Concept explainers

JOURNALIZE AND

REQUIRED

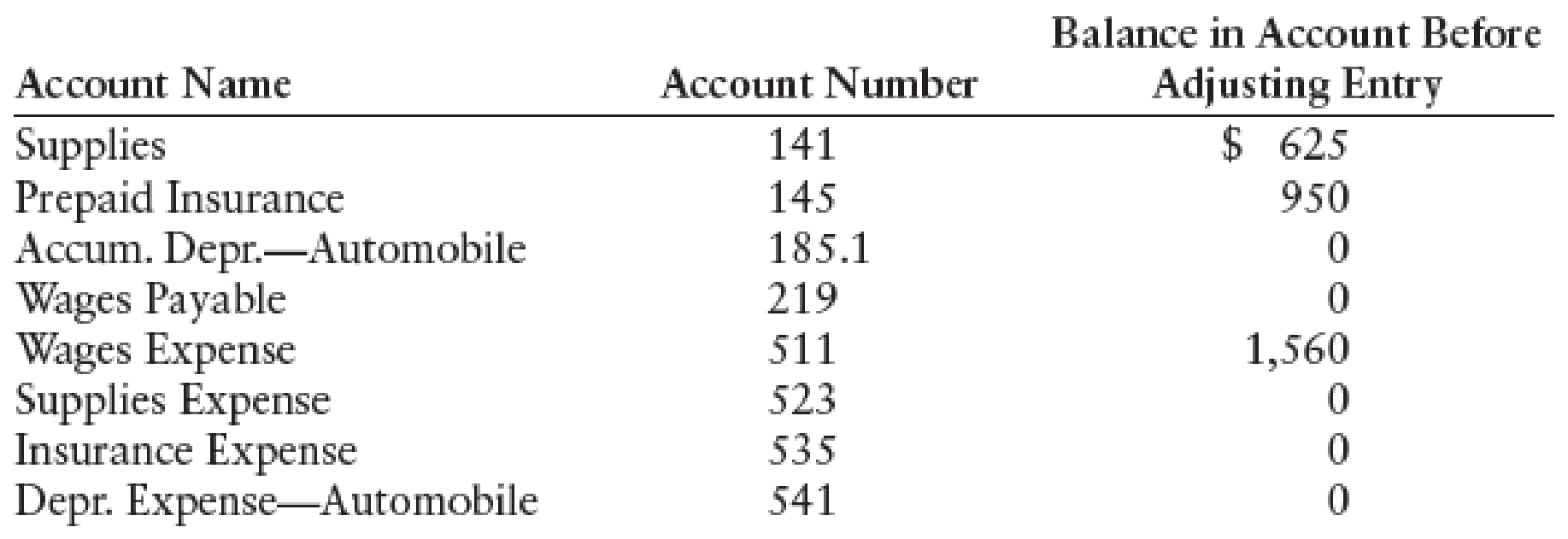

- 1. Journalize the adjusting entries on page 3 of the general journal.

- 2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany this text, enter the balances provided in this problem before posting the adjusting entries.)

1.

Prepare adjusting entries for the given transactions.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the ending inventory on supplies on October 31, $210.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Supplies expense | 523 | 415 | |

| Supplies | 141 | 415 | ||

| (To record the additional amount of supplies that must be used) |

Table (1)

- Supplies expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the supplies expense by $415.

- Supplies are an asset and there is decrease in the value of an asset. Hence, credit the supplies by 415.

Prepare adjusting entries for the unexpired insurance as of October 31, $800.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Insurance expense | 535 | 150 | |

| Prepaid insurance | 145 | 150 | ||

| (To record the insurance expense during the end of the year.) |

Table (2)

- Insurance expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the insurance expense by $150.

- Prepaid insurance is an asset and there is decrease in the value of an asset. Hence, credit the prepaid insurance by $150.

Prepare adjusting entries for the depreciation of automobile, $250.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Depreciation expense | 541 | 250 | |

| Accumulated depreciation | 185.1 | 250 | ||

| (To record the depreciation expense at the end accounting of the year.) |

Table (3)

- Depreciation expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the depreciation expense by $250.

- Accumulated depreciation is a contra asset and it has increased. Therefore, credit the accumulated depreciation by $250.

Prepare adjusting entries for the wages earned but not yet paid as of October 31, $175.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Wages expense | 511 | 175 | |

| Wages payable | 219 | 175 | ||

| (To record the wages earned but not yet paid to the employees at the end of the year.) |

Table (4)

- Wages expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the wages expense by $175.

- Wages payable is a liability and there is an increase in the value of the liability. Hence, credit the wages payable by $175.

2.

Post the adjusting entries to the general ledger.

Explanation of Solution

Post the adjusting entries to the general ledger.

| Supplies Account No: 141 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 625 | 625 | |||

| 31 | Adjusting | 415 | 210 | ||||

(Table 5)

| Prepaid insurance Account No: 145 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 950 | 950 | |||

| 31 | Adjusting | 150 | 800 | ||||

(Table 6)

| Accumulated Depreciation-Automobile Account No: 185.1 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 7)

| Wages Payable Account No: 219 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 175 | 175 | |||

(Table 8)

| Wages Expense Account No: 511 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 1,560 | ||||

| 31 | Adjusting | 175 | 1,735 | ||||

(Table 9)

| Supplies expense Account No: 523 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 415 | 415 | |||

(Table 10)

| Insurance Expense Account No: 535 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 150 | 150 | |||

(Table 11)

| Depreciation expense-Automobile Account No: 541 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 12)

Want to see more full solutions like this?

Chapter 5 Solutions

College Accounting, Chapters 1-9

- The Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets? Accurate Answerarrow_forwardThe Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets? Don't Use Aiarrow_forwardAt the beginning of the year, manufacturing overhead for the year was estimated to be $810,000. At the end of the year, actual direct labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $780,000, and the manufacturing overhead for the year was overapplied by $30,000. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been ____ hours. ANSWERarrow_forward

- Compute the company's plantwide predetermined overhead rate for the yeararrow_forwardSuppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Need helparrow_forwardSuppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Accurate Answerarrow_forward

- Accurate answerarrow_forwardThe current ratio of a company is 5:1, and its acid-test ratio is 2:1. If the inventories and prepaid items amount to $450,000, what is the amount of current liabilities? Answer this financial accounting problem. Ansarrow_forwardCullumber Company uses a job order cast system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,000, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102.480 and $132,720, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $75,600 on account. 2 Incurred factory labor costs of $58,800. 3 Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forward

- Net sales total $525,000. Beginning and ending accounts receivable are $42,000 and $46,000, respectively. Calculate days' sales in receivables.arrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __. General Accountarrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub