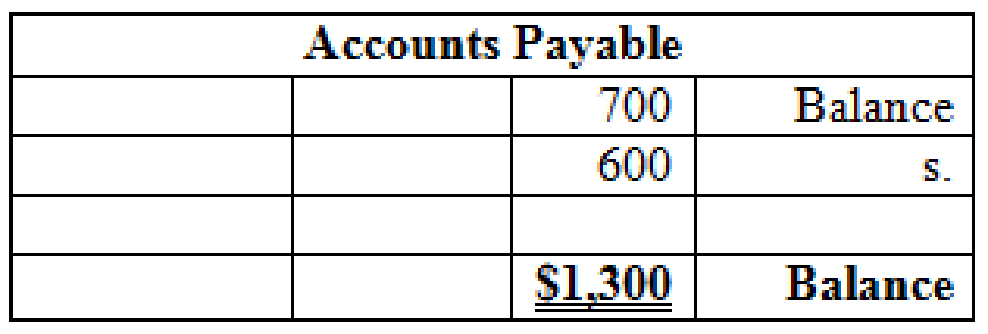

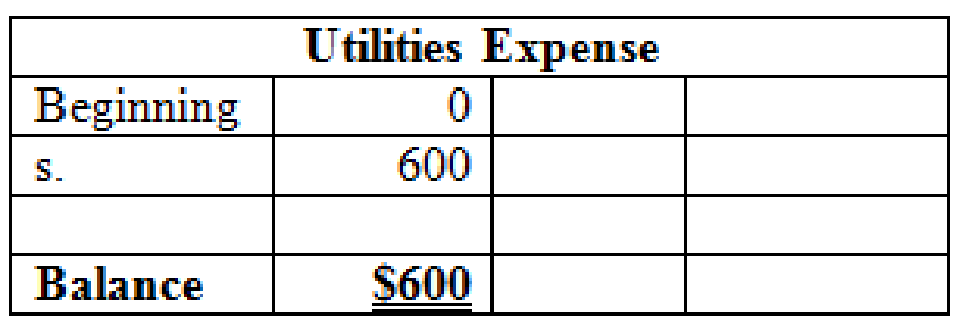

- s. Received $600 invoice for January electricity charged on account to be paid in February but is not yet recorded.

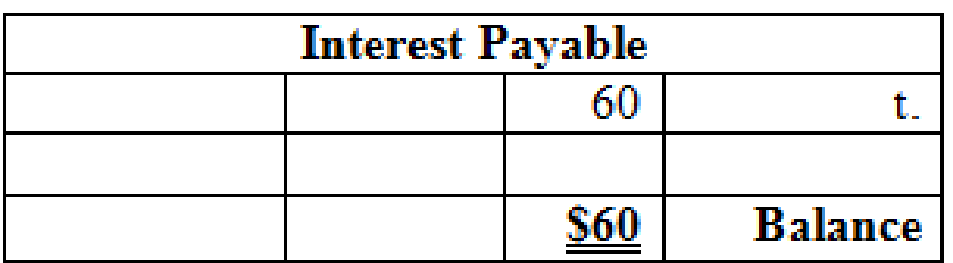

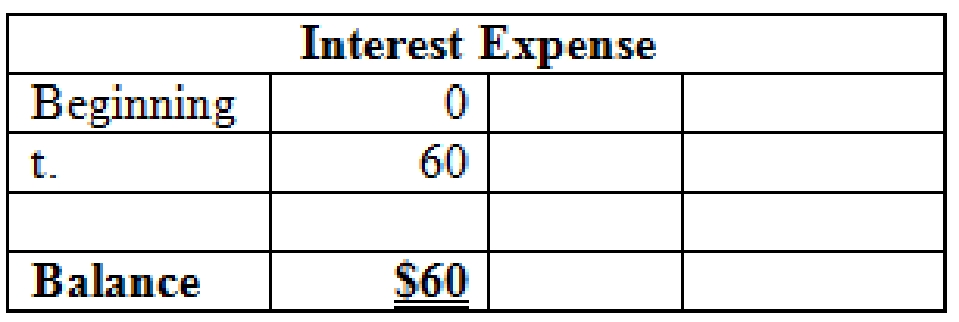

- t. Interest on the promissory note of $60 for January has not yet been recorded or paid.

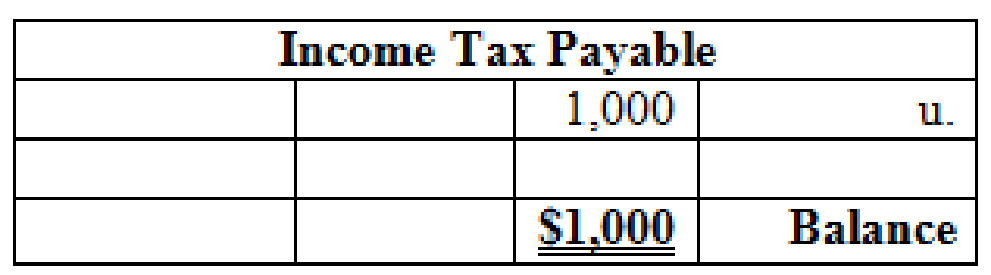

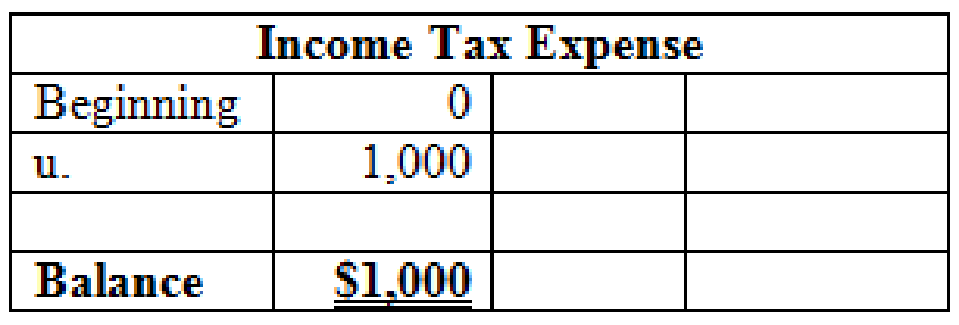

- u. Income tax of $1,000 on January income has not yet been recorded or paid.

- o.

- 6. Post the adjusting journal entries from requirement 5 to the T-accounts and prepare an adjusted

trial balance . (If you are completing this requirement in Connect, it will be completed for you using your previous answers.) - 7. Prepare an income statement for January and a classified

balance sheet at January 31. Report PRS’s cash and cash equivalents as a single line on the balance sheet. - 8. Calculate the

current ratio at January 31 and indicate whether PRS has met its loan covenant that requires a minimum current ratio of 1.2. - 9. Calculate the net profit margin and indicate whether PRS has achieved its objective of 10 percent.

1.

Prepare journal entries for the transactions occurred in January.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

- a. Prepare journal entry for the transaction occurred on January 1.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 1 | Cash | 2,500 | |||

| Accounts Receivable | 2,500 | |||||

| (To record the cash receipt for the service performed on account ) | ||||||

Table (1)

Description:

- Cash is an asset account. Thus, an increase in cash increases the asset account. Hence, debit cash account by $2,500.

- Accounts receivable is an asset account. Thus, a decrease in accounts receivable decreases the asset account. Hence, credit accounts receivable account by $2,500.

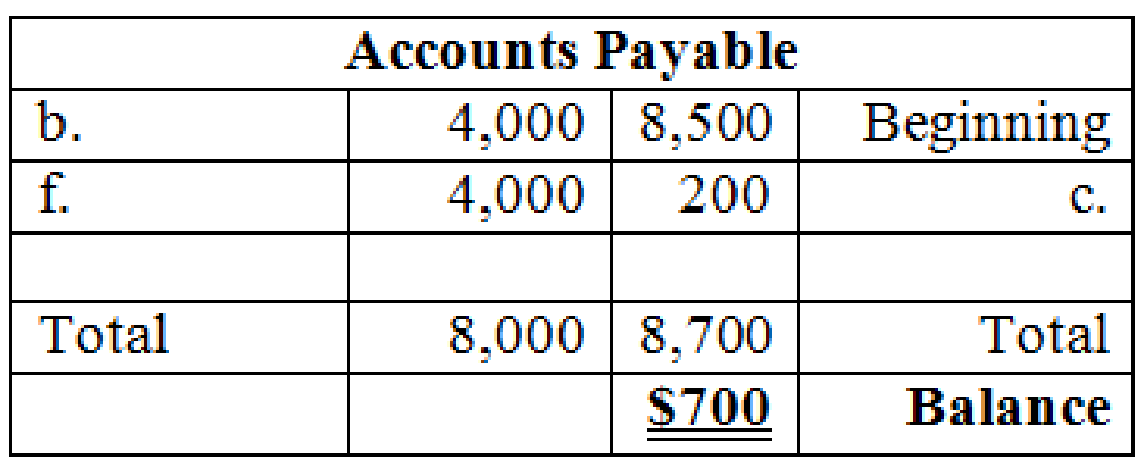

- b. Prepare journal entry for the transaction occurred on January 2.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 2 | Accounts Payable | 4,000 | |||

| Cash | 4,000 | |||||

| (To record the payment of cash for the purchases made already) | ||||||

Table (2)

Description:

- Accounts payable is a liability account. Thus, an increase in accounts payable increases the value of liability account. Hence, accounts payable account is being credited to increase its balance by $4,000.

- Cash is an asset account. Thus, a decrease in cash decreases the value of asset account. Hence, credit cash account by $4,000.

- c. Prepare journal entry for the transaction occurred on January 3.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 3 | Supplies | 200 | |||

| Accounts Payable | 200 | |||||

| (To record the purchase of supplies on account) | ||||||

Table (3)

Description:

- A supply is an asset account. Thus, an increase in supplies increases the value of asset account. Hence, debit supplies account by $200.

- Accounts payable is a liability account. Thus, an increase in accounts payable increases the value of liability account. Hence, accounts payable account is being credited to increase its balance by $200.

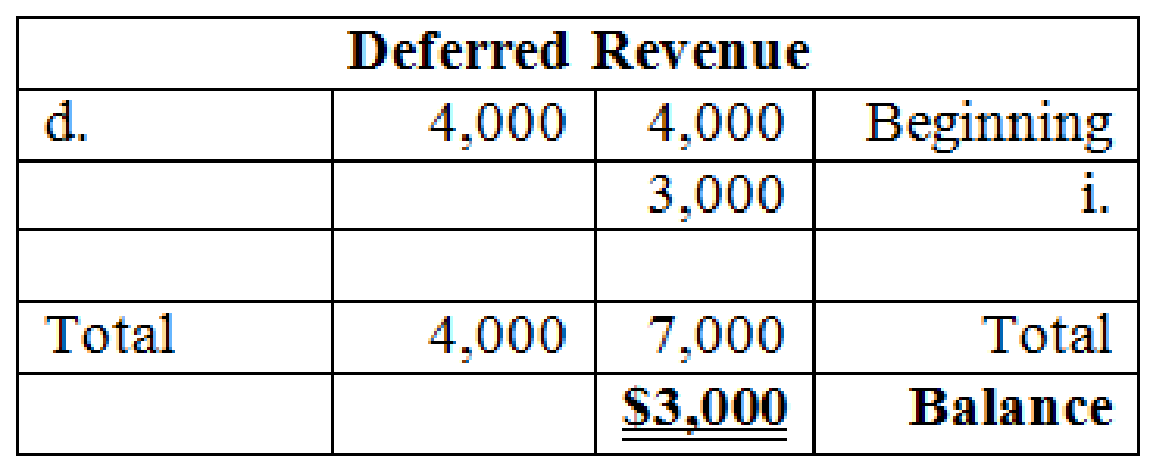

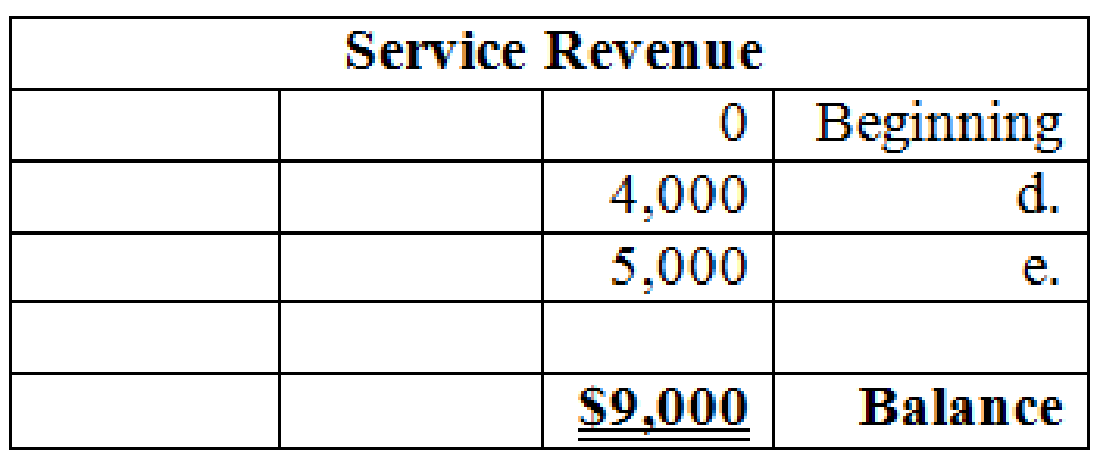

- d. Prepare journal entry for the transaction occurred on January 4.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 4 | Deferred Revenue | 4,000 | |||

| Service Revenue | 4,000 | |||||

| (To record the service performed for the cash collected in advance ) | ||||||

Table (4)

Description:

- Deferred Revenue is a liability and there is a decrease in the value of liability. So debit the deferred revenue account for $4,000.

- Sales Revenue is a component of stockholder’s equity and there is an increase in the value of stockholder’s equity. So credit the sales revenue account for $4,000.

- e. Prepare journal entry for the transaction occurred on January 5.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 5 | Cash | 5,000 | |||

| Service Revenue | 5,000 | |||||

| (To record the cash received for the service rendered) | ||||||

Table (5)

Description:

- Cash is an asset account. Thus, an increase in cash increases the value of asset account. Hence, debit cash account by $5,000.

- Service revenue is a stockholder’s equity account. Thus, an increase in service revenue increases the value of stockholder’s equity account. Hence, service revenue account is being credited to increase its balance by $5,000.

- f. Prepare journal entry for the transaction occurred on January 6.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 6 | Accounts Payable | 4,000 | |||

| Cash | 4,000 | |||||

| (To record the payment of cash for the purchases made already) | ||||||

Table (6)

Description:

- Accounts payable is a liability account. Thus, an increase in accounts payable increases the value of liability account. Hence, accounts payable account is being credited to increase its balance by $4,000.

- Cash is an asset account. Thus, a decrease in cash decreases the value of asset account. Hence, credit cash account by $4,000.

- g. Prepare journal entry for the transaction occurred on January 7.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 7 | Cash | 1,000 | |||

| Cash Equivalents | 1,000 | |||||

| (To record conversion of cash equivalents into cash) | ||||||

Table (7)

Description:

- Cash is an asset account. Thus, an increase in cash increases the value of asset account. Hence, debit cash account by $1,000.

- A cash equivalent is an asset account. Thus, a decrease in cash equivalents decreases the value of asset account. Hence, credit cash equivalents account by $1,000.

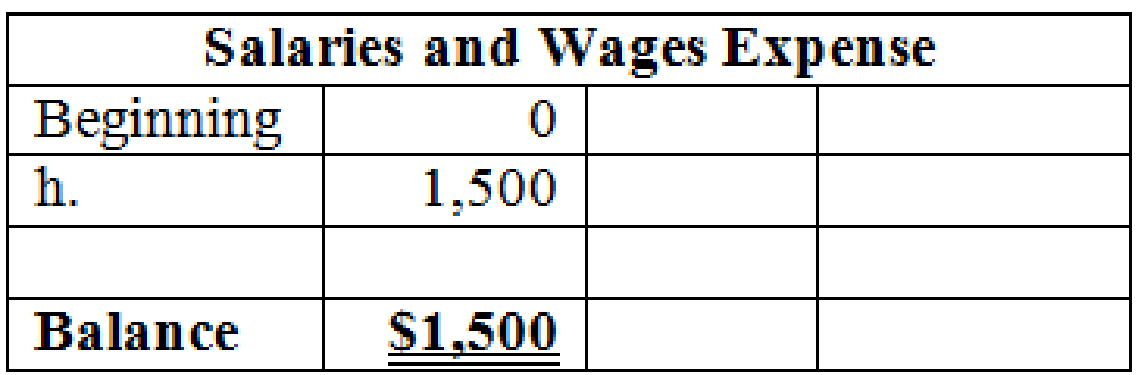

- h. Prepare journal entry for the transaction occurred on January 15.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 15 | Salaries and Wages Expense | 1,500 | |||

| Cash | 1,500 | |||||

| (To record payment of wages and salaries expense) | ||||||

Table (8)

Description:

- Salaries and wages expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in salaries and wages expense account decreases the value of stockholder’s equity account. Hence, salaries and wages expense account is being debited to increase its balance by $1,500.

- Cash is an asset account. Thus, a decrease in cash account decreases the value of asset account. Hence, cash account is being credited to decrease its balance by $1,500.

- i. Prepare journal entry for the transaction occurred on January 31.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Cash | 3,000 | |||

| Deferred Revenue | 3,000 | |||||

| (To record the receipt of cash for the service yet to provide ) | ||||||

Table (9)

Description:

- Cash is an asset account. Thus, an increase in cash increases the value of asset account. Hence, debit cash account by $3,000.

- Deferred revenue is a liability account. Thus, an increase in deferred revenue increases the value of liability account. Hence, deferred revenue account is being credited to increase its balance by $3,000.

2.

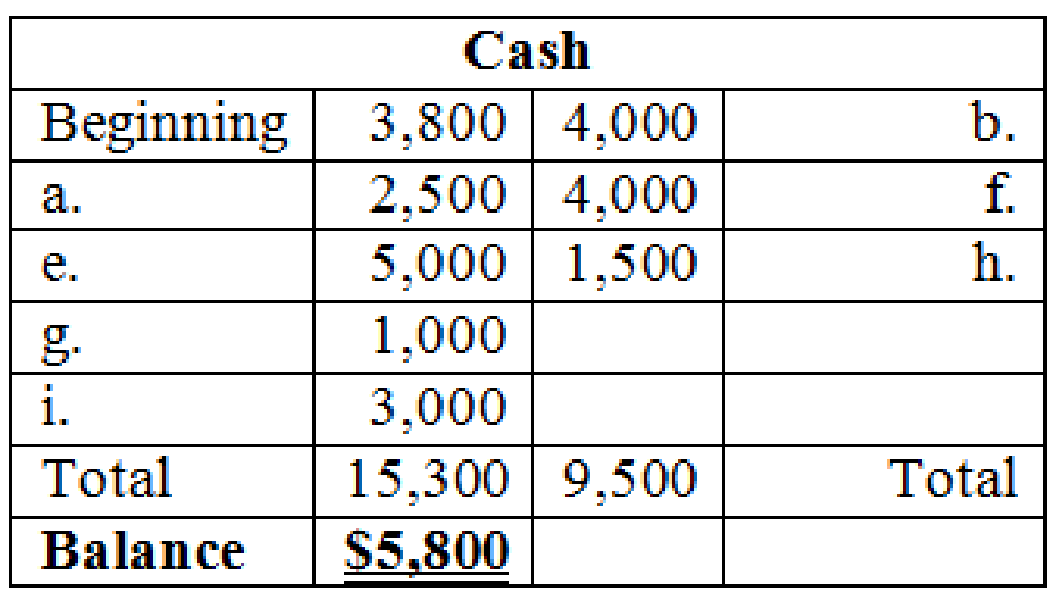

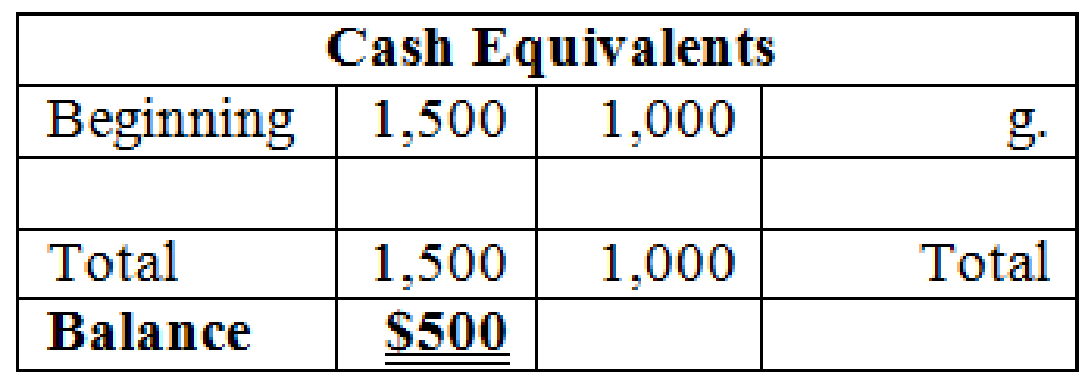

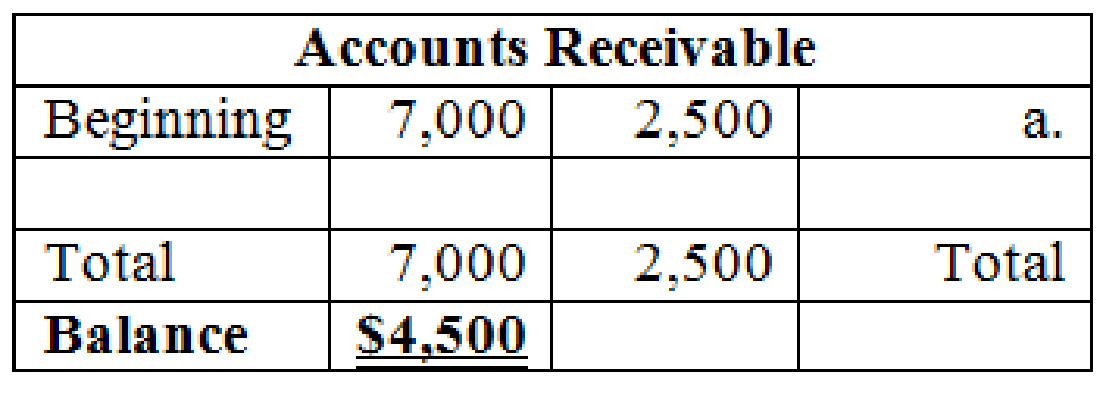

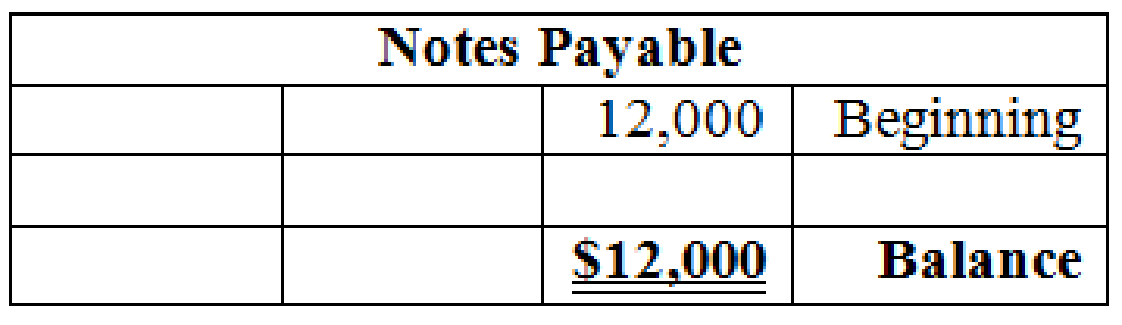

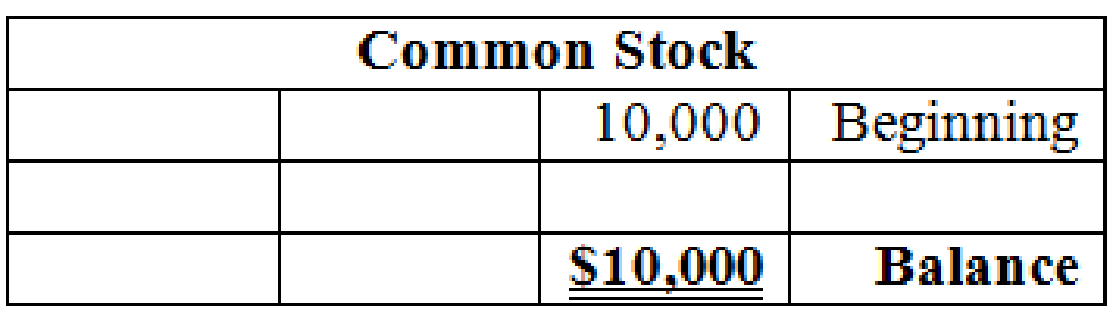

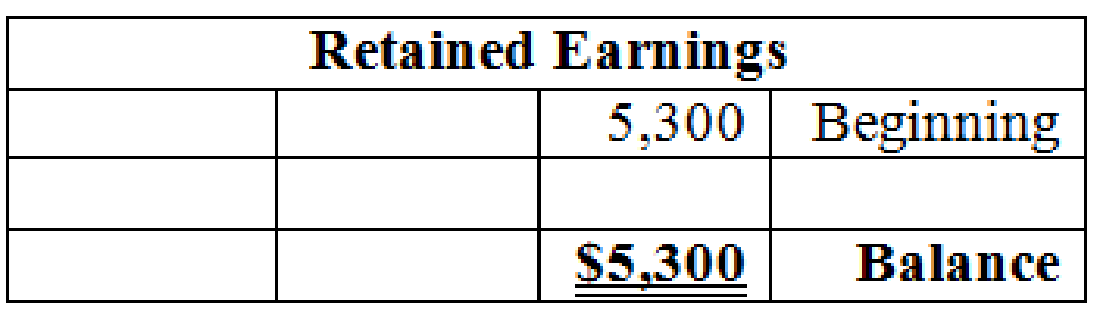

Open the T-accounts with balances as on January 1, post the entries recorded in Part (1), and compute the balances as on January 31.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

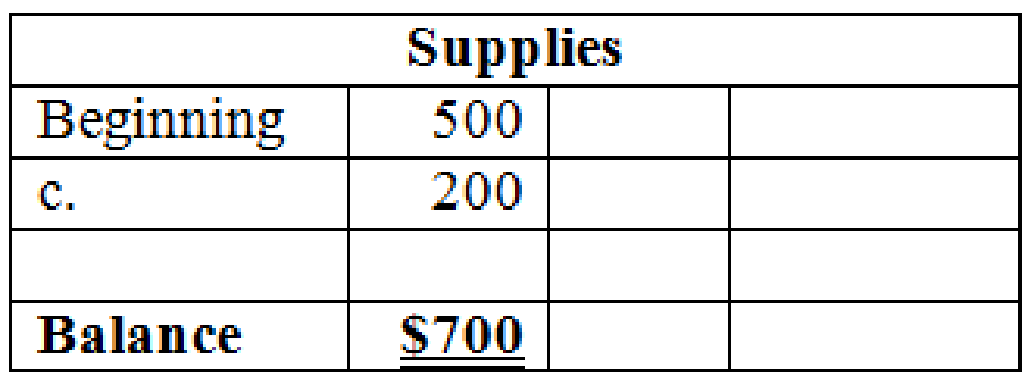

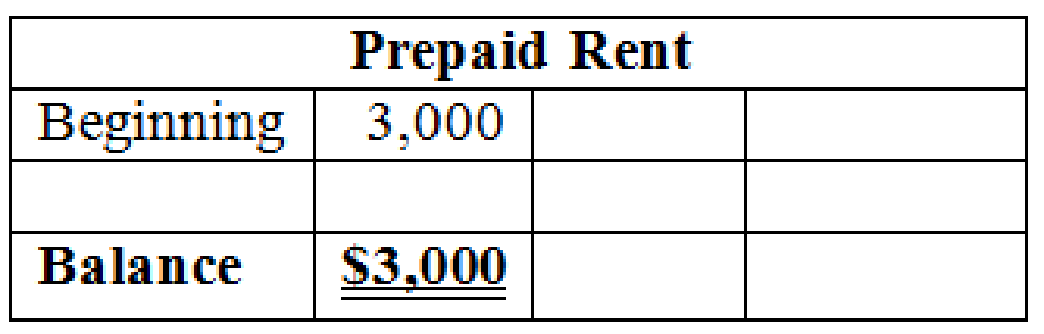

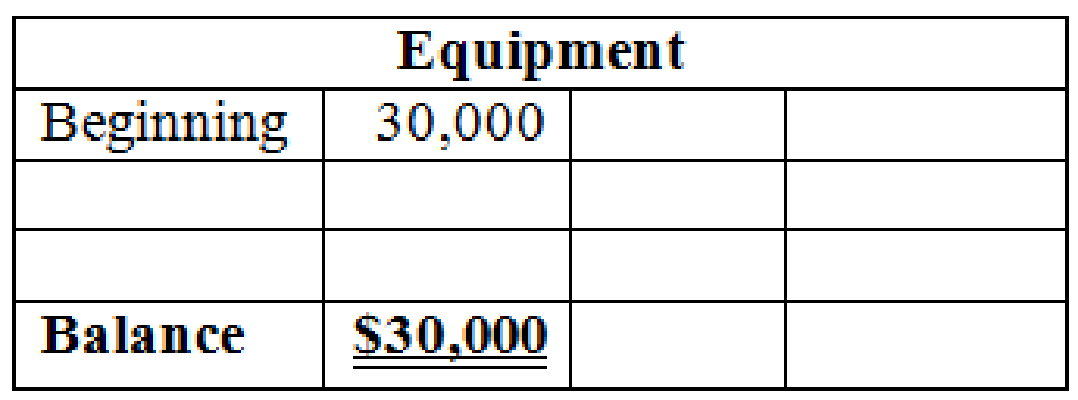

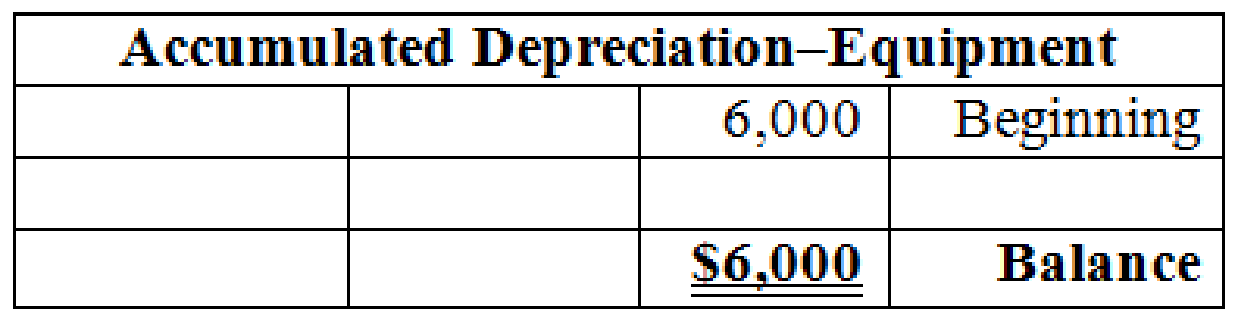

Open the T-accounts with balances as on January 1, post the entries recorded in part (1), and compute the balances as on January 31.

Table (10)

Table (11)

Table (12)

Table (13)

Table (14)

Table (15)

Table (16)

Table (17)

Table (18)

Table (19)

Table (20)

Table (21)

Table (22)

Table (23)

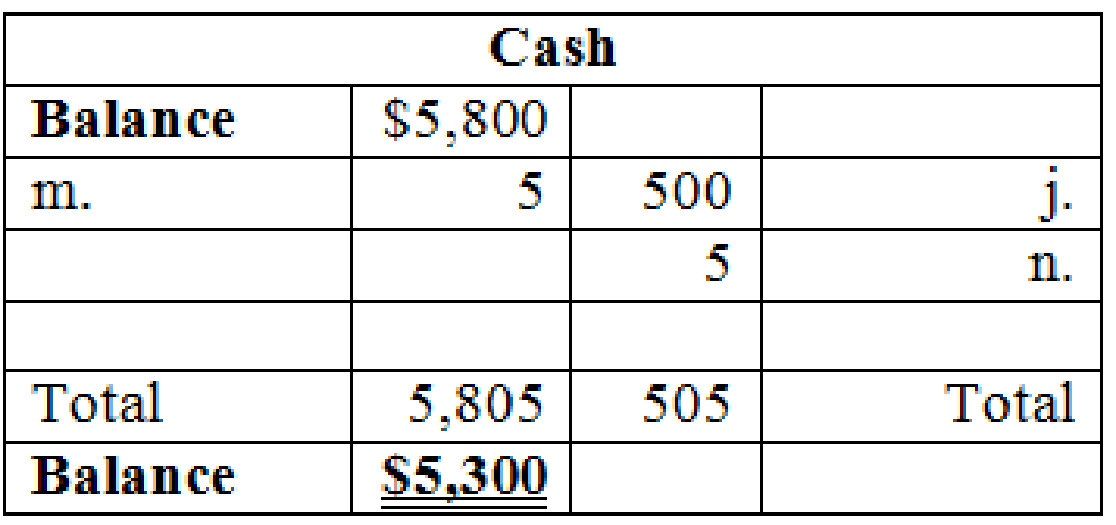

3.

Prepare a bank reconciliation of PR Studio, as at January 31.

Explanation of Solution

Bank reconciliation: Bank statement is prepared by bank. The company maintains its own records from its perspective. This is why the cash balance per bank and cash balance per books seldom agree. Bank reconciliation is the statement prepared by company to remove the differences and disagreement between cash balance per bank and cash balance per books.

Prepare bank reconciliation of PR Studio, as at January 31.

| PR Studio | ||||

| Bank Reconciliation | ||||

| January 31 | ||||

| Updates to Bank Statement | Updates to Company’s Books | |||

| Ending cash balance per bank statement | $6,300 | Ending cash balance per books | $5,800 | |

| Additions: | Additions: | |||

| Deposits in transit | 3,000 | Interest received | 5 | |

| 9,300 | 5,805 | |||

| Deductions: | Deductions: | |||

| Outstanding checks | 4,000 | NSF check | 500 | |

| Up-to-date ending cash balance | $5,300 | Bank service charge | 5 | 505 |

| Up-to-date ending cash balance | $5,300 | |||

Table (24)

Description:

- The deposits which are not recorded by the bank are referred to as deposits in transit. Since the deposits in transit are not reflected on the bank statement, the company should add deposits in transit to cash balance per bank, while preparation of bank reconciliation statement.

- Outstanding checks are the checks that are issued by the company, but not yet paid by the bank. When the check is issued for payment, the company deducts the cash balance immediately. But the bank deducts only when the cash is paid for the issued check. So, company deducts the cash balance per bank to remove the differences.

- Interest received is credited by bank to the bank account of which the company is not aware of. So, while preparing bank reconciliation statement, company should add the amount to the cash balance per books.

- While bank reconciliation, the NSF check should be deducted from the cash balance per book. This is because the bank could not collect funds from the customer’s bank due to lack of funds. But being recorded as accounts receivable previously, the balance should be deducted from books, to increase the accounts receivable account.

- Banks deduct the service charge for the services rendered like lock box rental, or printed checks. But the company is not aware of such deductions. So, company deducts the cash balance per books while bank reconciliation preparation.

4.

Prepare adjusting journal entries for items (j) to (n) that arise due to bank reconciliation, and post the entries into T-accounts.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

- j. Prepare journal entry to record NSF check.

| Date | Account Titles and Explanation | Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Accounts Receivable | 500 | |||

| Cash | 500 | |||||

| (To record the cash receipt for the NSF check from a customer deposit made on January 5) | ||||||

Table (25)

Description:

- Accounts receivable is an asset account. Thus, an increase in accounts receivable increases the value of asset account. Hence, debit accounts receivable account by $500.

- Cash is an asset account. Thus, a decrease in cash decreases the value of asset account. Hence, credit cash account by $500.

- k. Prepare journal entry for the checks written but not cleared by bank.

These are the outstanding checks, which are recorded by the company. So, company does not record it again, but this is an adjustment for bank balance. Hence, no journal entry is required.

- l. Prepare journal entry for the deposits recorded by company.

These are the checks deposited by company but not recorded by bank, which are recorded by the company. So, company does not record it again, but this is an adjustment for bank balance. Hence, no journal entry is required.

- m. Prepare journal entry to record interest received.

| Date | Account Titles and Explanation | Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Cash | 5 | |||

| Interest Revenue | 5 | |||||

| (To record interest earned) | ||||||

Table (26)

Description:

- Cash is an asset account. Thus, an increase in cash increases the value of asset account. Hence, debit cash account by $5.

- Interest revenue is a stockholder’s equity account. Thus, an increase in interest revenue increases the value of stockholder’s equity account. Hence, interest revenue account is being credited to increase its balance by $5.

- n. Prepare journal entry to record bank service charge.

| Date | Account Titles and Explanation | Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Office Expense | 5 | |||

| Cash | 5 | |||||

| (To record the deduction of bank service charge) | ||||||

Table (27)

Description:

- Utilities expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in utilities expense account decreases the value of stockholder’s equity account. Hence, utilities expenses account is being debited to increase its balance by $5.

- Cash is an asset account. Thus, a decrease in cash account decreases the value of asset account. Hence, cash account is being credited to decrease its balance by $5.

Prepare T-accounts.

Table (28)

Table (29)

Table (30)

Table (31)

(5)

Journalize the adjusting entries for the items (o) to (u) as on January 31

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

- o. Prepare adjusting entry for the depreciation expense as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Depreciation Expense | 200 | |||

| Accumulated Depreciation–Equipment | 200 | |||||

| (To record depreciation expense) | ||||||

Table (32)

Description:

- Depreciation expense is an expense account and it is increased by $200. Expenses are the component of stockholder’s equity and it decreases the value of equity. Therefore, debit depreciation expenses account with $200.

- Accumulated depreciation is a contra-asset account and would have a normal credit balance. Therefore, credit accumulated depreciation account with$200.

- p. Prepare adjusting entry for the wages expense as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Salaries and Wages Expense | 1,500 | |||

| Salaries and Wages Payable | 1,500 | |||||

| (To record accrued expenses) | ||||||

Table (33)

Description:

- Salaries and wages expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in salaries and wages expense account decreases the value of stockholder’s equity account. Hence, salaries and wages expense account is being debited to increase its balance by $1,500.

- Salaries and wages payable is a liability account. Thus, an increase in salaries and wages payable increases the value of liability account. Hence, salaries and wages payable account is being credited to increase its balance by $1,500.

- q. Prepare adjusting entry for the prepaid rent as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Rent Expense (W.N. 1) | 1,000 | |||

| Prepaid Rent | 1,000 | |||||

| (To record part of prepaid rent expired) | ||||||

Table (34)

Description:

- Rent expense is a component of stockholder equity account. Thus, an increase in rent expenses decreases the stockholders equity account. Hence, rent expenses account is being debited to increase its balance by $1,000.

- Prepaid rent is an asset, and it decreases the value of asset by $1,000. Therefore, credit prepaid rent account by $1,000.

Working note 1:

Calculate the value of rent expense incurred during the month:

- r. Prepare adjusting entry for the supplies as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Supplies Expense (W.N. 2) | 200 | |||

| Supplies | 200 | |||||

| (To record part of supplies consumed) | ||||||

Table (35)

Description:

- Supplies expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in supplies expense account decreases the value of stockholder’s equity account. Hence, supplies expenses account is being debited to increase its balance by $200.

- A supply is an asset account. Thus, a decrease in supplies decreases the value of asset account. Hence, credit supplies account by $200.

Working note 2:

Calculate the value of supplies expense:

- s. Prepare adjusting entry for the utilities expense as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Utilities Expense | 600 | |||

| Accounts Payable | 600 | |||||

| (To record the receipt of bill for the utilities expenses incurred) | ||||||

Table (36)

Description:

- Utilities expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in utilities expense account decreases the value of stockholder’s equity account. Hence, utilities expenses account is being debited to increase its balance by $600.

- Accounts payable is a liability account. Thus, an increase in accounts payable increases the value of liability account. Hence, accounts payable account is being credited to increase its balance by $600.

- t. Prepare adjusting entry for the interest expense as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Interest Expense | 60 | |||

| Interest Payable | 60 | |||||

| (To record accrued expenses) | ||||||

Table (37)

Description:

- Interest expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in interest expense account decreases the value of stockholder’s equity account. Hence, interest expenses account is being debited to increase its balance by $60.

- Interest payable is a liability account. Thus, an increase in interest payable increases the value of liability account. Hence, interest payable account is being credited to increase its balance by $60.

- u. Prepare adjusting entry for the utilities expense as on January 31.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| January | 31 | Income Tax Expense | 1,000 | |||

| Income Tax Payable | 1,000 | |||||

| (To record accrued expenses) | ||||||

Table (38)

Description:

- Income tax expense is an expense account which comes under retained earnings in stockholder’s equity. Thus, an increase in income tax expense account decreases the value of stockholder’s equity account. Hence, income tax expense account is being debited to increase its balance by $1,000.

- Income tax payable is a liability account. Thus, an increase in income tax payable increases the value of liability account. Hence, income tax payable account is being credited to increase its balance by $1,000.

(6)

Post the adjusted entries into T-accounts, and prepare adjusted trial balance for PR Studio as on January 31.

Explanation of Solution

Post the adjusting entries into T-accounts.

Table (39)

Table (40)

Table (41)

Table (42)

Table (43)

Table (44)

Table (45)

Table (46)

Table (47)

Table (48)

Table (49)

Table (50)

Table (51)

Table (52)

Adjusted trial balance: It is that statement which shows all the asset, liability, and equity account balances at the year-end, after recording of adjusting entries.

Prepare adjusted trial balance of PR Studio as on January 31.

| PR Studio | ||

| Adjusted Trial Balance | ||

| January 31 | ||

| Particulars | Debit $ | Credit $ |

| Cash | $5,300 | |

| Cash Equivalents | 500 | |

| Accounts Receivable | 5,000 | |

| Prepaid Rent | 2,000 | |

| Supplies | 500 | |

| Equipment | 30,000 | |

| Accumulated Depreciation - Equipment | 6,200 | |

| Accounts Payable | 1,300 | |

| Interest Payable | 60 | |

| Income Tax Payable | 1,000 | |

| Salaries and Wages Payable | 1,500 | |

| Deferred Revenue | 3,000 | |

| Notes Payable (Long-term) | 12,000 | |

| Common Stock | 10,000 | |

| Retained Earnings | 5,300 | |

| Service Revenue | 9,000 | |

| Interest Revenue | 5 | |

| Salaries and Wages Expense | 3,000 | |

| Rent Expense | 1,000 | |

| Income Tax Expense | 1,000 | |

| Utilities Expense | 600 | |

| Depreciation Expense | 200 | |

| Supplies Expense | 200 | |

| Interest Expense | 60 | |

| Office Expense | 5 | |

| Total | $49,365 | $49,365 |

Table (53)

(7)

Prepare an income statement of PR Studio for the month ended January 31, and classified balance sheet of PR Studio as on January 31

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement for PR Studio for the month ended January 31.

| PR Studio | ||

| Income Statement | ||

| For the Month Ended January 31 | ||

| Revenue | ||

| Service revenue | $9,000 | |

| Interest revenue | 5 | |

| Total revenue | $9,005 | |

| Expenses | ||

| Salaries and wages expense | $3,000 | |

| Rent expense | 1,000 | |

| Income tax expense | 1,000 | |

| Utilities expense | 600 | |

| Depreciation expense | 200 | |

| Supplies expense | 200 | |

| Interest expense | 60 | |

| Office expense | 5 | |

| Total expenses | 6,065 | |

| Net income | $2,940 | |

Table (54)

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare classified balance sheet for PR Studio, as at January 31.

| PR Studio | ||

| Balance Sheet | ||

| January 31 | ||

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | $5,800 | |

| Accounts receivable | 5,000 | |

| Supplies | 500 | |

| Prepaid rent | 2,000 | |

| Total current assets | $13,300 | |

| Property, plant, and equipment | ||

| Equipment | 30,000 | |

| Less: Accumulated depreciation | 6,200 | 23,800 |

| Total assets | $37,100 | |

| Liabilities and Stockholders’ Equity | ||

| Current liabilities | ||

| Accounts payable | $1,300 | |

| Interest payable | 60 | |

| Income tax payable | 1,000 | |

| Salaries and wages payable | 1,500 | |

| Deferred revenue | 3,000 | |

| Total current liabilities | $6,860 | |

| Long-term liabilities | ||

| Notes payable | 12,000 | |

| Total liabilities | 18,860 | |

| Stockholders’ equity | ||

| Common stock | 10,000 | |

| Retained earnings (W.N. 3) | 8,240 | |

| Total stockholders’ equity | 18,240 | |

| Total liabilities and stockholders’ equity | $37,100 | |

Table (55)

Working Notes 3:

Compute retained earnings for the month ended January 31.

| Particulars | Amount ($) |

| Retained earnings, January 1 | $5,300 |

| Add: Net income | 2,940 |

| 8,240 | |

| Less: Dividends | 0 |

| Retained earnings, January 31 | $8,240 |

Table (56)

Note: Refer to Table (54) for net income value.

(8)

Ascertain the current ratio of PR Studio for the month ended January 31.

Explanation of Solution

Current ratio: The financial ratio which evaluates the ability of a company to pay off the debt obligations which mature within one year or within completion of operating cycle is referred to as current ratio. This ratio assesses the liquidity of a company.

Formula of current ratio:

Compute current ratio of PR Studio for the month ended January 31.

Yes, PR Studio has met its loan covenant because its current ratio, 1.94 is more than the minimum current ratio of 1.2.

(9)

Ascertain the net profit margin for the month ended January 31.

Explanation of Solution

Net profit margin: This ratio gauges the operating profitability by quantifying the amount of income earned from business operations from the sales generated.

Formula of net profit margin:

Ascertain the net profit margin for PR Studio for the month ended January 31.

Note: Refer to Table (54) for both values.

Want to see more full solutions like this?

Chapter 5 Solutions

Fundamentals Of Financial Accounting

- Write down as many descriptions describing rock and roll that you can. From these descriptions can you come up with s denition of rock and roll? What performers do you recognize? What performers don’t you recognize? What can you say about musical inuence on these current rock musicians? Try to break these inuences into genres and relate them to the rock musicians. What does Mick Jagger say about country artists? What does pioneering mean? What kind of ensembles warrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?arrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning